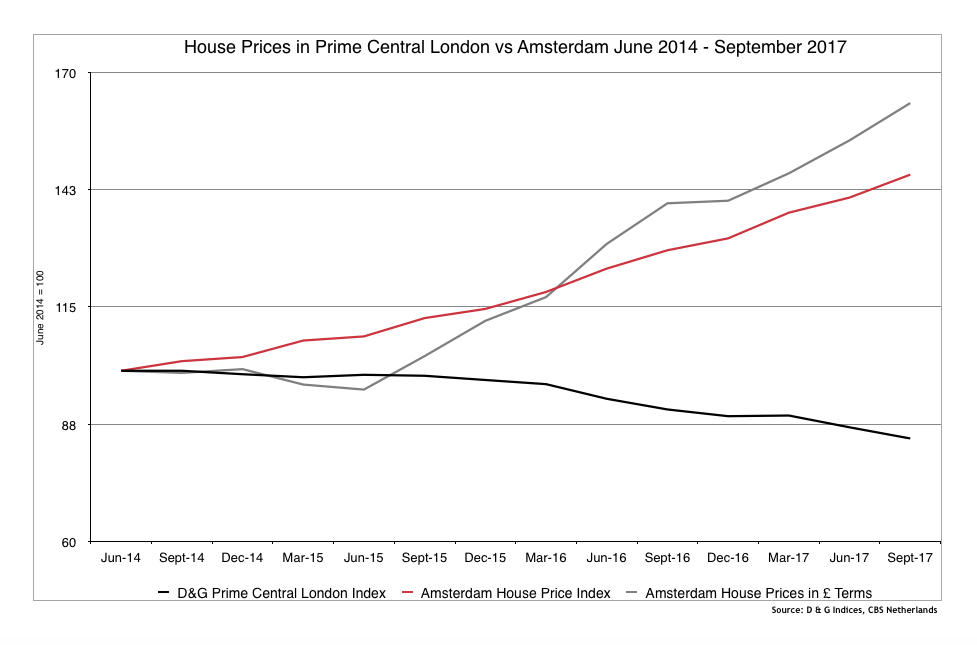

Those of us that track the fortunes of UK house prices know very well that the music stopped in Prime Central London in the summer of 2014. A raft of legislation that included changes to CGT for overseas investment and increases in SDLT initially dampened the market; then along came Brexit, and with it the uncertainties surrounding London’s future as a global financial centre.

The chart above highlights the fortunes of Prime Central London residential property against the Amsterdam market. Amsterdam is frequently mentioned as a desirable alternative to London for those hedge fund managers and investment bankers who might find the idea of relocating to Paris or Frankfurt culturally challenging. What is interesting to note is how the Amsterdam market in sterling terms has powered ahead since the summer of 2016, when Britain voted to leave the EU.