The decade since the Global Financial Crisis has seen sharp increases in asset prices apparently driven by low interest rates. These low interest rates have been caused by quantitative easing, and lower interest rates have caused lower discount rates to be used in valuations, with the result that asset prices have been marked up.

Asset-price inflation in periods such as the dot.com boom and the pre-GFC housing bubble, has traditionally resulted in central banks setting higher interest rates as they aim to rein in speculation and inflationary pressure in the wider macroeconomy. However, the current round of asset price inflation has not fed into higher prices for consumers, and monetary policy has remained expansionary.

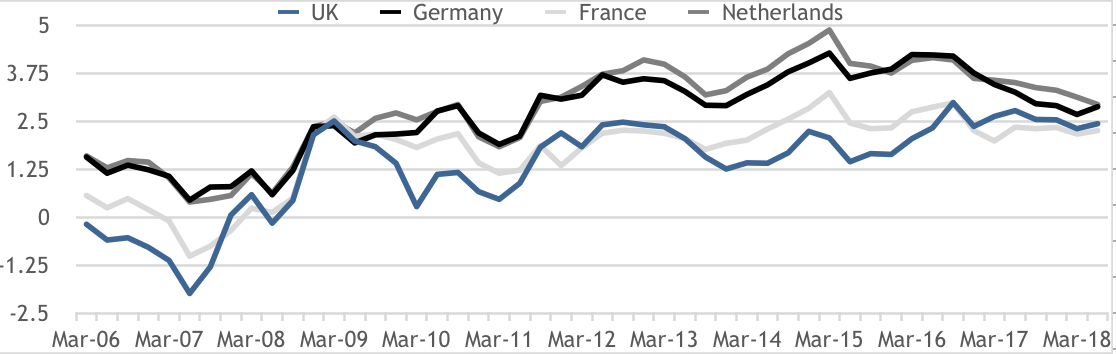

Property cap rates have continued a 30-year downward trajectory, following falls in both the nominal and real risk-free rates proxied by fixed interest and index-linked government bonds respectively. Figure 1 shows that, even though property cap rates have fallen since the GFC, lower interest rates have caused increasing spreads for property investors and made real estate an attractive asset. But is it really attractive?

There is now some consensus that rates will start to move upwards as central banks feel the economic recovery is sufficiently entrenched, allowing them to reverse quantitative easing. What impact will higher bond yields have on future property valuations?

Figure 1: Prime office spreads over ten-year bonds

In our last Property Chronicle piece, we developed the theoretical connection between real estate rents and inflation, real estate prices and indexed bonds (real risk fee rates) and real estate prices and fixed interest bonds (nominal risk free rates). But how strong in practice is the link between real estate cap rates and index-linked bond yields – and between real estate cap rates and conventional government bonds? Which is the stronger connection?

Rents and inflation

Let us start by looking at the relationship between rent and inflation. If property acts as a hedge over the long run, then rents will have a high correlation with inflation.

Property is often touted as an inflation hedge in the belief that rents will be regularly reviewed in line with inflation, and so over the long run the real value of rents will at least stay constant. Assuming that property costs also grow in line with inflation, the net rent will also hold in real terms.