The housing minister describes being stopped in the street by people wanting to thank him for Help to Buy. ‘Several people have stopped me and thanked me for it, because it gives young people access to homes that otherwise they would not obtain,’ Kit Malthouse told the Commons last week. It’s easy to see why, despite mounting criticism of the scheme, it remains a favourite of ministers.

The latest figures show that Help to Buy equity loans have assisted 158,000 first-time buyers onto the property ladder since they were introduced in 2013. Meanwhile there has recently been a modest uptick in owner-occupation. The latest English Housing Survey (EHS) pointed to an increase in mortgaged homeowners from 6.7m to 6.9m (and no change in unmortgaged owners) between 2016/17 and 2017/18. The scale of that shift might be exaggerated by noisiness in the EHS’s sampling but a corner does seem to have been turned, for now.

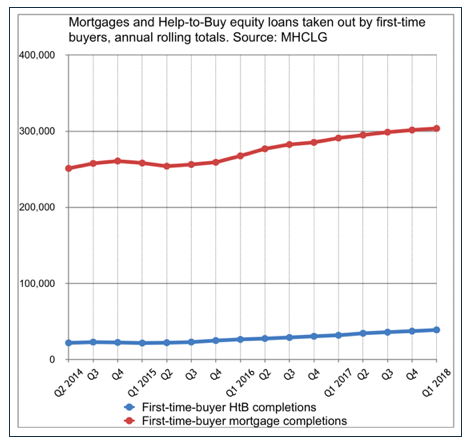

The significance of Help to Buy in that might not be as great as ministers suppose, however. Some commentators have doubted whether this trend is even sustainable without it. But first-time buyer acquisitions in England are now above 300,000 a year (judging by mortgages issued); those using Help to Buy account for about 39,000. The former has increased by about 50,000 since 2015; the latter by about 15,000. Help to Buy has been a factor, certainly – but there are much bigger forces at work.

One of these is that interest rates for those with smaller deposits have been improving. What had been a major obstacle to first-time buyers following the financial crisis – tighter lending criteria and increased costs of borrowing for higher loan-to-value mortgages – have eased somewhat in the past few years. This has given more young people a fighting chance of affording their first property. So too has their reduced stamp duty rates – including a complete exemption on properties under £300,000 – since November 2017.