BAE Systems is an obvious choice for dividend investors.That’s because:

(1) BAE

(2) BAE has a long track record of dividend growth, with the dividend going from 9.2p in 2003 to 22.2p in its 2018 results.

(3) BAE has a decent dividend yield of 4.7% at its current price of 458p.

However, BAE also has a few features which make it less attractive than it might at first appear.

BAE’s dividend growth is not matched by earnings or revenue growth

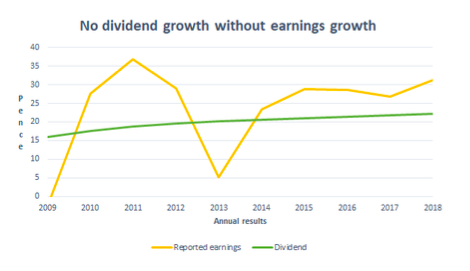

Long-term dividend growth is almost a requirement for attractive dividend-based investments, but dividend growth alone is not enough.

That’s because dividend payments must be covered by earnings, which are extracted from revenues, which come from customers paying for products or services, which are produced using the assets of the business (e.g. factories, warehouses and stock), which are paid for with shareholder and debt holder capital.

So if earnings, revenues and capital employedare not going up then any dividend growth will eventually hit a ceiling.

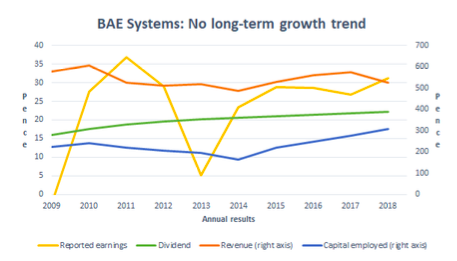

With that in mind, the previous chart shows several things:

(1) BAE’s revenues have gone essentially nowhere for a decade.

(2) BAE’s earnings also show no obvious growth trend.

(3) BAE’s capital base (i.e. capital employed) shrank following government cutbacks after the global financial crisis. This came about through a mixture of business writedowns, disposals and ‘rightsizings‘. After 2014 the company’s capital base has returned to growth, but this a relatively short period and has yet to drive consistent revenue growth.

(4) BAE’s dividend has continued to grow every year, but the rate of increase has slowed from more than 5% per year to less than 2% per year today.

This lack of consistent broad-based growth is not the end of the world and I wouldn’t rule out investing in BAE because of this alone. But averaged across capital employed, revenues and dividends, its growth has failed to match inflation over the last decade, and that has to be reflected in the purchase price.

BAE’s dividend cover is wafer thin

An uncovered dividend is a classic sign of a dividend under threat, so having earnings that consistently cover the dividend is important.

In BAE’s case, its progressive dividend growth and lack of earnings growth has given the company an average dividend cover over the last ten years of just 1.2.

In other words, the company has paid out 85% of its earnings over the last ten years as a dividend, and that’s a problem for a couple of reasons:

(1) The margin of safety between earnings and the dividend is relatively thin, so any small but prolonged decline in earnings is likely to put the dividend under severe pressure.

(2) With just 15% of earnings being retained, BAE may find it hard to increase its investment in productive capital assets such as offices, factories and machinery (often called property, plant and equipment) in order to drive future growth.