The report is divided into the following sections:

1) A summary of Fund performance

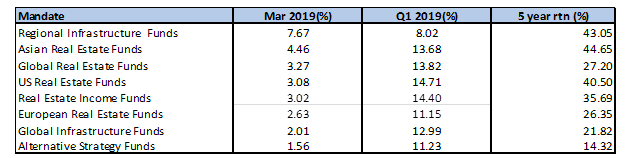

The table below shows the average March 2019, Q1 2019 and 5 year returns for the mandates in our database. As can be seen, the benefit of the US interest rate led rally was felt most significantly in the Q1 2019 numbers for US Funds and Income Funds (> +14%). In March it was the turn of the Regional Infrastructure Funds to see a significant improvement (+8%). It is interesting to note that for Global Real Estate Funds and Global Infrastructure Funds the Q1 rally was equivalent to 50-60% of the 5 year returns.

2) Focus : Quarterly Performance Review (p3)

This month we look at the Q1 2019 performance of our different fund mandates and establish that: