This article was originally published in October 2017.

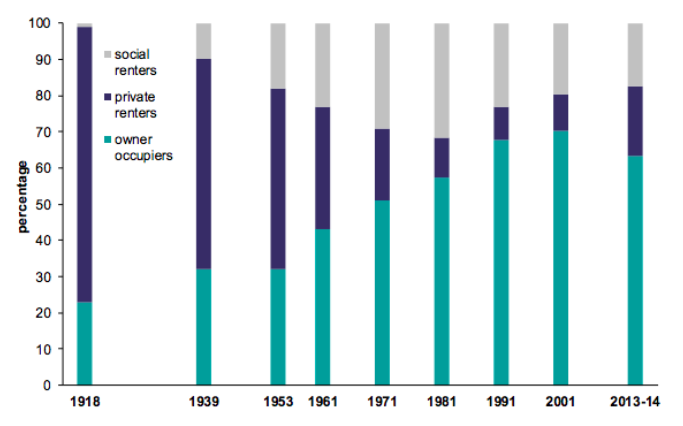

In a conscious echo of Harold Macmillan who oversaw the construction of more than 300,000 mostly local authority houses in 1953, the Prime Minister recently announced that her government is ‘getting back into the business of building houses’ by allocating £2 billion towards new affordable homes. Commentators were quick to point out this will finance just 25,000 additional properties against a manifesto commitment of 1.5 million new homes over the next five years. Nonetheless, the announcement marked a shift in emphasis from a party that has consistently advocated owner occupation for more than a century. During this time, owner-occupancy rose from just 23% in 1918 to a peak of 71% (in England) in 2003. This article briefly outlines some of the drivers of changing patterns of property tenure since the late nineteenth century.

Figure 1: English property tenure since 1918

Source: English Housing Survey, 2013-14

Before the First World War, more than three-quarters of households rented from private landlords. These ‘housing capitalists’ were nonetheless on the defensive as the burden of rising local authority expenditure fell largely on the rates. Landlords received little support from a Conservative party dedicated to defending the propertied interest by creating a ‘rampart of small proprietors’. Given the distribution of tenure, this had to be at the expense of private landlords.