Rightmove is an incredible business. In the 11 years since it listed on the stock exchange its:

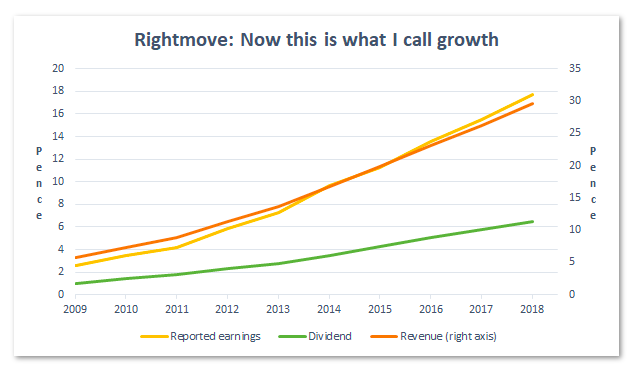

- Revenues have gone up by more than 370%, going from £57 million to £268 million

- Earnings have gone up by more than 1100%, going from 1.4p per share to 17.7p

- Dividend has gone up by more than 980%, going from 0.6p per share to 6.5p

If that isn’t impressive then I don’t know what is.

And this isn’t the result of a one-off fluke, because Rightmove’s revenues, earnings and dividends per share have increased every single year for the last decade.

That, in a nutshell, is exactly the sort of broad and steady growth that so many of us are after, so Rightmove definitely deserves a closer look.

But like all investments, Rightmove has its bearish points as well as its bullish points, so in this blog post I run through what I think are the main ones before getting onto the subject of Rightmove’s measly dividend:

Bull point 1) Rightmove’s growth has been broad, steady and rapid for many years

All else being equal, its better to invest in high growth companies than low growth companies:

Rightmove’s growth has been impressively rapid and consistent

Here are some of Rightmove’s dazzling statistics:

- 10-year revenue per share growth rate of 20% per year

- 10-year earnings per share growth rate of 24% per year

- 10-year dividend per share growth rate of 23% per year

And don’t think this rapid growth is simply a recovery from the dark days of the 2008/2009 credit crunch, because it isn’t. Other than a slight dip in revenues, Rightmove sailed right through the financial crisis as if it were nothing.

One thing I haven’t shown in the chart above is Rightmove’s capital employed growth. That’s because Rightmove has almost no capital assets (i.e. property, plant or equipment), so its capital employed growth rate is meaningless.

In this case, ‘almost no capital assets’ means about £11 million of office equipment, computer equipment and motor vehicles, but £11 million is peanuts for a company generating net profits north of £160 million per year, as Rightmove is.

The reason Rightmove can make so much profit from so little capital is that its main asset is its website, which is the UK’s most popular property portal. Even super-high traffic websites only require a few servers to run, and they cost very little compared to buildings, factories and other heavy capital infrastructure.

Actually, Rightmove’s main asset isn’t its website, although the website is the glue that holds everything together. Rightmove’s main assets are property buyers and sellers who use its website.

It works like this:

- Property sellers (or landlords) advertise their properties on Rightmove because that’s where most of the buyers (or prospective tenants) are.

- Property buyers (or renters) visit Rightmove because that’s where most of the properties are.

It’s a virtuous circle or positive feedback loop that’s also known as the network effect, and this network effect, combined with Rightmove’s position as the UK’s largest network of property buyers and sellers, is what drive’s the company’s success.

It’s a type of winner-takes-all economics and in some cases it can lead to profitability numbers that are off the scale.

Bull point 2) Rightmove’s profitability is through the roof.

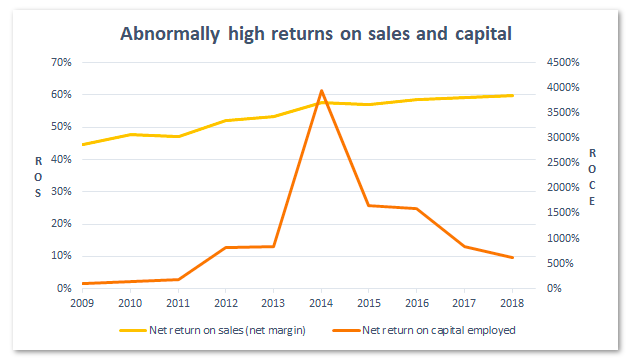

Rightmove’s profitability is on another level

Here are some more of Rightmove’s amazing statistics:

- 10-year average return on sales of 56%

- 10-year average return on capital employed of 604%

Those numbers, especially the return on capital, are ridiculous. Normal companies just don’t produce returns of over 600% on shareholder and debtholder capital. But Rightmove does.

These returns are not the result of having the flashiest website, or the best engineers, or the most heroic CEO; they’re simply a function of Rightmove’s position as the go-to location for buyers and sellers of UK property.