Introduction

Amidst a backdrop of political and economic uncertainty, 2018 was a turbulent year for UK capital markets. BDO’s six-monthly analysis of the UK’s key markets (click here to view the AIM insights and the Main Market insights) has demonstrated that as we head towards some sort of conclusion to Brexit talks, the public markets are craving certainty. But what has been the impact on transaction activity since the UK voted to leave the EU in 2016, and what could be in store for the markets for the rest of this year?

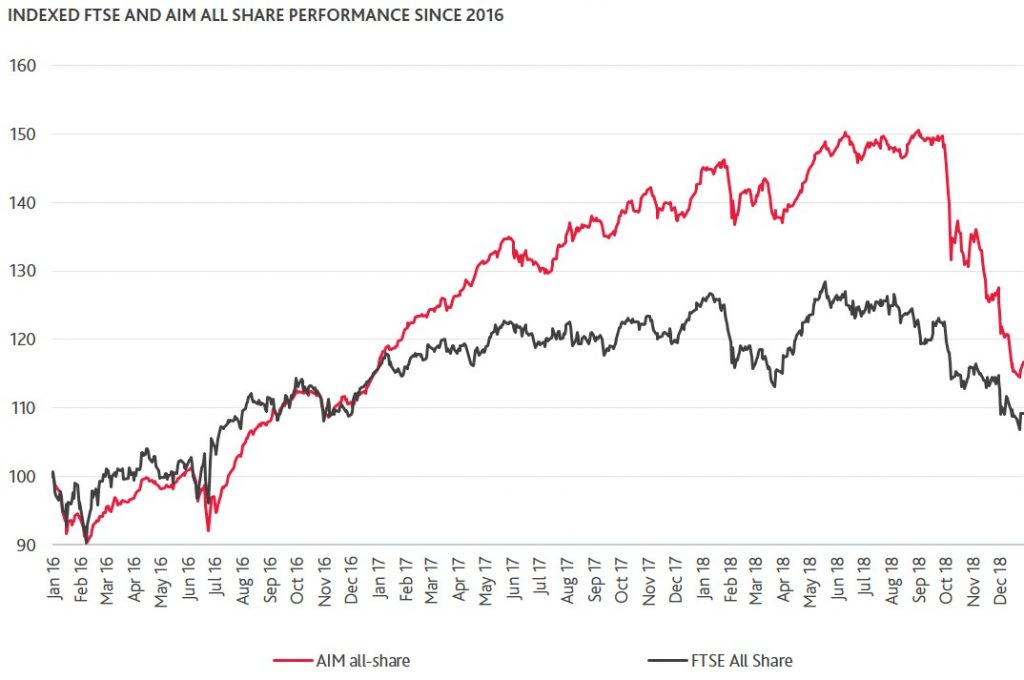

Indexed FTSE and AIM all share performance since 2016

Year on year transactional performance on the Main Market and AIM

FTSE indices

Having been rocked by the UK Referendum in 2016, the UK capital markets gradually recovered and climbed to record highs in 2017. This was driven in large part by the ever weakening Pound, with internationally-focused businesses (in particular the constituents of the FTSE 100) significantly benefitting from their foreign-denominated revenues being worth more when translated back into Sterling. AIM also rallied over the same period, its returns actually exceeding those of the broader FTSE market, possibly a reflection of the market’s higher exposure to thriving sectors like technology.

2018, however, marked a challenging year for the UK stock markets. Concerns over slowing global economic growth, interest rate rises, international trade wars and Brexit all led to volatile market conditions, and ultimately the worst annual FTSE 100 performance in a decade (a fall of over 10%). The correction was even more dramatic for AIM, which fell 20% over the year. Both markets ended the year having substantially reversed their original gains from 2017.

While the indices were volatile throughout 2018, much of the decline occurred as Brexit uncertainty intensified in the final quarter of the year. Even a further devaluation of Sterling in the period did not stem the decline, a sign of more systemic market uncertainty. Of course, the UK was not uniquely affected; globally, markets suffered their worst quarter since Q4 2011.

Transaction activity

The impact of the above volatility on transaction activity has been somewhat intriguing.

On the Main Market, total funds raised in 2018 were £19.4bn, not markedly below 2017 (£20.3bn) but still higher than 2016 (£15.6bn) when markets all but closed for the second half of the year after the UK Referendum. However, there has been a clear shift in investors’ focus away from IPOs and towards the relative safety of secondaries; assets they know, with a clear, liquid market value. Funds raised on new issues were down 37% on 2017, whereas funds raised on further issues were up to their highest level since 2015.

That said, while Main Market investors plunged £14.3bn into further issues in 2018, they did so in smaller quantities across a larger number of transactions, thereby spreading risk; a further sign of market caution. Funds raised on secondaries were £22.1m per transaction on average compared with £28.5 in 2017 and £31.8 in 2016.

On AIM, transaction activity in 2018 was a tale of two halves. There were just 14 IPOs in the second half of 2018, half that of the first six months, as Main Market IPO sentimentwas echoed in the junior market. IPO proceeds were £1.1bn for the year, compared with £1.4bn in 2017. The secondary market also saw similar year on year declines, with further issue funds raised of £3.9bn compared with £4.8bn in 2017.

That said, to give context as to AIM’s increased appeal over the last ten years, total funds raised were £5.5bn which, whilst 20% down on 2017 (£6.4bn), was still the third highest annual total since 2011.

Furthermore, as AIM transactions are typically of a lower value than the Main Market, AIM did not appear to experience the same level of de-risking from investors in 2018; average further issue values per transaction were in line with 2017 and IPO proceeds (for the new issues that did raise funds) were actually up to £40.2m, compared with £34.0m in 2017.

Real estate sector performance

The Main Market has been the more traditional home for real estate in recent years. 2017 marked a strong year for the sector with 56 transactions, including eight new IPOs. Amidst the market uncertainty, real estate activity halved in 2018, with funds raised totalling £1.9bn compared with £4.3bn in 2017. Investors were cautious and selective about the sector, with only the seemingly safest companies and certain sub-classes (such as logistics) attracting investors.

Grainger Plc was the largest real estate fundraise of 2018, a secondary raise of £347m. There were just five real estate IPOs on the Main Market in 2018, the largest of the year being Tritax Eurobox Plc, which raised £300m, making it the seventh largest IPO fundraise across all sectors.

AIM, typically less of a focus for real estate investment, saw substantially all of its real estate deal activity in the first half of 2018. £486m was raised in the first half of the year, including Secure Income REIT Plc undertaking AIM’s largest fund raise (£315m) and Purplebricks Group Plc successfully tapping the market for £100m. However, just £3m was raised in the second half of 2018 as nervousness in the sector set in. There was just one real estate IPO on AIM all year (YEW Grove REIT Plc).

Outlook for 2019

After a tentative end to 2018, it is clear the markets are craving certainty.

Investors, banks and companies largely appear to have been holding fire while Brexit negotiations unfold. January is a seasonally quiet month on the markets, but January 2019 was exceptionally so. There were just two IPOs in the month, both on the Main Market, which raised just £2m in total.

That said, the indices have since recovered slightly and there a number of companies seeking to reignite their IPO plans and/or raise funds once political and economic conditions settle. This is of course assuming that markets calm should a favourable Brexit deal be agreed (notwithstanding the risk of an extension to negotiations or “No Deal” scenario).

This would point to a more active Q2 for secondaries, subject to share prices/valuations, followed by increased activity in the second half of the year for new issues, which often have a longer lead time.

In the meantime all eyes are on European politics.