Originally published November 2021.

Investment opportunity and political conundrum.

The past 30 years saw the rise of coastal cities in the United States. New York, Boston, Miami, San Diego, Los Angeles, Seattle and perhaps most spectacularly, San Francisco.

Immigration, the financialisation of the economy and more recently the tech boom were the economic motors. The reinvention of cities as total live/work/play environments with the best jobs and the coolest amenities attracted the talent.

These forces have not gone into reverse, the coastal cities retain real economic power, but change is afoot, not least due to the political feedback loop.

Drift to the Sun Belt

Florida’s population grew by nearly three million in the period 2010-20. While a noticeable share of Florida’s growth is driven by retirees, the Carolinas, Tennessee and Georgia are also seeing an influx of new residents and a broadening economic base that includes professional services and advanced manufacturing. Manufacturing employment in in less unionised Atlanta and Charleston, SC, grew by 8% and 16% respectively from 2016-19, well above the 3.5% growth for the US overall. The Southwestern and Mountain states, such as Arizona and Idaho, are also seeing a wave of newcomers, particularly from coastal California.

The demographic shift to the Southeast is borne out in new homebuilding activity. Year-to-date, Sun Belt states represent 56% of new single-family permitting (and comprise seven of the top eight most active states). The strong development pipeline reflects fewer regulatory challenges (planning regulations) than are commonly encountered in West Coast and Northeast markets.

“The Northeast Corridor and coastal California will require a substantial uptick in immigration to support growth, especially as fertility rates fall”

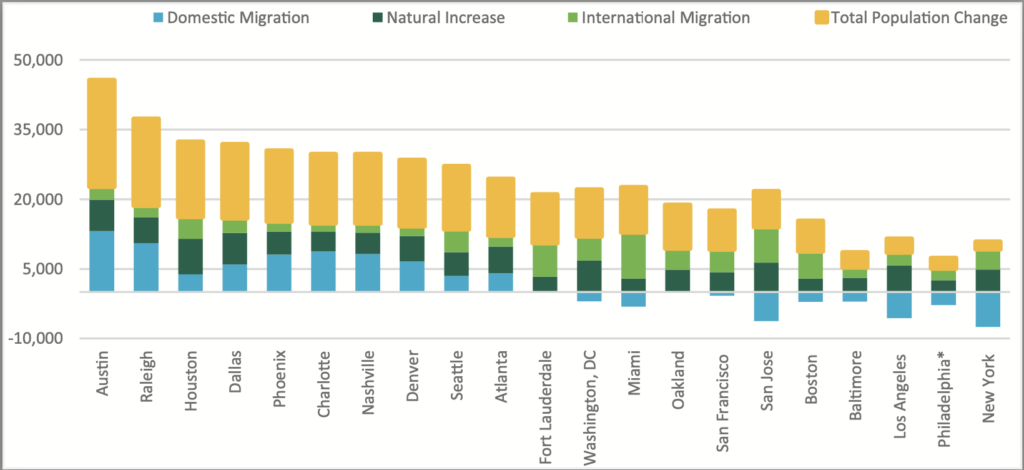

By contrast, the expensive and higher tax metro New York saw a net outflow of domestic residents in the past decade, with mainly immigration keeping its population in positive territory. Looking forward, the Northeast Corridor and coastal California will require a substantial uptick in immigration to support growth, especially as fertility rates fall.

Components of population change per 100,000 residents during 2010-19:

Source: US Census, CBRE-EA. Philadelphia* includes Philadelphia proper, Bucks/Montgomery Counties and Camden, NJ metro divisions

Suburbia redux

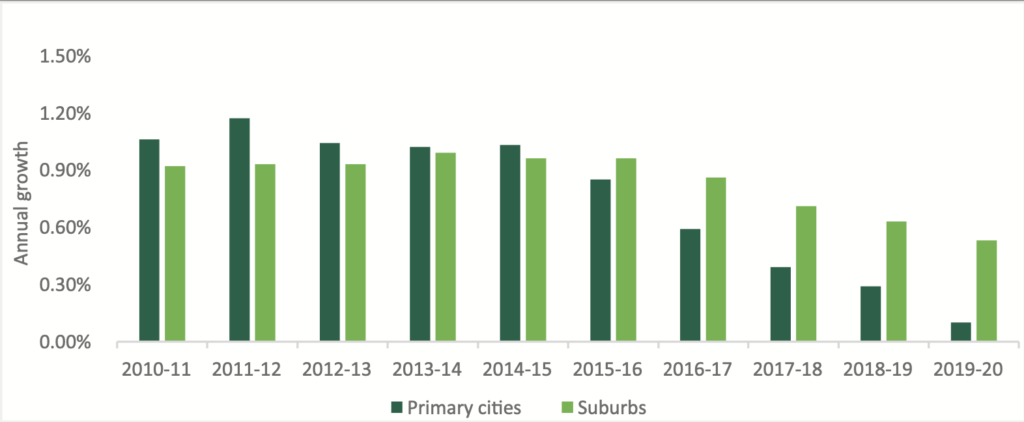

Throughout 2020, the outflow from the urban centres accelerated, according to USPS address change data, with the suburban periphery receiving more move-ins. This pattern proved remarkably consistent in areas as different as the Northeast, Sun Belt and the Rust Belt. The rising fortunes of the suburbs coincide with the ageing of the large millennial cohort into the family formation life stage: today, there are five million more people between the ages of 25 and 34 than there were a decade ago.

Population growth for primary cities and suburbs within major metro areas

The emergence of ‘mini San Franciscos’

The tech sector is rapidly dispersing from its high cost West Coast havens. The digital diaspora is only going to a few select places, however. The new tech enclaves offer the rare combination of a highly skilled labour force paired with lower relative living costs. Denver, Austin and Raleigh saw 3% average annual job growth in the years preceding the pandemic, with a strong showing among high-paying occupations, compared to roughly 2% growth for most US metros. There are such strong benefits to tech firms and tech workers from clustering that, even when they disperse from super high-cost locations like San Francisco, they tend to go to only a few ‘mini-San Franciscos’.

The rise and rise of Texas

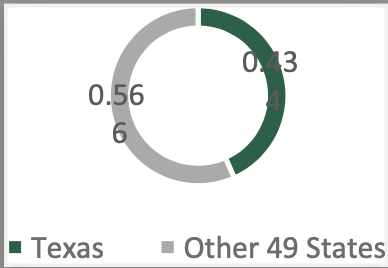

According to Spectrum Location Services, 43% of headquarter moves that ended in the first half of 2021 stopped in Texas. Some high earners have followed suit in response to the more flexible regulatory environment and easier tax burden.

Corporate HQ destinations

New opportunities

Real estate investors are making their post-pandemic preferences clear: the Sun Belt is in focus and the future is multifamily and industrial. Investment volume throughout the Southeastern US has surged past pre-pandemic levels: when comparing Q2 2021 investment volume with Q2 2019, Orlando (+83%), Nashville (+73%), Raleigh (+63%) and Miami (+45%) were top metros in terms of growth, while Tier I cities like New York (-41%) and Boston (-28%) fell short. This will likley continue!

More broadly, the changing economic geography of the United Sates is mainly driven by the normal process of households seeking to maximise their their post-tax and property cost real wage. The coastal cities have been successful in every respect apart from the supply of new housing (London is the same). The process has been reinforced in the long term by spatial variations in tax rates (for which read politics!), in the medium term by demographics, and in the short term by the pandemic and associated technology changes. These processes might be expected to trigger some sort of cumulative decline in the areas of population outflow and this is a danger. The coastal cities can easily maintain themselves with population growth through immigration. Whether the United States will choose this (rational) economic path depends a lot on whether it’s willing to accept the cultural changes that immigration implies. In the meantime, investors will need to be adroit: the situation on the ground is changing quite quickly.