Following an unprecedented crisis due to Covid, Italy became Europe’s largest beneficiary of the EU’s €750bn recovery plan designed to “emerge stronger from the pandemic, transform economies and create opportunities and jobs.” In return, Italy has pledged to (i) invest in promoting the uptake of digital technologies and (ii) implement solutions to secure the green transition to net zero.

What does this mean in practice? In August 2021, 80-year-old president Mattarella became the first citizen to download a registry certificate from a new national online service, saving Italians from queuing at public offices or pay postal orders to obtain copies. To access this service, Italians need to obtain the now mandatory ‘digital identity’ or ‘SPID’ (Sistema Pubblico di Identità Digitale).

Cool, huh? Where’s the catch? To obtain the SPID code, a new combined national and health insurance number is required. By birth, I am entitled to the former, but as a member of The Registry of Italians Residing Abroad (AIRE) I am, justifiably, not eligible to benefit from the latter. I won’t bore you with the ongoing battle I’m having with Italian authorities to resolve the issue. Let’s just say that red tape remains the raison d’être of the public sector. Period.

What about the green pledge and the link to real estate? While visiting family over Christmas, I noticed that at least one apartment block per neighbourhood was covered in scaffolding. No festive family gathering went without uttering the figure “cento dieci” …the discussion proceeded with a …” have you applied yet?”. I quickly learnt that the government had launched a plan allowing homeowners to finance 110% of energy efficiency renovation works through tax deductions up to December 2023 (110%!! New kitchen?). The scheme is considered a means to kick-start the economy after the pandemic while taking action to fight climate change.

Again, where’s the catch? According to the Chamber of Deputies, excessive bureaucracy and the regulatory complexity of the scheme is leading to a lack of applications with new tax credits of €140m in 2022 reaching a scheme utilisation rate of only 19%. According to a survey, more than three million Italians interested in the scheme have given up because of the amount of red tape required. Six million say they do not fully understand how the facility works. Ouch. Why am I not surprised?

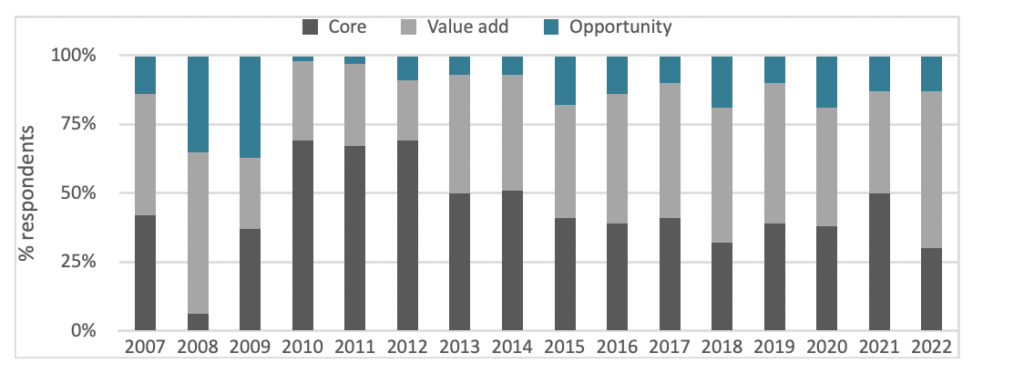

INREV Investor Intention Survey 2022

Back to work in January and the annual INREV Investor Intentions Survey unveiled a complete strategy reversal among global investors across all regions. In 2021, 50% of respondents expressed a desire to deploy capital to Core strategies – a successful bet given ODCE’s record return achieved in Q4 (3.42%). In 2022, of the €67.5bn expected to be deployed, 57% will target Value Add strategies.

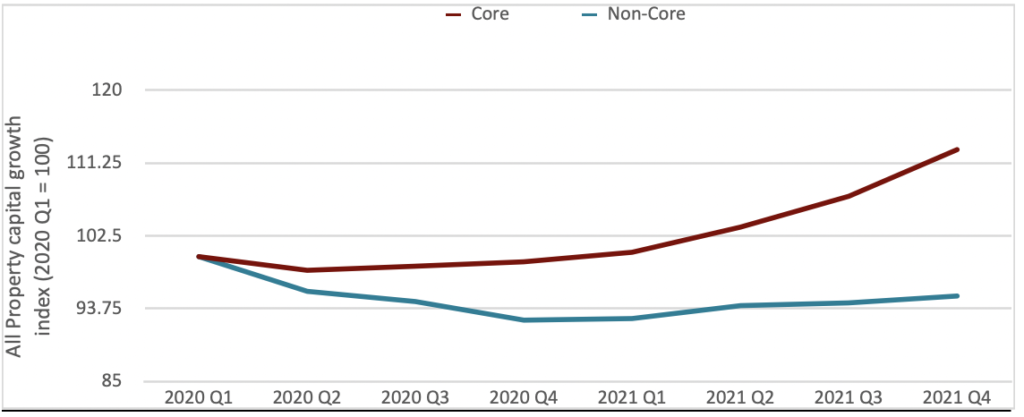

Why the sudden change of heart? After all, Non-Core All-Property values have almost recovered since the start of the pandemic. The window of opportunity to buy at a discount has virtually eroded.

Core vs non-Core funds capital growth index

What’s going on? You guessed it. 2021’s climate calamities, COP26 and Storm Eunice continue to remind us that the Paris Agreement deadline lies just around the corner. It’s as if Value Add funds have inherited some higher purpose to save the planet with their ability to limit ‘stranded risk’ through decarbonisation solutions. The regulatory environment has essentially stripped fund managers from the pressure of selecting the right timing to enter a market. In short, Value Add funds will remain relevant between now and 2050, no matter where we are in the property cycle.

Besides obsolescence, other headwinds include persistently higher inflation, shortening lease lengths and the need to better understand the performance of emerging sectors of an operational nature. In a nutshell, the real estate asset class is evolving, becoming more niche and will require experience coupled with new skill sets to support the transition from passive to active strategies.

On the upside, long-term structural forces are likely to keep long-term interest rates low due to longevity and low fertility rates resulting in a savings glut, implying real estate will continue to look attractive versus bonds. E-commerce continues to provide compelling support for logistics demand while allocations to the counter-cyclical living sectors are supported by (sub)urbanisation, smaller households, and affordability constraints. Overall, investors have voted with their feet by seeking to increase allocations to global real estate from 9% to 10% this year.

As for progress on obtaining my digital identity, like Sorrentino’s Oscar-nominated film, it remains In the Hand of God.