Gentrified locations, life sciences and IT.

Many cities across APAC (Asia Pacific) continue to grow at an aggressive pace. And with this growth has come the emergence of new and exciting urban locations including in Sydney, Melbourne, Brisbane, Seoul and Fukuoka. These locations are often the home of rapidly expanding business clusters – centred around growth sectors, such as technology or life sciences – and supported by improving infrastructure.

Higher investability of office stock and superior amenities are characteristics of particular importance to a new breed of tenant. These factors coupled with rental affordability are expected to attract a new generation of employees through the development of innovative and flexible workspace, particularly in the technology and creative hubs.

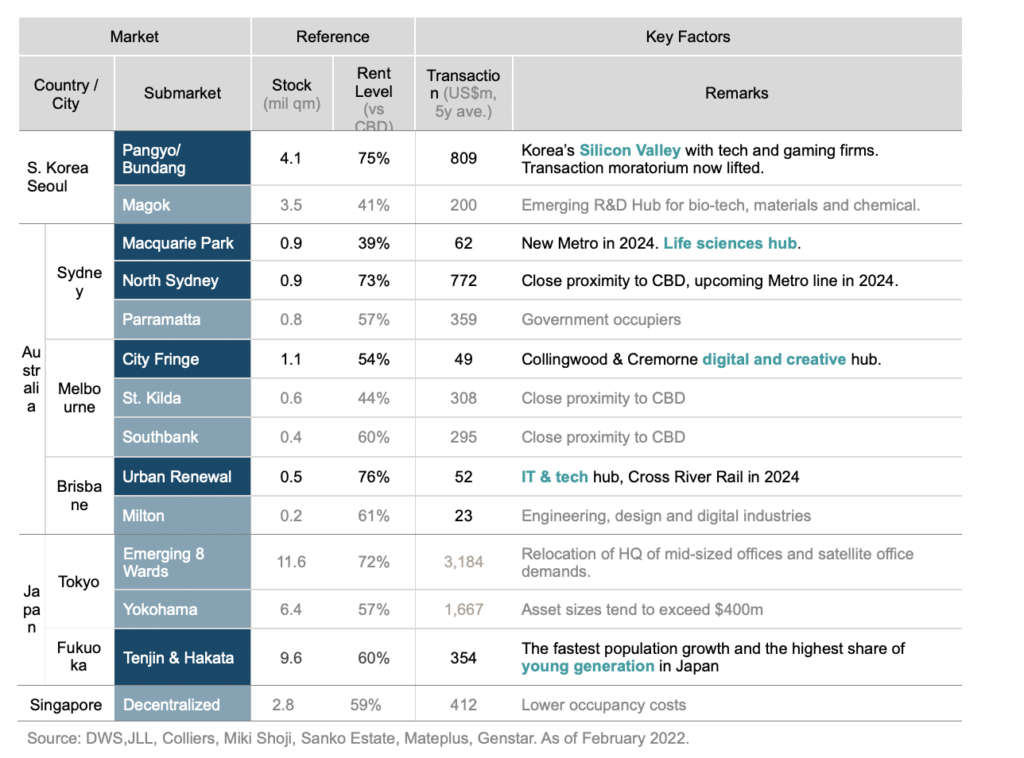

Exhibit 1: stock and rent level

Australia

North Sydney and Macquarie Park

The North Sydney office market is a natural extension of the Sydney CBD and in recent years has emerged as a media and technology hub. Given the availability of good quality office stock and public transport accessibility, including the upcoming Sydney Metro line (Victoria Cross Station) in 2024, have seen major firms including Microsoft, SAP and Nine Entertainment establishing their headquarters in this precinct. Improvement in retail amenities is expected to increase the attractiveness of the submarket over the long term.

Macquarie Park, one of the established life science hubs in Australia, is approximately 18kms north-west of the Sydney CBD. One of the unique features of the submarket is the co-location of the hospital and university, which are important for many of the pharmaceutical companies, given the research and development (R&D) partnerships. Major companies, including Johnson & Johnson, Novartis and AstraZeneca are all headquartered here. With life science expected to advance further in light of the Covid-19 pandemic, this will favour office markets such as Macquarie Park.

Melbourne city fringe

The Melbourne city fringe market draws tenant demand from creative and technology industries and is well serviced with retail amenities and excellent connectivity to public transport networks. This submarket has undergone gentrification and has attracted many companies with younger employees, who also reside in the suburbs and prefer to live and work in the same area.

Within the city fringe submarket, the more established submarkets include Richmond and Cremorne, which have become Melbourne’s tech hub, housing several companies, including Tesla, MYOB, Walt Disney and advertising company REA. The presence of these companies provide an anchor to the precinct, supporting a wider ecosystem of start-ups and entrepreneurs. The new Melbourne Metro in 2025 at Townhall Station is expected to improve connectivity, with a direct link to Melbourne Airport in 2029 (via Melbourne Airport Rail).

Brisbane Urban Renewal

The Urban Renewal precinct is located about 2.5kms north-east of the Brisbane CBD and has undergone a significant urban renewal programme, transforming the neighbourhood into a work-live-play area with retail and entertainment amenities. The Fortitude Valley train station is just a stop away from the Brisbane Central Station. Several infrastructure projects currently underway, such as the Brisbane Metro in 2023 and Cross River Rail in 2024 are expected to improve connectivity between the north and south of the city.

The Brisbane Olympics 2032 will bring major economic benefit and raise the city’s profile globally. While the majority of infrastructure is already in place, some new projects could be delivered to facilitate the games, including Brisbane Live, the main aquatic venue to be built above the current Roma station.

South Korea

Pangyo/Bundang (Seoul)

Pangyo, dubbed the Silicon Valley of South Korea, is located 10kms south-east from Gangnam, one of the main established business submarkets in Seoul. The office submarket was developed by the Korean government as a hub for hi-tech and start-ups. Since the completion of the first office building in 2009, it has grown rapidly to become the fourth-largest office submarket in Seoul.

Pangyo/Bundang is the most popular office location for the country’s IT and gaming companies, with seven out of the 10 major IT companies in Korea located in this area, including Naver, Kakao and online gaming companies such as NC Soft and Netmarble Games. Its connectivity with Gangnam and the satellite cities have significantly improved since the opening of the Shin-Bundang subway line in 2011, shortening the travel time to Gangnam from 45 minutes to 14 minutes. Other public transportation projects are also underway to enhance the accessibility to the Greater Seoul’s key residential areas.

Japan

Tenjin and Hakata (Fukuoka)

As the educational and economic centre of Kyushu Island, Fukuoka is one of the four largest metropolitan areas in Japan after Tokyo, Osaka and Nagoya. The city has the fastest population growth and the highest share of youth population in the country.

The traditional business and retail hub of Tenjin is where the city government office and local companies are headquartered. Hakata is also an established submarket with easy connectivity to the main train station and Fukuoka international airport. Urban revitalisation projects including Tenjin Big Bang and Hakata Connected are expected to bring further high-quality office developments by 2025. Google has announced it will establish its second Japan office in Tenjin after Shibuya in Tokyo, indicating that the city is primed to become the next hi-tech hub.

Conclusion

Areas close to the CBD with high accessibility and ‘lifestyle’ precincts with retail and entertainment amenities continue to attract a new generation of employees who prefer to live and work in the same area. Better-quality office stock, particularly in cities such as Melbourne, Brisbane (Australia), Pangyo, Bundang (Seoul, South Korea), Tenjin and Hakata (Fukuoka, Japan) are expected to benefit from enhanced transport connectivity and emerging clusters of technology and gaming.