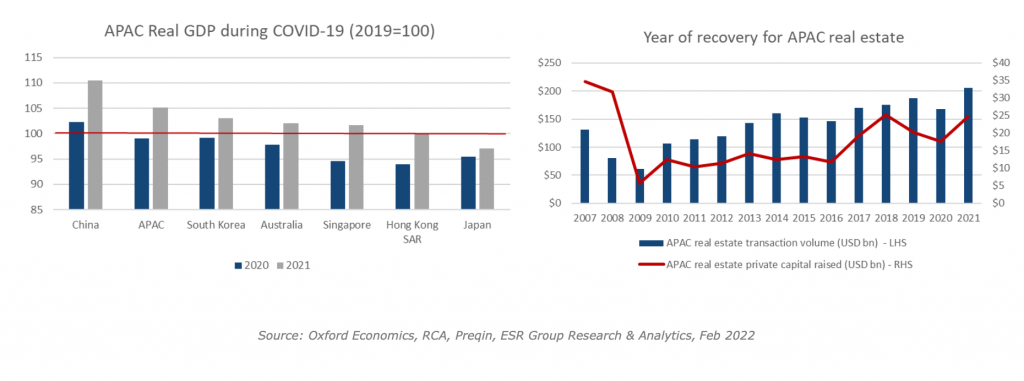

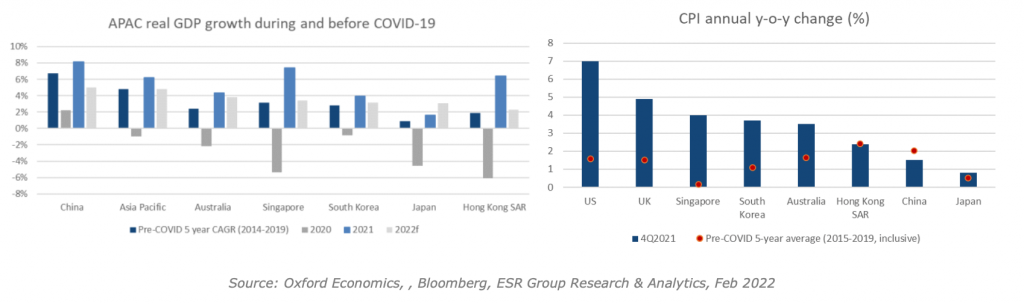

2021 was a year fraught with challenges, ranging from the emergence of new Covid-19 variants to regulatory pressure on China’s property developers. Asia Pacific (APAC) saw an economic recovery despite these downside risks. Preliminary data from Oxford Economics shows APAC’s real GDP in 2021 exceeding that in 2019 by 5.2%. Most major APAC economies have also seen real GDP recover past pre-Covid levels.

Data on APAC’s real estate landscape tells a similar story. Investment in APAC real estate hit a historic annual high in 2021, surpassing the US$200bn mark in one calendar year for the first time. APAC real estate private capital fundraising also experienced a strong rebound, with annual capital raised only narrowly, missing the past decade’s record figure.

Real estate investor sentiment is positive, suggesting that growth is likely to continue despite lingering and emerging headwinds. According to ANREV’s 2022 Investment Intentions Survey, 63% of APAC institutional investors plan to increase their real estate allocation over the next two years, while the remaining 37% expect no change.

With that in mind, we spoke to several of our senior decision-makers for their take on the most promising investment opportunities in APAC, as well as the key risks that investors will need to remain mindful of.

Riding on the new economy

The new economy has been a rising trend that will keep gaining momentum in APAC, benefitting demand for certain real estate asset classes. Data from the International Telecommunications Union indicates that various APAC economies have achieved a level of digitisation comparable to developed Western nations. Meanwhile, the internet user base of countries like China has substantial potential for growth given the large population and relatively low internet penetration.

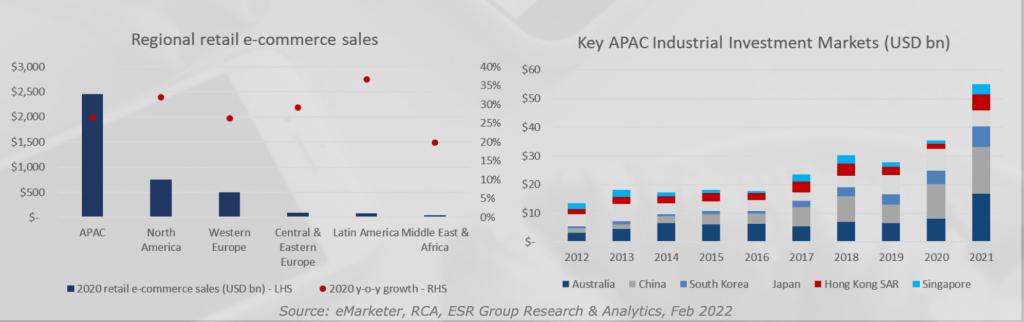

We expect logistics assets to continue to be a key beneficiary of APAC’s digitisation. Continual population growth, rising affluence, and high levels of internet users have turned the region into a hotbed for e-commerce. The latest available data shows that APAC is the world’s leading region for e-commerce sales by a significant margin, largely due to China’s sizeable e-commerce industry.

China, Australia and South Korea are key markets for logistics, where all are seeing robust e-commerce and investment activity. Another promising market is Thailand. According to Jai Mirpuri, ESR Country Head of Singapore (Development) & Thailand, the country has a favourable environment where currency volatility is low, and yield spreads are healthy. He adds that demand is also likely to benefit from positive e-commerce prospects and infrastructure investment. Railway connectivity with China via Laos is expected to link supply chains to Thailand’s ports across the region.

Cold storage is another asset type worth keeping a finger on. Moses Song, CEO of ARA, opines that logistics will still be the hot sector but it’s becoming more of a land banking play. “Cap rates on stabilised portfolios are very low, and given the inflationary environment, there’s a serious risk that the leases currently locked in will be on the low side in the next few years. Perhaps a more specialised focus in cold chain logistics might be better as that’s still in heavy demand,” he added. Indeed, cold storage has seen an upswing in demand driven by the robust growth of the online grocery industry, which the COVID-19 pandemic has further accelerated. Data from Forrester shows online grocery was the fastest-growing APAC e-commerce subsector in 2020, with annual sales expanding at 46%. The subsector is forecasted to continue to lead e-commerce growth through 2025 (Robert Stockdill, Sep 8, 2021, Online retailers in Asia Pacific drew 154 million new customers last year. Inside Retail. https://insideretail.asia/2021/09/08/online-retailers-in-asia-pacific-drew-154-million-new-customers-last-year/).

Concurring with Moses’ view, Head of ARA China Alvin Loo remarked that the primary focus in China is on New Economy sectors i.e. logistics and business parks, with additional focus on strategic sub-sectors such as cold chain logistics. Logistics and business parks are beneficiaries of the Covid-19 pandemic and China’s drive to be more self-sufficient.

Offices are here to stay

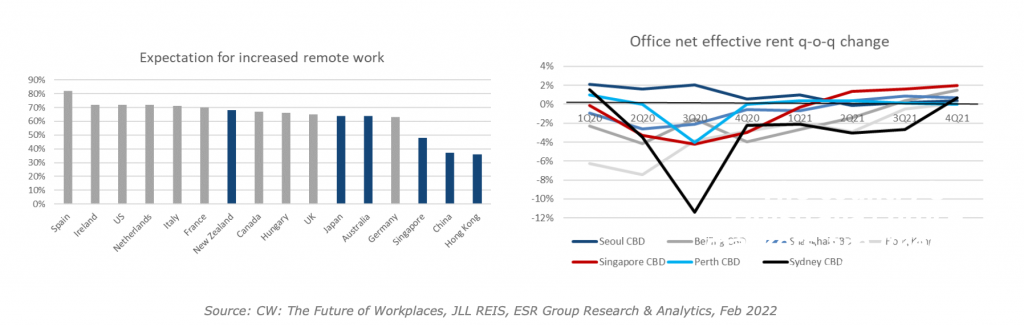

Aside from new economy assets, which include business parks, data centres, and logistics warehouses, we also remain bullish on offices. While working-from-home (WFH) is likely to rise in popularity, we believe that office demand is expected to remain resilient, at least in the near term. This will especially be the case in markets like China, Hong Kong, and Singapore, where WFH seems less popular (Cushman & Wakefield, The George Washington University, 2020, Workplace ecosystems of the future, pg 10. https//www.cushmanwakefield.com/en/insights/covid-19/the-future-of-workplace/).

A recent CBRE survey corroborates the resiliency of APAC office demand, showing that those managing APAC office portfolios are much more positive than peers managing global office portfolios (CBRE, Jan 2021. Future of Work – Resetting Asia Pacific Office Strategy, pg 20. https://pacresearch.cbre.com/en/research-and-reports/Asia-Pacific-Major-Report—The-Future-of-Work-January-2021). The office sector remains on most investors’ agenda and is the largest sector by dollar value in APAC, with over US$86 billion worth of transactional activity in 2021, according to RCA data.

We are also optimistic about the longer-term outlook of the office sector due to the region’s vital services sector. The service sector has been instrumental to APAC’s economic success, being the largest contributor to economic activity in most key APAC markets and outpacing services sector growth of the US and UK in the decade up to Covid-19 (2009-2019). This is likely to continue, with the region’s services sector forecasted to continue clocking strong growth on the back of structural trends, such as digitisation.

Notably, multiple office markets in the region already look to be bottoming out. Office rents in Perth, Sydney, and more have returned to growth as leasing demand returns. Investment prospects abound about this inflexion point as David Blight, CEO of ARA Australia alluded that, “the country’s office markets are likely to be an attractive source of mispricing opportunities”.

Multifamily to benefit from tailwinds

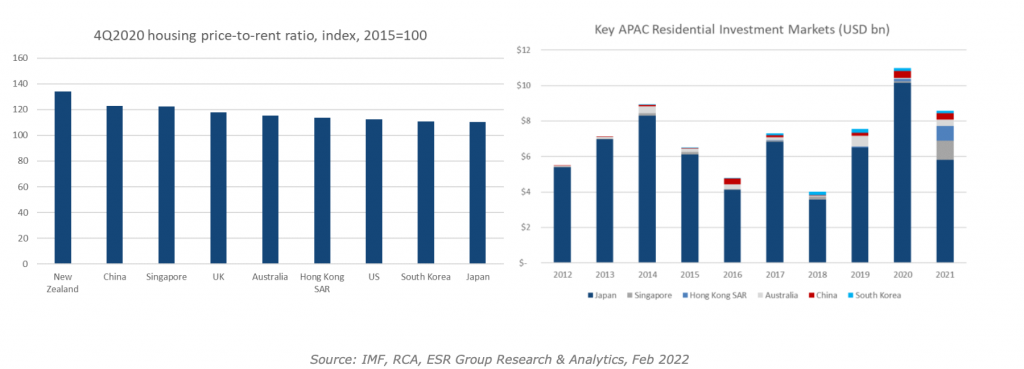

Multifamily is another sector we’re most optimistic about. According to Mr Song multifamily rental housing is a sector that will benefit from multiple tailwinds. “These include the rising affordability of renting versus purchasing a house, as well as the undersupply of adequate substitutes in key APAC markets, which have nascent multifamily rental markets compared to the US and Europe,” he added. A recent survey by PwC echoes our view, with their respondents picking the multifamily/rented residential sector as having the second most positive prospects in APAC, just behind industrial (PwC and ULI, Emerging Trends in Real Estate Asia Pacific 2022. https://www.pwc.com/sg/en/publications/aprealestemerging.html/).

The multifamily sector is likely to remain attractive in the long term given a robust set of structural trends. Population growth coupled with rising migration into APAC gateway cities will fuel an expansion in demand for housing. Renting is likely to become an increasingly attractive option, as IMF data shows the increase in housing prices outpacing rents.

APAC’s institutionalised rental housing market is still in its infancy, meaning that early movers in the sector can capitalise most on the rising demand and lack of supply. Thus far, Japan and Australia are at the forefront of multifamily development in APAC, although both markets heavily lag those in the West. Other key cities, including Shanghai and Singapore, are also likely to see increasing activity given their strong fundamentals for rental housing.

Rising geopolitical risk

While 2022 is likely to hold promising opportunities, investors should remain mindful as they navigate the emerging risks. We are monitoring the delicate geopolitical tension, between US and Russia on the latter’s assault on Ukraine. Oil prices (Brent futures) breached the US$100 per barrel mark, reaching an eight-year high of US$104.97. The situation in Ukraine is likely to stoke oil prices above the US$100 level in the near term, according to market watchers. This elevated oil price will hurt the delicate global economic recovery and fuel inflation. Oxford Economics expects this conflict to lower the GDP growth in the Asia Pacific by 0.1-0.15 ppts in 2022 and inflation higher by 0.3-0.4 ppts (Oxford Economics, February 2022, Asia Pacific Chartbook February 2022).

Another risk is between China and the US. The current relationship between the two nations is possibly at its lowest, with actions ranging from the US diplomatic boycott of the Winter Olympics to disruption of Chinese tech companies like Bytedance (the creator of TikTok). The US-China relationship is increasingly adversarial, according to US Secretary of State Anthony Blinken (South China Morning Post, 25 Jan 2022, .China-Us Relations : Blinken says Beijing is bringing more aggression to competitive and cooperative ties”. https://www.scmp.com/news/china/diplomacy/article/3164627/china-us-relations-blinken-says- beijing-bringing-more).

As tensions over various flashpoints heighten, more APAC nations are at risk of having to take sides between the two superpowers. A key example is Australia’s exporters, which have been impacted by the country’s worsening political relationship with China. With US-China tensions having a widening scope of impact, it will be important to monitor how APAC’s real estate markets may be impacted.

Economic uncertainty and the threat of inflation

According to Mr Loo, the economic uncertainty and weaker than expected growth in China is another key risk we should be watching. While China’s economy was relatively resilient in response to Covid-19 and started recovering earlier than many other nations, its rebound is now facing multiple headwinds. These include its struggling property sector, tepid private consumption, and the new Omicron Covid-19 variant. Notably, Oxford Economics is forecasting China’s 2022 real GDP growth to be lower than pre-Covid levels.

China’s weakening economic growth has prompted the People’s Bank of China to lower interest rates for the first time in almost two years. But in most other economies, the concern is the opposite. Anthony Kang, CEO of ARA Korea, keeps a keen eye on any premature interest rate hikes that could derail the fragile global economic recovery and hurt the Korean economy. South Korea, as the bellwether of the global export activity, has remained resilient amidst the pandemic although the Bank of Korea, one of the most hawkish central banks in Asia, has been steadily raising its rates since August 2021. The latest 25bps hike in January to 1.25% is set against a rising wave of Covid infections. Nonetheless, the South Korean real estate market has also emerged as the busiest. Greater Seoul led Asia Pacific with well over US$939 million worth of investment into the new economy sectors, over 40% ahead of the next largest Shanghai, according to RCA data.

While inflation has thus far been more of an issue in the US and Europe, some APAC economies are seeing rate hikes as inflation creeps up. Key examples include Singapore and South Korea, where 2021 inflation was much higher than pre-Covid levels. Australia is similarly at risk, with the Reserve Bank of Australia recently opening the door to rate hikes later in the year.

Growing construction costs a challenge

Another key challenge on our radar is rising construction costs. Rising demand for construction coupled with labour shortages, scarcity of raw materials, and supply chain disruptions have increased construction costs. According to Turner & Townsend, this trend is expected to continue into 2022, with Singapore (+8.0%) and Seoul (+5.2%) forecasted to experience the highest construction cost inflation amongst APAC cities.

Rising construction costs are a critical challenge that new economy investors must navigate. Despite rapidly intensifying demand for sectors such as cold storage, which have complex specifications and are often build- to-suit, the construction of new supply is limited by the scarcity of key materials. For instance, China produces 87% of the world’s magnesium, a key material used for cold storage, but has cut production due to growing energy costs (JLL, 8 Dec 2021, Raw materials shortfall is squeezing the cold storage sector. https://www.jll.com.sg/en/trends-and- insights/investor/raw-materials-shortfall-is-squeezing-the-cold-storage-sector).

A promising year ahead

Overall, although there are downside risks and challenges, the year ahead is promising. The main risks to keep track of include rising geopolitical tensions, a heightened economic risk with the possibility of premature rate hikes, and growing construction costs. Meanwhile, we believe that new economy assets, offices, and multifamily hold the best opportunities for investors. These asset classes have remained mainly resilient in the face of the pandemic and are well-positioned for long-term growth given the various structural trends that will support demand for such assets.