There’s a far more plausible explanation, and if anything, AI will be a job-creator.

“AI is taking white collar jobs” is a thing people are saying, but they’re very probably wrong.

The claim focuses on the increasingly difficult hiring market for entry-level white-collar workers, recent college graduates, MBAs and the like. The observation is correct – it is hard for new- and re-entrants to the job market (and hiring is generally slow) – but it’s been correct for a while, and you’d probably only attribute it to AI, if you only started paying attention recently.

So, what is putting pressure on white collar hiring?

Random Walk isn’t going to rehash the whole thing right now, but the gist of my theory is white collar stagnation (which is a byproduct of no exits for private capital), too long; didn’t read, if the “knowledge economy” (and its biggest paydays) are linked to the intermediation of capital, then when capital got (and stayed) relatively scarce, the knowledge economy jobs (and its paydays) would get scarce, as well.

I can’t prove it, but it makes sense, it’s been my theory for a while, and it shows up in the data. Plus, becoming a lean, mean profit-generating machine is generally not associated with lots of hiring (at least not at first).

The other thing to note is that the end of the white-collar tailwind (i.e. free money) preceded the end of the blue-collar tailwind (i.e. the labour shortage) by one year.

But now both tailwinds are over, albeit for different reasons, and hiring is slow for everyone, and AI has got nothing to do with it.

If anything, I would expect AI to increase hiring because that’s what great productivity breakthroughs tend to do.

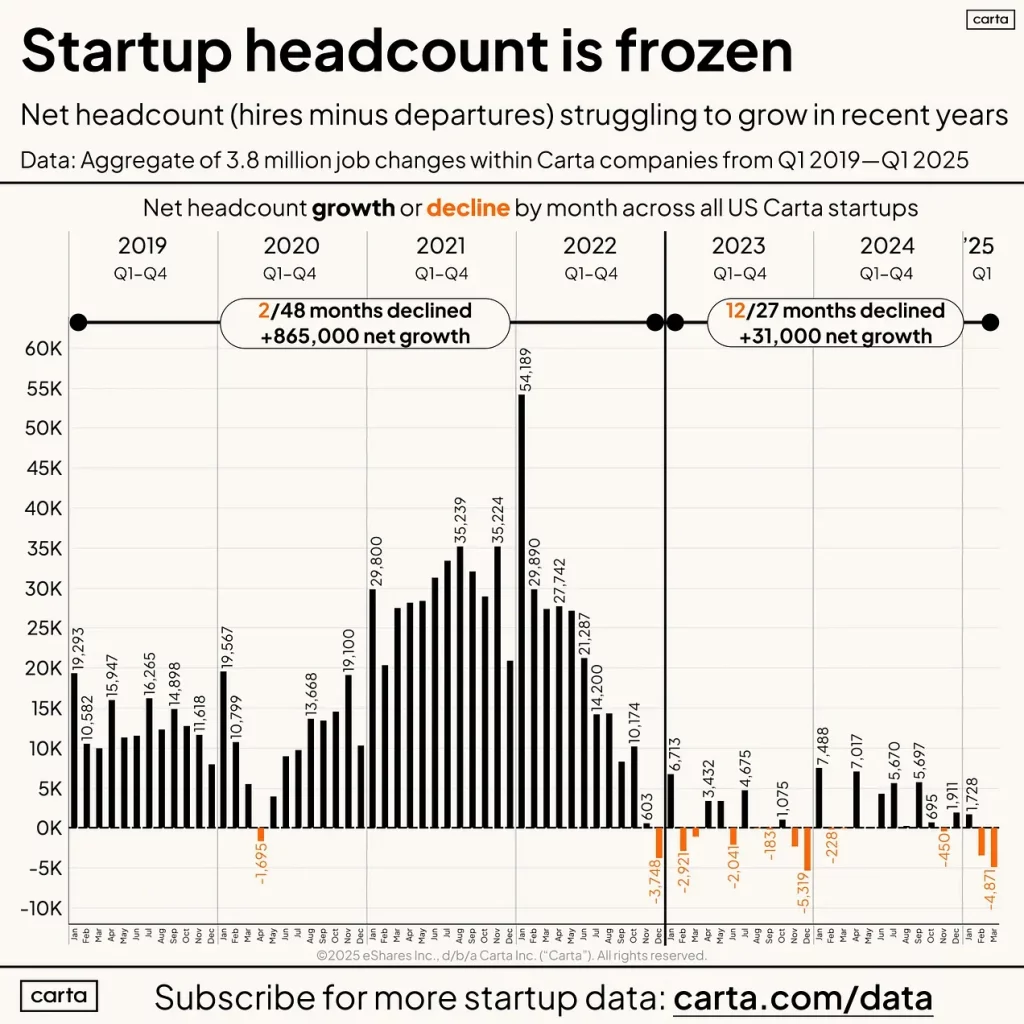

I mean, if you think e.g. startup hiring is depressed because AI (and not because VCs simply have less money to throw at startups), then I don’t know what to say:

Startup headcount has been flat for ~2+ years.

Must be AI (which gets ~70% of the funding) that froze hiring, and not the sudden rise of interest rates that turned the capital spigot to “off.”

Anyways, without debating the cause too much, at present, here are two vignettes on the state of white collar stagnation.

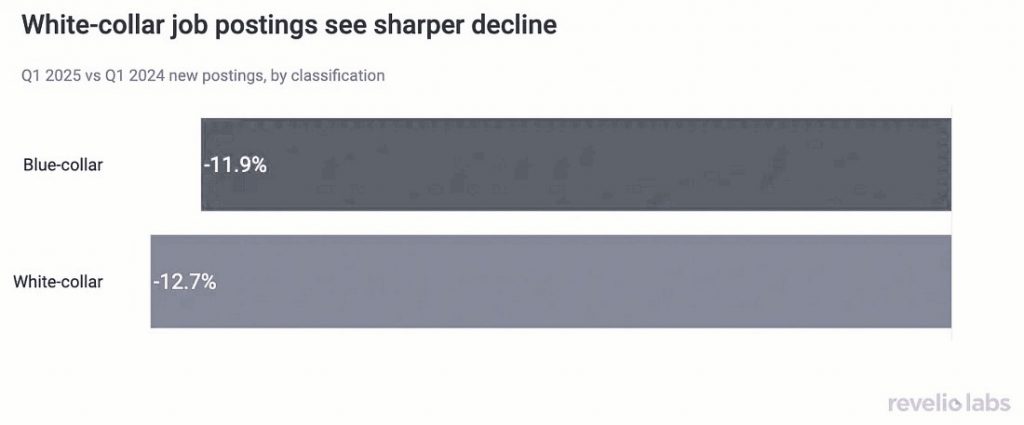

White collar postings (and wages) have stagnated more

First, white collar job postings have declined more sharply year-on-year:

Revelio

The difference between white and blue is small, but it’s there.

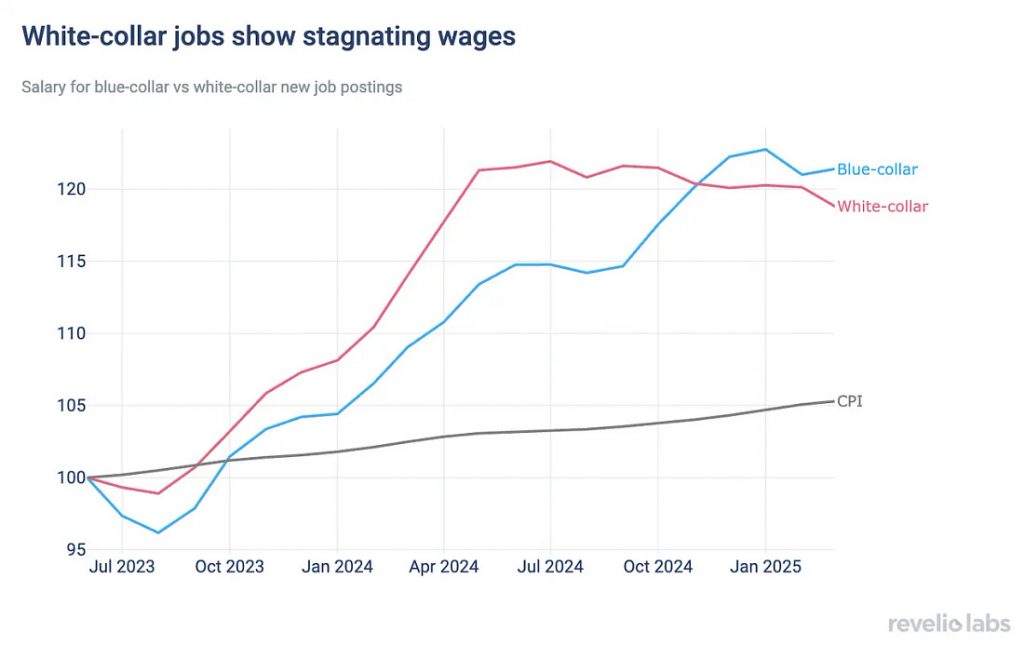

Also, white collar wages have stagnated sooner and more severely:

Posted wages for white collar jobs have been in steady decline since April 2024, while blue collar wages rolled over around October 2024.

These are posted wages (presumably for job-switchers), and not wage growth more generally, but you get the idea . . . white collar stagnation has been in the works for a while now.

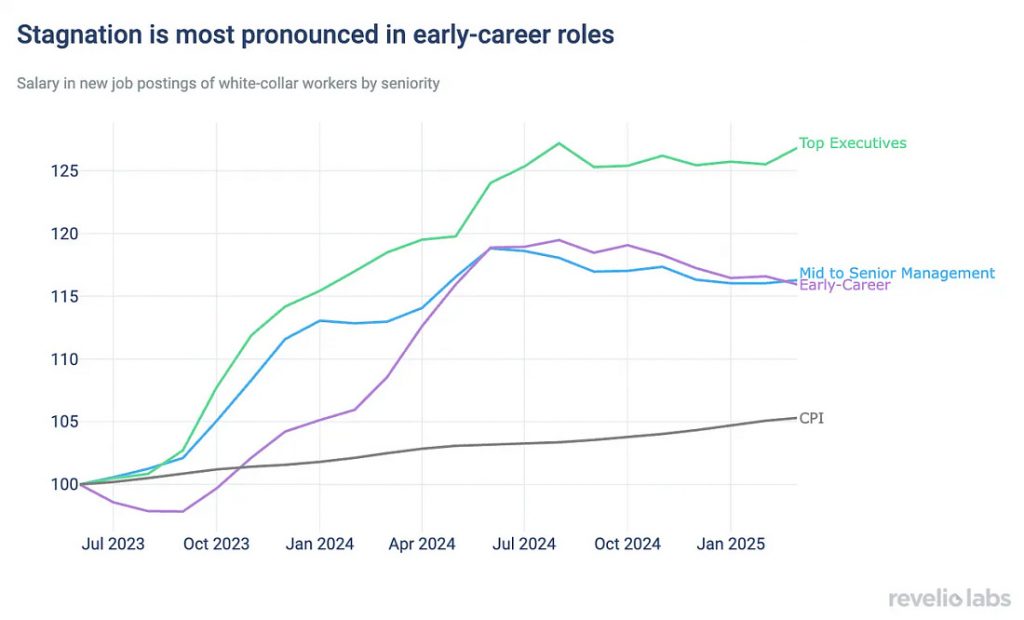

Revelio makes the additional observation that stagnation is “most acute” for mid- and early-career roles:

Posted salaries for “top executives” are mostly flat, but way ahead of mid- and early.

Plus, the flat wage growth of the top execs is better than the declining growth for the mids and earlies.

Now, it’s unclear how many “top exec” salaries are posted anywhere that Revelio can see them, but I’m including the chart to lend fuel to the “it’s the AI” fire, if only for a moment.

See, it’s the juniors that are getting replaced by AI. It’s not White Collar Stagnation! You’re wrong, Random Walk!

Perhaps.

Or Perhaps, selection-effects at-work (such that the data is meaningful at all).

To wit, from the WSJ story Three years into downturn, PE job market faces a critical test:

During the past three years there has been especially high demand for senior-level employees who specialize in one of the areas into which private-equity firms are expanding, such as private credit, infrastructure or secondaries. About 25% of all hiring is tied to firms’ efforts to diversify from being primarily buyout managers to multiasset managers, Rubinetti estimated.

The market is extremely active at the partner level, less so at the junior ranks, he added.

Right, so there is still some semblance of a talent-war for the very few PE sectors with any steam (plus capital-raisers, more generally), but for everyone else, not so much.

‘Not a good job’ > ‘good job’

Here’s some more anecdata to support the claim that white collar job growth is generally stagnant.

It comes from the NYC Comptroller, who puts out these charty reports every now and again, I love ‘em.

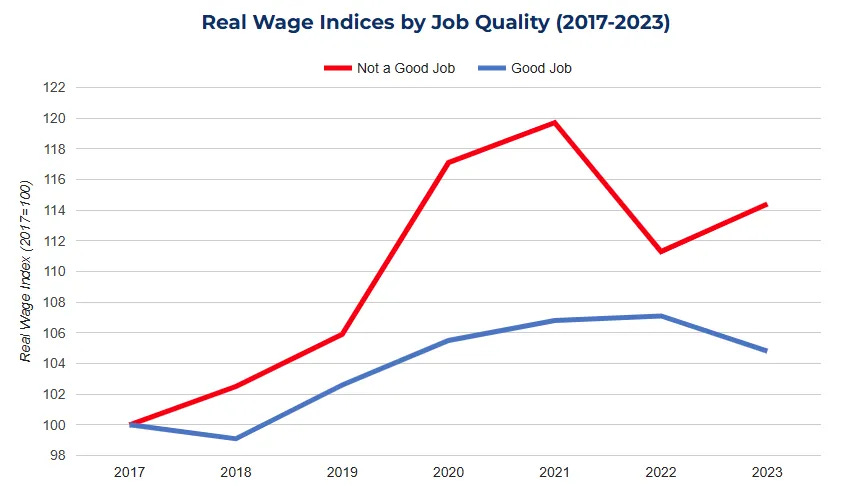

In this case, the comptroller points out that in NYC—the white-collar capital of the world—wage growth for “not a good job” has been much more robust than for “good jobs”.

Since 2022, real wages for “good jobs” have been shrinking, while “not a good job” wage growth, continues apace.

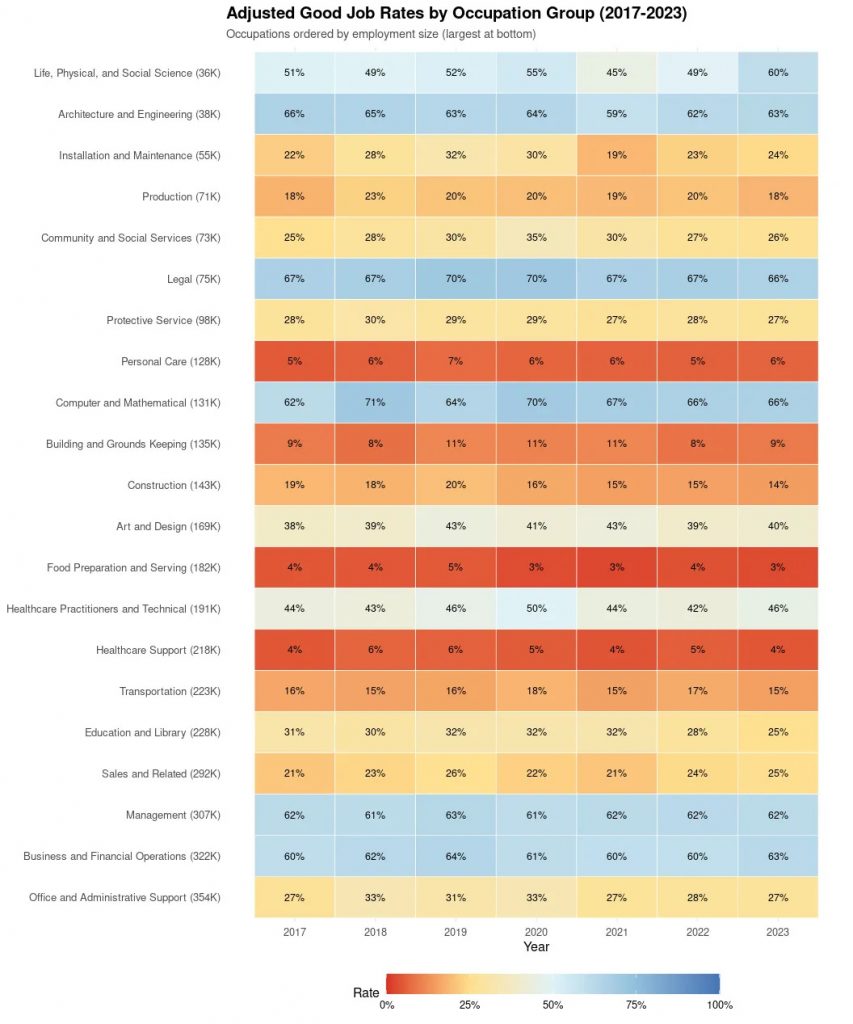

Now, the “good jobs” are not exclusively white collar, but they mainly are:

Good jobs concentrate in architecture, computers, legal and management, while “not good” concentrates in food preparation and healthcare support.

Food preparation and healthcare support are the little job-engines that could(and not just in NYC).

Now, to be fair, the data cuts off in 2023, and NYC has seen more in-migration and job-growth since then, so perhaps things have changed a bit.

But again, you get the idea—the jobs story was mostly bottom’s up, and then when free-money went away, it was entirely bottom’s up (and now everything has just normalised to slow).

This article was originally published by Real Random Walk.