A trade deal between the U.S. and China was supposed to be one of the things that would mark a return to normality for the markets and maybe even ignite the next leg of the bull market.

Even though we got one last week (who knows what’s actually a part of the deal, but it’s not likely to be a game changer), the market again largely shrugged it off.

If investors are settled on their view of the trade war, it’s time for them to find the next catalyst.

For many, it’ll probably be the Fed and the never-ending game of “will they, won’t they”. The market has been preparing itself for a continuation of the rate cutting cycle that began back in September 2024, but has gotten little cooperation from Jerome Powell and company. The Fed Funds rate has been lowered by 100 basis points in the past year, but there have been no rate cuts in 2025. The calendar keeps getting pushed back as inflation has remained sticky.

I think the catalyst will be something different. I’m looking at the Japanese yen, its relationship to the dollar and long-term Treasury yields.

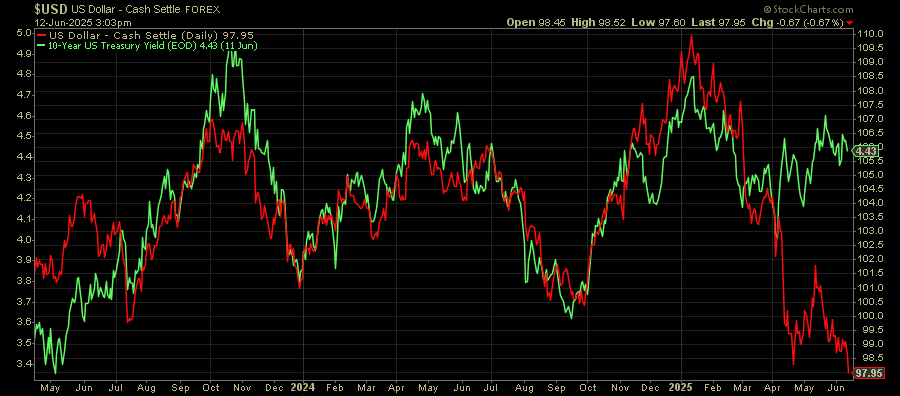

Yields and the dollar typically have a pretty durable relationship. When yields rise, the dollar tends to strengthen as investors look to boost their returns. Recently, however, that’s turned into something much different.

That correlation has clearly disintegrated. The 10-year yield has made a modest move higher, but the dollar continues to fall. As I write this, the dollar just hit a three-year low and who knows where the bottom is.

The impetus is likely the concerns around the “One Big Beautiful Bill”. If it passes, it’s probably going to end up adding trillions to the national debt and balloon annual budget deficits to $1 trillion+ for the foreseeable future. Deficit hawks have sounded the alarms and this in conjunction with Trump’s tariff threats have eroded confidence in some dollar-denominated assets.

The yen is having its own issues. Japan’s combination of 0% growth in Q1 and an inflation rate hovering around 3.5% creates a stagflation threat that could roil the entire global market. Weakness in the dollar, however, has masked some of that risk, at least as it shows up in the dollar/yen exchange rate.

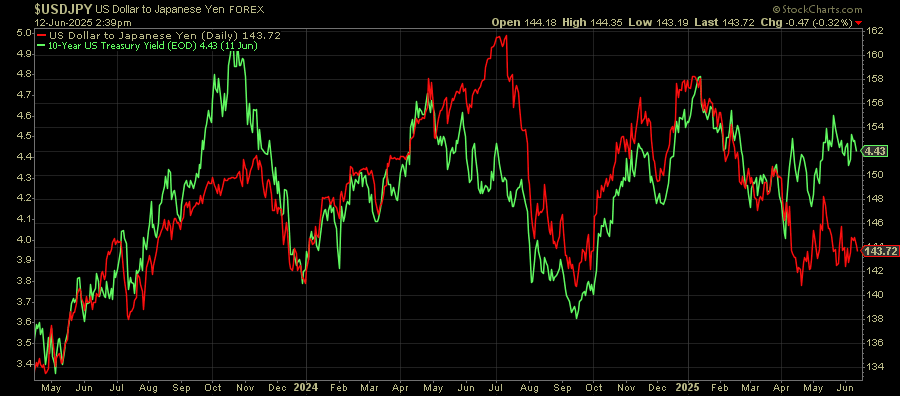

You probably know that I’ve been watching the yen closely for some time. When I recently put the dollar/yen rate against the 10-year Treasury yield, an interesting pattern emerges.

This just over the past 2+ years and reflects the generally positive, but sometimes disconnected relationships between the dollar, yen and yields. In particular, there are three disconnects that got out of hand fairly quickly and mean-reverted even faster to get the relationship back in line.

- H2 2023 – The Fed’s focus on QT and a persistently hawkish outlook helped to spike rates on the long end of the curve. To recapture the trend, either yields needed to plunge or the dollar needed to strengthen. Turns out the dollar fell, but yields fell faster, bringing the relationship back in line.

- Summer 2024 – Widening interest rate differentials (the BoJ kept rates near zero at the time) flooded the yen carry trade. The BoJ signaled an intention to keep policy conditions loose and the yen plunged. The correction, of course, happened with the yen carry trade unwind that sent the yen sharply higher again to bring it back to the mean.

- 2025-Present – As mentioned earlier, the lack of faith in the dollar and government bonds, thanks to tariffs, the prospect of new debt and a Moody’s downgrade, have created the latest disconnect. It has yet to correct.

If history is any guide, that leaves one of two outcomes possible to bring this relationship back in line. Either the dollar needs to strengthen or Treasury yields need to drop.

My bet is that it’s the latter.

This article was originally published by The Lead-Lag Report.