Well, I suppose Trump doesn’t actually chicken out of everything.

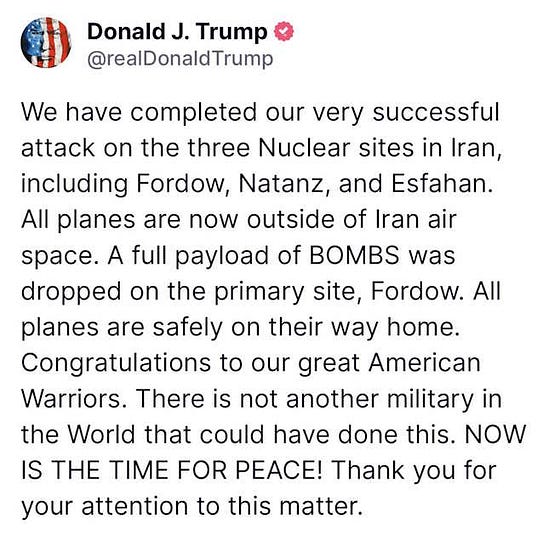

The U.S. has bombed Iran’s three nuclear enrichment facilities. Here was Trump’s announcement of the strikes on social media:

The consequences of these strikes aren’t yet clear. I’ve seen a lot of hyperventilating takes about how World War III is now underway, but this seems obviously false. The world may indeed be in the foothills of WW3, but even if it is, it’s highly doubtful that strikes on Iran’s nuclear facilities will be what push us over the edge. Iran has friendly relations with China and Russia, but neither one seems to have any interest in coming to Iran’s aid in the current conflict — China doesn’t appear to be interested in getting in wars outside its own neighborhood, while Russia is simply too preoccupied with its war in Ukraine.

Nor do I expect the strikes on Iran to lead to a U.S. “boots on the ground” invasion. First of all, there’s the TACO factor — Trump was only willing to conduct some very limited airstrikes, and only targeted narrowly at Iran’s nuclear program, and he was only willing to do it after Israel had already neutralized much of Iran’s long-range strike capability. So far, the best Iran has been able to do in this war was to kill a few dozen Israeli civilians, and even its ability to do that much might have been mostly neutralized. Iran’s leaders are issuing dire threats against the U.S. in response to today’s strike, but there’s just not much they can do other than take some weak potshots at U.S. bases in Iraq.

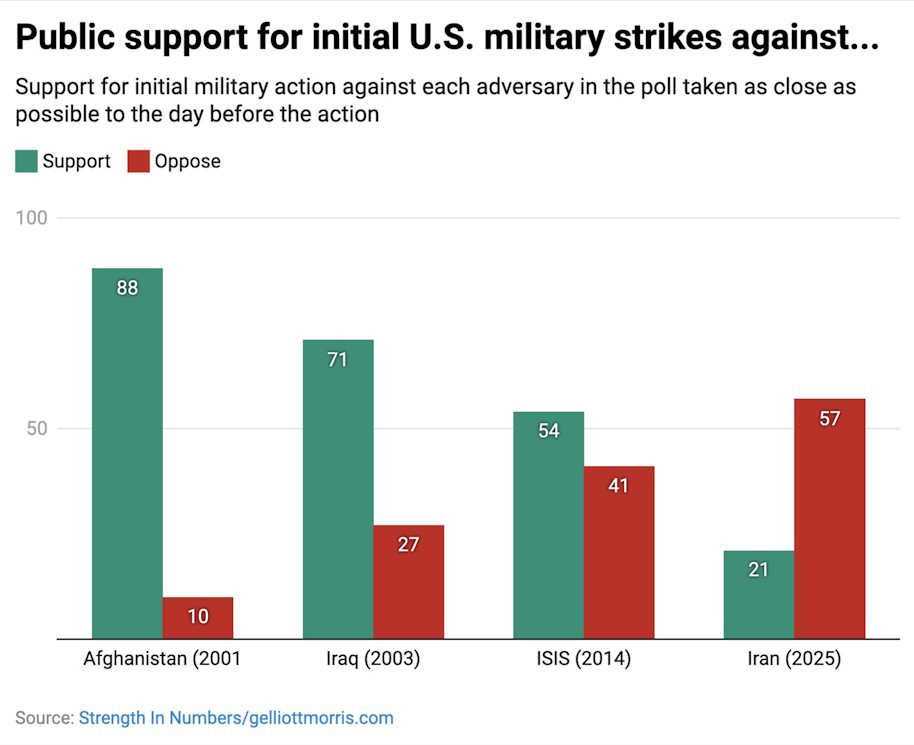

So Trump was taking almost no military risk with these strikes — they don’t show a new, bolder, braver Trump. And the President knows that public opinion is strongly against a war with Iran:

Source: G. Elliott Morris

So, while these things are always hard to predict, the likeliest outcome seems to be that Trump simply conducts airstrikes until Iran’s three nuclear facilities have been destroyed (if that isn’t the case already), and then backs off and leaves the conflict to the Israelis. Trump’s assassination of Iranian general Qasem Soleimani in 2020 turned out similarly.

But even though a major war seems highly unlikely, it’s still worthwhile to consider possible economic consequences. When we’re talking about the Middle East, that really means one thing: oil.

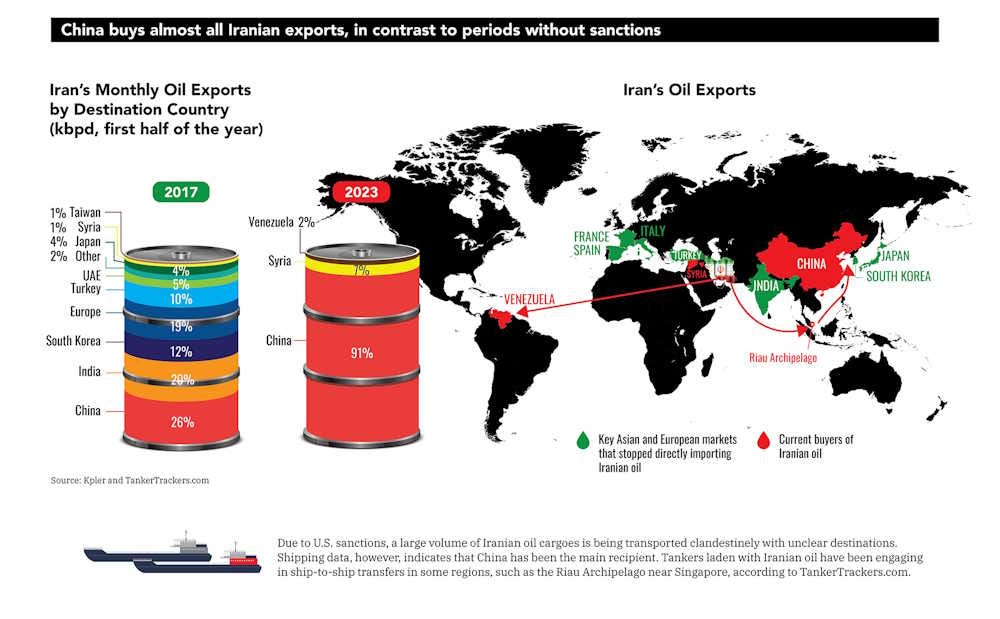

There are two ways that the Iran war might affect oil prices. First, Israel’s strikes on Iran may reduce Iran’s own oil exports. Iran is responsible for about 3-4% of world oil production, though only around a third of that gets exported. Almost all of Iran’s oil exports go to China:

Source: Washington Institute for Near East Policy

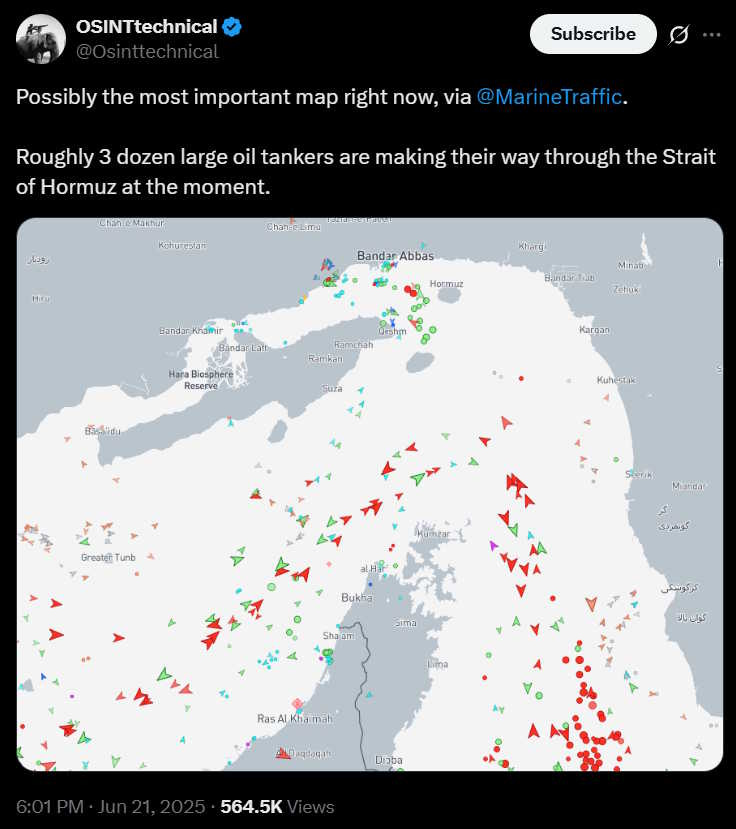

Second, and more importantly, Iran may close the Strait of Hormuz, which is the main transit point for Middle Eastern oil. About one fifth of all global oil supply goes through the Strait of Hormuz, so if it were closed off, that would be a very big deal. Iran has threatened to close the strait throughout the conflict with Israel, and in the wake of the U.S. strikes, it has reportedly announced that it’s closing the strait to all ships bound for Europe:

It’s not entirely clear whether Iran has the military ability to close off the strait, but most analyses I read say that they could probably do it. Iran has a vast and diverse array of weapons that it could bring to bear, and the strait is very narrow, meaning that its weapons wouldn’t have to operate over long range. The Houthi militia, which is supplied by Iran, has shown the ability to almost completely scare away all shipping from the exit of the Red Sea.

Even if Iran’s forces in the strait could eventually be defeated, the risk of attack would make civilian ships avoid the area entirely. Who wants to try sailing through a war zone? Already, tankers are scrambling to leave the area:

So a lot of people are worried about the impact of Trump’s strikes on the global economy. But to be honest, I think these worries are overblown. And the U.S. itself is even more insulated from oil disruption than other countries.

Why none of this is actually very scary…

This article was originally published by Noahpinion. Read it in full.