Annoyingly uncorrelated. A spark of an idea popped up. What if, the companies which had gained the most in the stock market in recent months and years had a positive impact on property prices and rents in the areas in which they operate?

It stands to reason that if the company is doing well, the employees would also prosper, or more would be hired, and so demand and property prices would also increase?

Well on that basis I went looking up and down the country for major employment sites owned or operated by companies which have done significantly well in the past year. Such as;

- BAE Systems (+44%)

- Rolls-Royce (+92%)

- NatWest/RBS (+69%)

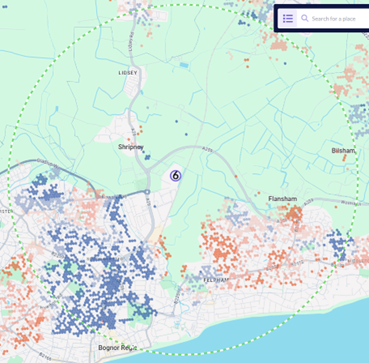

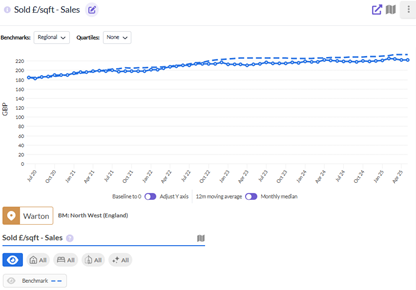

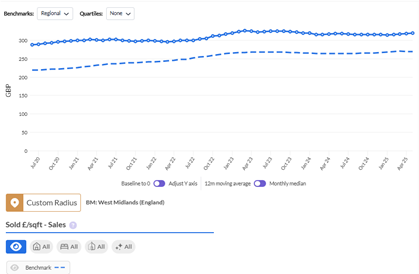

For example, I looked at BAE’s locations across the UK (first image), which covers everything from submarine pens to F-35 assembly plants, or Rolls-Royce’s factories (second image) and then looking at changes in prices and rents around those locations.

However, again and again, no matter which location or which company, there didn’t appear to be any relationship between the increase in the share price and changes in the housing market in those locations!

I then wondered if perhaps my assumed correlation only works in reverse! Property prices don’t go up with share prices as companies keep the profits, but property prices go down if share prices go down as companies engage in layoffs.

Unfortunately, (for this study, but fortunately for people in general) it was hard to find major single site layoffs other than British Steel, and even that showed little to no impact on the nearby housing market.

So, somewhat unsurprisingly, it shows that housing remains generally uncorrelated with equities, particularly specific stocks.

There may however be some implication of this knowledge in de-weighting the importance of local employers in a particular housing market, when looking at new developments. If the success or failure of significant employers has a limited impact on housing markets, then should their presence have much of an impact on investment and development decisions?

Certainly, something where more research could be done.

BAE Systems – Warton site

Two miles around British Steel – Scunthorpe site

Rolls Royce – Bognor Regis site