As investors turn to gold as a safe haven in tumultuous times, we have forgotten the role that real estate can play as a store, and source, of wealth. Prime UK residential property particularly seems to have been ignored since the heady days of ‘Cool Britannia’. Can it still act as a safe global asset class?

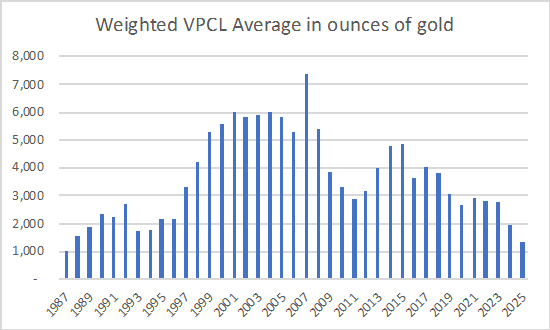

This analysis suggests that very prime central London residential property has rarely looked better value on the global stage. It is now at the same time-adjusted, universal price as it was in the recovery year of 1987. It has never been cheaper since then. Either gold is over-priced – or prime UK property is a BUY.

Recent financial turmoil in both stock and bond markets globally has highlighted the need to diversify risk in any investment portfolio. The traditional ‘safe haven’ asset is gold and it is not surprising that, at the time of writing this (19 May 2025), the price of gold is only a little off its all-time high – albeit accompanied by a very high level of volatility. As the US trade war with China escalated, there was continuing uncertainty and instability in all global markets, including stocks and bonds. Those people unwilling or unable to profit from short-term fluctuations and market manipulations were increasingly seeking alternative assets in which to shelter their finances.

Like all direct real estate markets, residential property’s lack of liquidity could be an advantage in a volatile world. The longer-term nature of the investment may make it less prone to price swings and short-term risks. Traditionally, property diversifies risk away from other asset classes, which is particularly important when both bond and stock markets seem to have been suffering simultaneously. Recent record highs in the gold price are testament to this but Real Estate, particularly land and ‘landed property’ (usually freehold) can also be seen as just the right sort of asset investment to fulfil ‘flight to safety’ requirements. There is already anecdotal evidence of an increased number of American buyers looking for Swiss real estate. Other currencies and real assets of choice may also come to include those denominated in Yen, Euros and Sterling (YES).

The chart below attempts to look at the long-term and global value of property from a somewhat unconventional angle. It shows how many ounces of gold would have been needed to buy a very prime central London residential property over the last 38 years. Using gold as a global standard of value, it incorporates elements of inflation adjustment, currency hedging and global comparison.

Wealthy individuals are attracted to cities away from war zones, with established rule of law and legal title. Also, climate, tolerance, education, culture, democracy, language, time zone, familiarity, amenities, open spaces, stock quality and a favourable exchange rate have played a part in attracting wealthy individuals and families to London. It has long been seen as a market where both capital and people are secure and where there are relatively few restrictions and taxes on overseas nationals owning land. Overseas purchasing activity in London has tended to be particularly high in years when the following three conditions were met:

1. Property prices had fallen in nominal or real terms

2. The value of the pound was low in overseas exchange markets – making UK assets appear even cheaper.

3. Economic contraction had occurred – so recovery is a possibility

Purchasers of London property, using capital that was generated overseas, have been a particularly important factor in early cycle UK housing market recoveries. Activity tends to start at the top end of the London market before extending to the prime country markets, the mainstream, mortgaged markets in the South East and then beyond. These capital injections are particularly important in the ‘re-start’ phase of the cycle before mortgage lending conditions are ripe to boost weak local demand. Could this be the case again in 2025 or 2026?

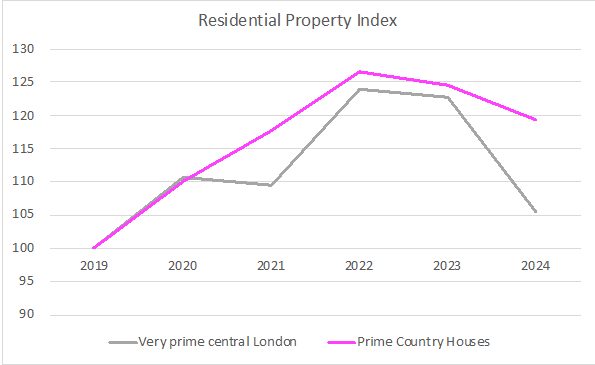

Unlike mainstream UK markets, London’s very prime market has been falling in value since September 2014, albeit with a brief reprieve during and after the Covid lockdowns. In the last five years, nominal prices are up just 5.5% on average.

The very prime country house market has shown similar patterns of growth to the London market of late. The 10% most expensive properties in counties with the highest proportion of sales over £1m grew from 2019 to 2023 but fell in value in 2024. The early signs are of continued decline in prices for the first quarter of 2025 in both markets.

Priced in US dollars, very prime central London residential property is back at pre 2011 price levels. Prime London homes have been cheaper for dollar buyers since 2016. The buying power of those holding the world’s reserve currency is still very strong. One of the most noticeable has been the weakness of sterling which, despite recent recovery, is still very near its all-time low.

However, there is a big question mark over the continued strength of the dollar as markets continue to adjust to the ‘Liberation Day’ fallout and continuing uncertainty as to how POTUS may behave next. In the short term, this may make assets denominated in other currencies look slightly more expensive to dollar holders, acting as a theoretical deterrent to American purchasers. The counterfactual to this is that, if the longer-term value of the dollar is believed to be threatened, US dollar holders may increasingly look for overseas assets, denominated in other currencies, as a longer-term hedge against dollar depreciation. Assessing the value of properties in international markets is quite different to looking at mainstream domestic prices, dependent on household incomes and mortgage rates.

London is among just a handful of the world’s 50 wealthiest cities to have seen net out-migration by millionaires and billionaires (only Moscow and Osaka have seen more). Over the same period, all the other European cities in the top 50 have seen a growth in the number of high-net-worth individuals – of between +5% and +60%. The number of London’s wealthy has fallen – by -10% between 2013 and 2023.

The UK, and London in particular, has work to do; re-inventing itself as a desirable place for ultra-high-net-worth Individuals (UHNWIs) to live, work and invest in again. This may seem like a tall order on the brink of a possible global recession, but there may be reasons for optimism. London’s stock market, alongside Europe’s, looks less overvalued and has to date been somewhat more resilient than other global bourses. Also, according to the latest October 2024 estimates from the ONS, overseas visitor numbers to the UK are well up on post pandemic levels, (though still not back to where they were in 2019). Visitors from the USA are an important component of the total number, having reached nearly 18% in 2022. This is a significant increase on 2020 levels.

On top of this are the ‘qualitative’ reasons for the UK and London to re-establish as a ‘safe haven’ in the broadest sense. Qualities like rule of law, political stability and ‘soft power’ could come to the fore. In a world where disruption is not confined to financial institutions, it may be that the UK’s cultural and educational establishments will find themselves able to prosper from a other countries’ “brain drains”. Students, academics and other talent from around the globe may find British cities relatively attractive again (provided visas remain obtainable).

In such a world, land is an asset unlike any other. It can be reinvented and re-purposed, it is the source of riches, including food and gold, but is not a purely financial asset. It is a productive asset and, with the right human interactions, it I can become more valuable and more productive (just as it can become degraded and denuded with the wrong ones). In countries with good title and rule of law, it is the foundation of wealth. Governments and citizens will do well to understand it better and to realise the role it plays as a foundation and store of our prosperity. Like the proverbial good wife, its value is more precious than jewels and its worth far beyond rubies or pearls.

A longer version of this research first appeared in Middleton Advisors’ Market Insights– UK REAL ESTATE: A GLOBAL PERSPECTIVE.

This article was originally published in The Property Chronicle Summer Issue.