Just a little grab bag of charts, asides, and riffs on themes.

YouTube is under-monetised

Random Walk made the case for Google as a $2T company, even assuming search is a worthless business (which it’s not).

As everyone expected, search continues to perform, and indeed, out-perform.¹

As perhaps some people expected, the other parts of the business, e.g. Cloud and YouTube, also out-performed (and indeed did better than baseline assumptions I used to get to the trillion dollar mark).

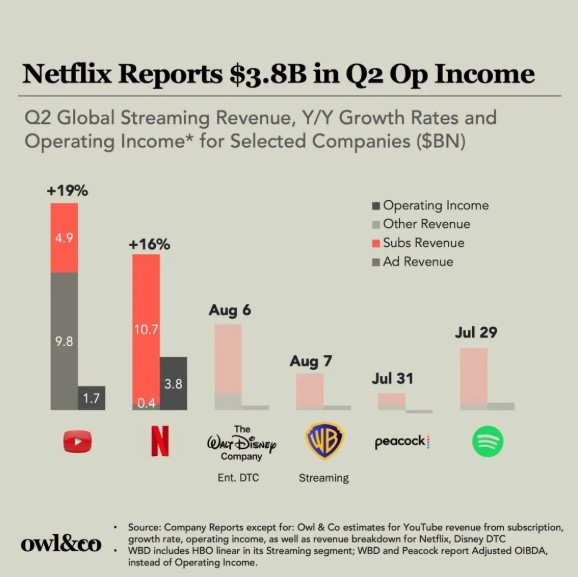

Anyways, that’s not really what I wanted to draw attention to. I just liked this visual on what I mean when I say “YouTube is Under-monetised”:

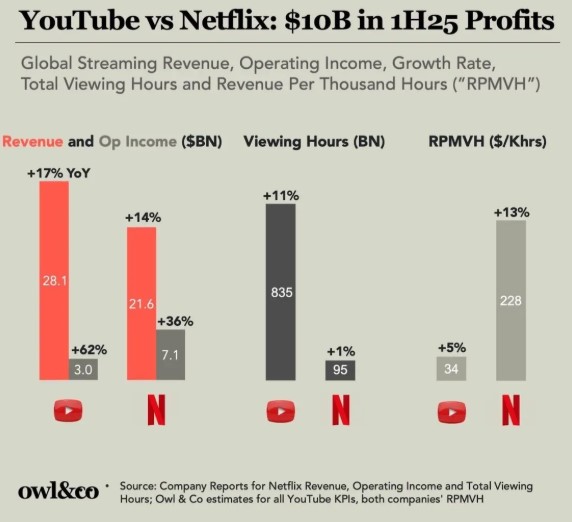

YouTube makes far less money on an absolute basis, viewing time, and/or per-viewer basis than Netflix.

Now, obviously there are good reasons for Netflix to be more profitable on a per-stream basis, but it won’t take all that much to shift YT’s unit economics more favorably, and it’s really the attention that YT commands (for better or for worse) that’s remarkable.

Is Netflix having its own Blockbuster moment, is a fair question to ask.

Spotify > OpenAI

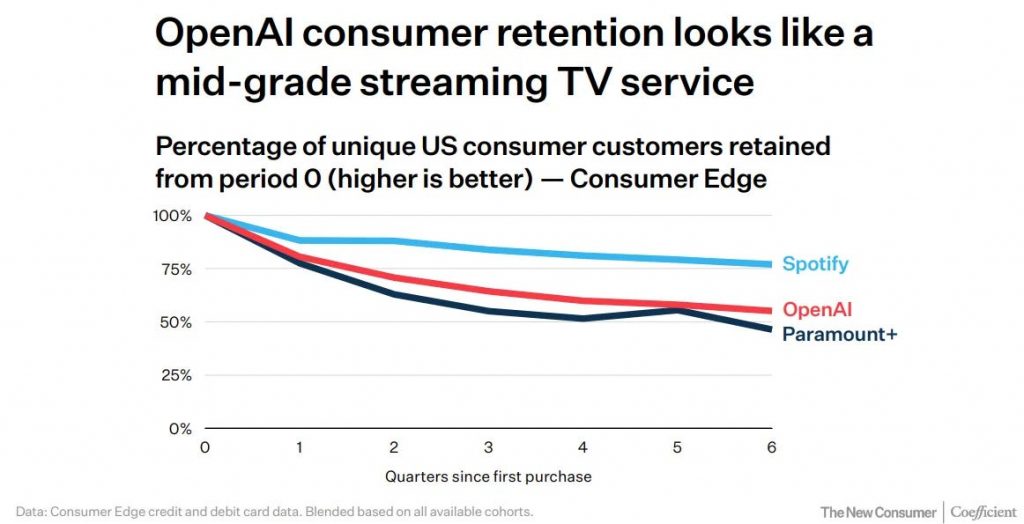

While on the subject of attention spans, this too was pretty remarkable:

OpenAI’s 6 month retention curve is 25pp lower than Spotify’s.

50% retention is a little worse than I would have expected, but I’m more impressed by Spotify than disappointed in OpenAI.

Trust the Experts

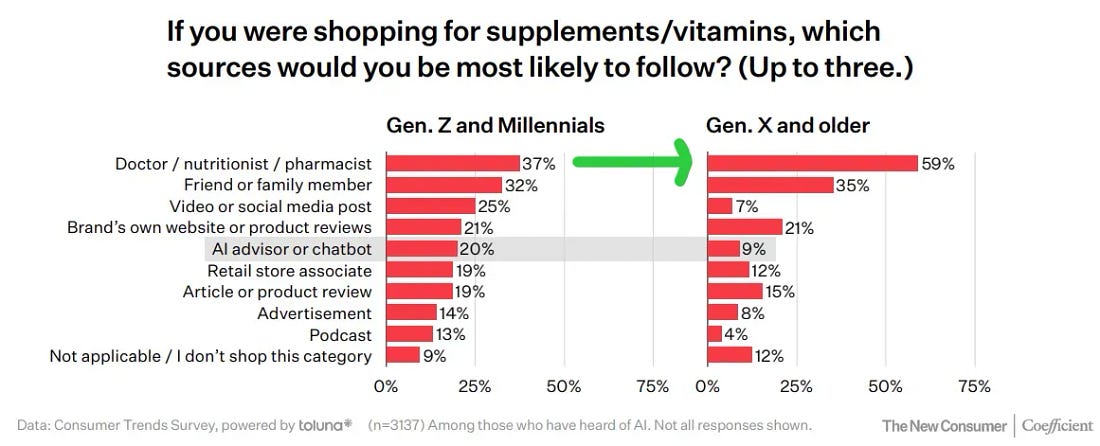

Here’s another amusing tidbit from the New Consumer report:

When it comes to supplements and vitamins:

- 60% of GenX+ asks a credentialed professional, compared to only 37% of Gen Z-Millennials

Maybe preferences shift as people get older, but I doubt it. [Younger] People increasingly do not “trust the experts.”

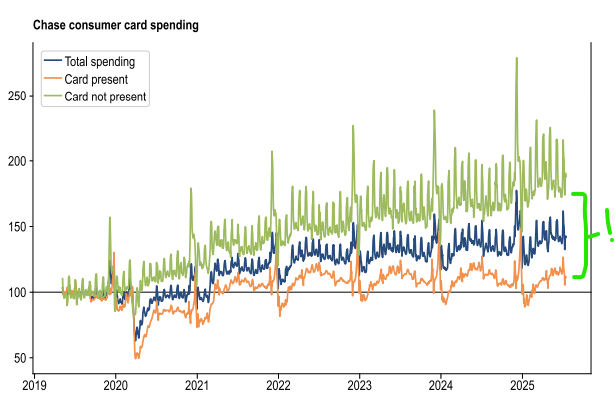

e-commerce 🤝 BNPLI still find this hard to believe, but the importance of ecommerce to the Almighty Consumer is still probably underappreciated:

Basically all of the gains in consumer spending since 2020 are attributable to “card not present” transactions.“Card not present” (which may include wanding like ApplePay) is ~60% higher than before, while “card present” is just ~5%. People really like to shop online. And online shopping continues to be a tailwind for BNPL, which gains increasing adoption across income groups and the sorts of things people buy.

- BNPL is increasingly popular for big-ticket items:

- The fastest growing user-group are high-income “extra heavy” users: BofA

“Light” users of BNPL are still the majority of BNPLers, but “extra heavy” users are growing, especially among higher-income shoppers, and apparently for increasingly expensive things. Rather than some sign of the apocalypse, this is just wider market penetration, and a well-executed plan. I mean, if BNPL is offered at checkout (as it increasingly is)—at no charge to the consumer—why wouldn’t I take advantage of it? It’s like people preferring to pay with a debit card rather than credit card…makes no economic sense. Presumably merchants will start to pushback on BNPL fees (as more people use BNPL to buy things they might have otherwise bought), but I suspect that will take a while. Idk, but I’ve been long Affirm $AFRM for a long time, and will continue to be long Affirm.

India loves Whatsapp, but really doesn’t like Whatsapp Pay

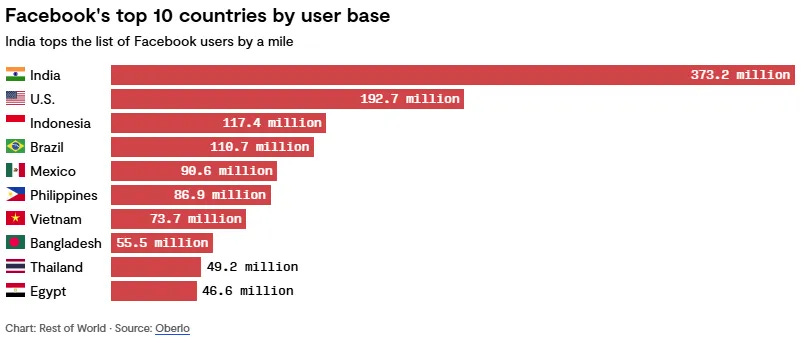

Another consistently underappreciated thing is just how prevalent “social media” happens to be in more recently connected parts of the world. Social media—facebook especially—is the internet, in some cases. Like, the fact that India is by far the largest userbase for Facebook never ceases to amaze me:

India has nearly 2x as many people on Facebook than the US. Now, this has been the basis of two Random Walkian observations:

- social media is just getting started; and

- this is especially bullish for $META

Well, the first part is definitely correct. The second part, I suppose, is TBD, but more accurately, just wrong (for now). It turns out that while India loves whatsapp, they basically never use Whatsapp to pay for things:

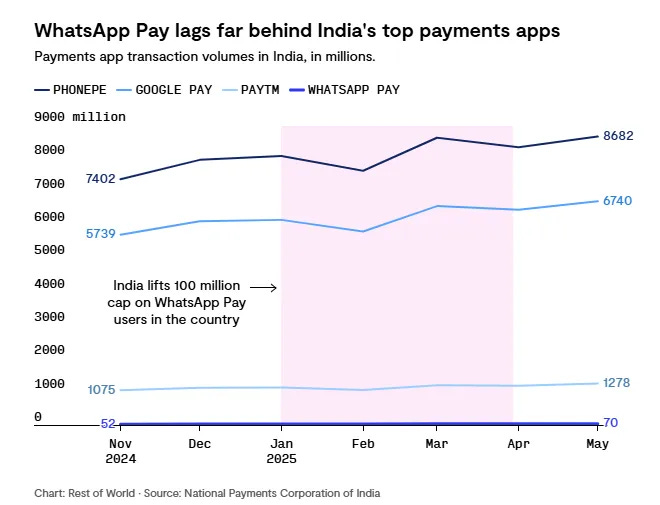

Rest of World Indian payment apps are dominated by PhonePE and Google Pay, while WhatsApp Pay is barely a rounding error. Part of that is regulatory—India (the highly protectionist country that it is)—initially capped WhatsApp Pay users to 100M. But, it’s not like Meta has made a lot of headway since then. Almost more remarkably, Google Pay and Walmart-owned PhonePE have made pretty substantial inroads to mobile payments in India. I had absolutely no idea that Walmart was in that business, at all.

Indian payment apps are dominated by PhonePE and Google Pay, while WhatsApp Pay is barely a rounding error.

Part of that is regulatory—India (the highly protectionist country that it is)—initially capped WhatsApp Pay users to 100M. But, it’s not like Meta has made a lot of headway since then.

Almost more remarkably, Google Pay and Walmart-owned PhonePE have made pretty substantial inroads to mobile payments in India. I had absolutely no idea that Walmart was in that business, at all.

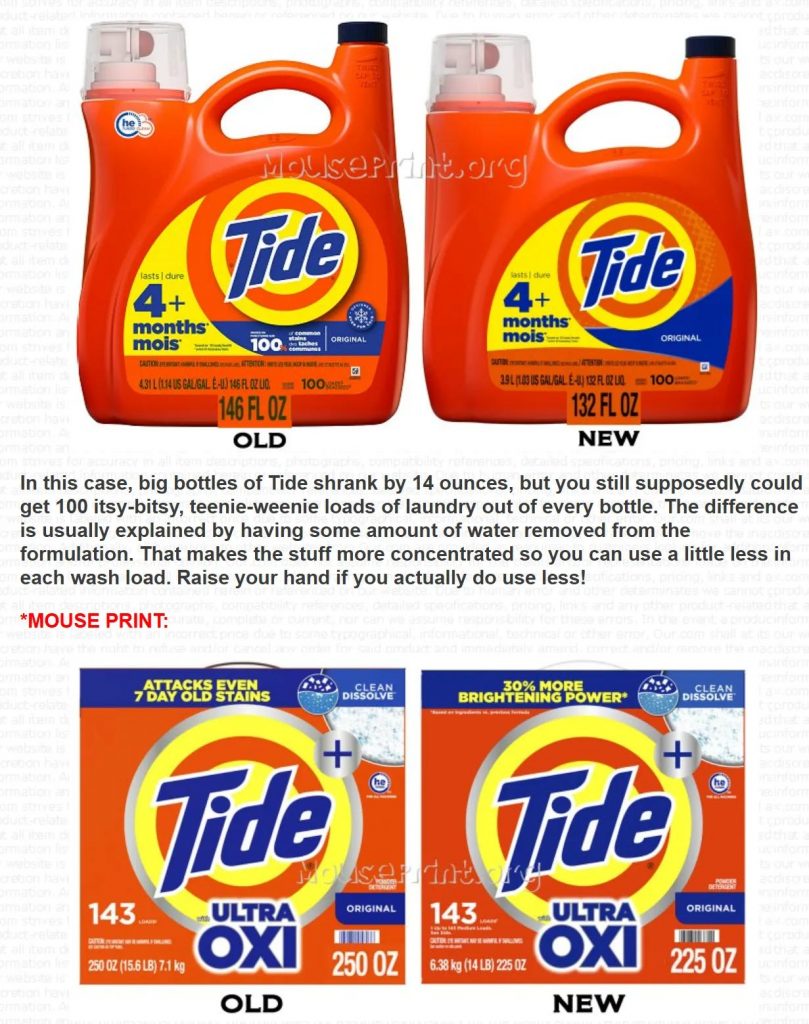

Shrinkflation

It’s hard to describe the elation I feel when I stumble across a website called “Mouse Print” that meticulously documents shrinkflation:

146 Ozs use to get you 100 washes, now it only takes 132 ozs!

Somehow I doubt the BLS is capturing that level of nuance (although it tries), but maybe that’s wrong.

Anyways, shrinkflation is a thing.

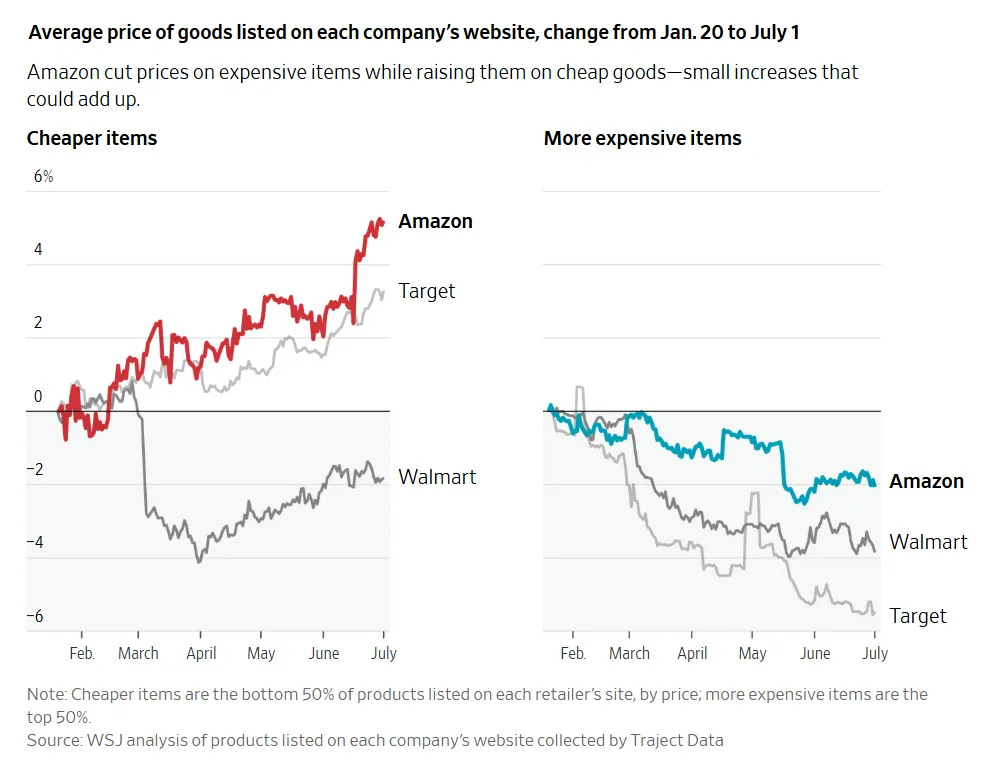

On the subject of prices, I found this interesting, as well:

Amazon raised prices on cheap stuff, but lowered prices on expensive stuff.

Walmart just made everything cheaper.

Is this tariffs? Algorithmic pricing strategies? Something else? Idk.

Reasons for selling

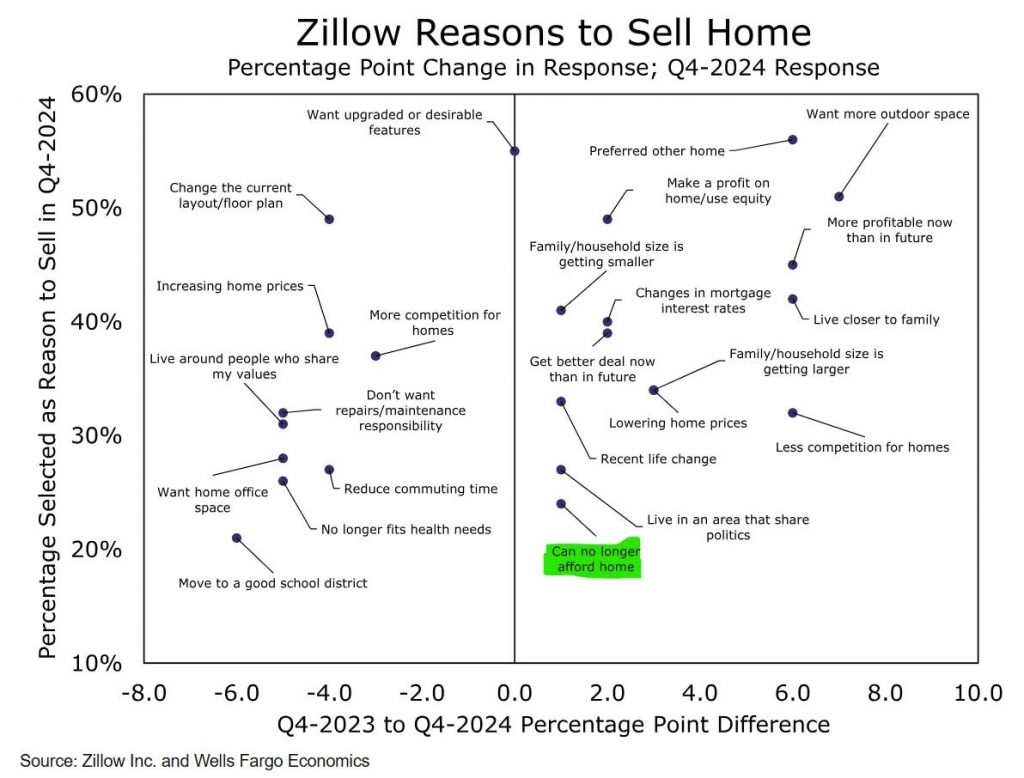

As longer-term Random Walk readers know, the great unlock to the housing market is pretty simple: homeowners need a reason to sell.2

- They’re not going to sell for the money, because home values have come down.

- They’re not going to sell because they have to, because the beauty of the 30-year mortgage (or curse, depending on which side of ‘higher for longer’ you sit) means that higher interest rates are not their problem.

But, of course, as an increasingly large share of mortgages (which is still quite small) are originated in the post-ZIRP world, some homeowners may actually feel the bite of higher rates.

As a motivation to sell, “can no longer afford home” is rising:

“Can no longer afford” is selected as a reason to sell ~25% of the time, which is quite small, but 2pp larger than before.

Truthfully, 25% is higher than I would expect.

Also, “more profitable now than in the future” jumped by 6 pp, which indicates that homeowners are starting to understand which way the wind is blowing.

More to come, I’m sure.

This article was originally published by Random Walk