With British Land and Landsec both reputedly ripe for new leadership, how do the legacies of chiefs Chris Grigg and Rob Noel compare? And what’s next?

Ignore gallery chatter that Landsec will either bloom or wilt when 55-year-old chief executive Rob Noel retires next year, after eight years at the top. Forget talk of a ‘new era’ if, or when, Chris Grigg, aged 60 and chief executive of British Land for the past decade, decides to leave. Both men have done as well as anyone can in cultivating already-rich lands. Their successors will almost certainly continue to till their prime acreages. It is naive to expect any different future for Britain’s bellwether propcos. Or is it?

Hostile takeover lurks, given the gaping discounts to net asset value. These companies’ combined NAV is £18.6bn. The market values them at half that figure. The pair are Lilliputians on a world stage bestrode by Blackstone and Brookfield: either could swallow both and not need to burp. Forbes ranks Landsec 33rd out of 35 global propcos. BL does not make the cut. Merger? Perhaps: a revival of the ‘British Land Securities’ option, sought last century by BL’s Sir John Ritblat but spurned by Landsec’s Lord Harold Samuel – empire builders both.

New appointees can only ever be tenant farmers, as a former incumbent quietly put it to me. The business models and remuneration packages are based on outperforming peers, not expanding the empire. Modernise the business? Of course. Trade? Yes, but not the crown jewels. Take development risk? Yes, but don’t bet the farm. Bet at the bottom of the cycle, not the top – a judgement call you are paid a lot of money to get right. Suckle shareholders with steady stream of dividends. Expect no plaudits from the gallery.

Spectators see Rob Noel’s tenure crimped by caution. No big or bold moves. Finishing developments begun by predecessors. Calling the top of the market too early. Entry, then withdrawal, from residential, marked by cancellation of plans to turn Portland House, in London’s Victoria, into flats. Faltering progress at Ebbsfleet Garden City in Kent. Chris Grigg scores better. His big call: buying into Canada Water, a £4bn long-term bet on south London. But neither have really got into anything that could qualify as the Next Big Thing: sheds, the private rented sector, student accommodation.

Why would they? These two able, approachable, highly articulate men have modernised their businesses and have plugged into the wider social agendas. Both pressed the button on lucrative City towers near the bottom of the cycle: BL the Cheesegrater, Landsec the Walkie Talkie. But both hedged these bets by selling half the equity to others: BL to Oxford Properties, Canary Wharf in Landsec’s case. Examine the results of both over the past seven years. What do you see? Job done.

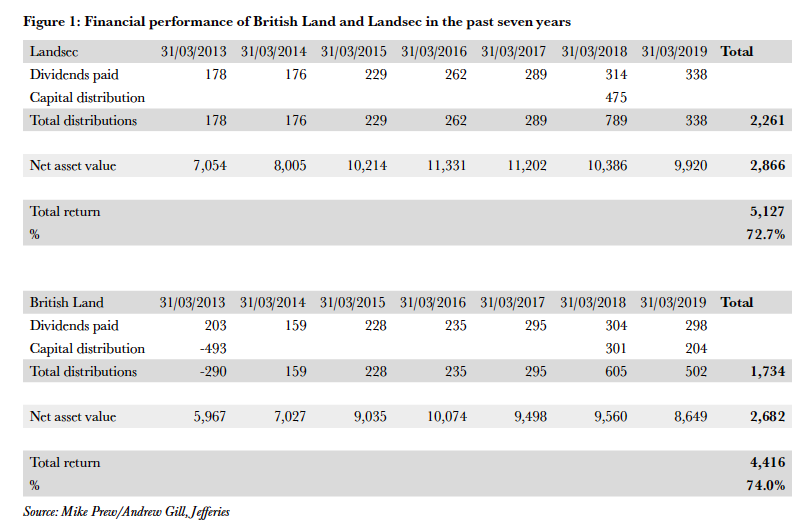

How can that be proved? Mike Prew and Andrew Gill of US bank Jefferies tend to be the scourge and flail of listed REITS. I asked the real estate analysts to compare the financial performance of Grigg and Noel over the past seven years, the period during which Noel has had full charge at Landsec. Take a look at the rising dividends. Noel has provided shareholders with £2.26bn and pushed up the NAV by 73% to £9.9bn. Grigg distributed £1.74bn in dividends and pushed up BL’s NAV by 74% to £8.65bn.

“British Land marginally wins out on total returns,” says Andrew Gill. “But Landsec has seen much stronger growth in income, which looks sustainable going forward versus British Land, where performance has been more reliant on NAV growth.”

“The pair are Lilliputians in world stage bestrode by Blackstone and Brookfield: either could swallow both and not need to burp.” How about simple money-in-money-out calculations? Noel made a profit of £291m on revenues of £734m in the year to March 2013 – a 40% margin. In the year to March 2019 a profit of £442m on revenues of £757m was made – a 60% margin. Grigg? A profit of £274m on 2013 income of £567m – 48% margin. BL made a profit of £340m on income of £576m in the year to March 2019 – 60% margin. Same as Landsec. Snap.

What would you do differently? Your monthly take-home pay is circa £40,000. Your long-term bonus scheme promises millions. You have banked enough over the years not to over-worry. Still, it is a matter of pride that you hit those long-term incentive plan targets, provided you outperform the market. Not too difficult; you have the best kit. In 2016 Grigg’s basic pay was £800,000 and his total remuneration £6.55m. In 2014 Noel’s total remuneration was £4.8m. Both have earned less lately – but still, frankly, far too much.

BL and Landsec are in the FTSE 100 – thanks largely to the size of their balance sheets. Remuneration consultants peg the pair’s pay to that of other FTSE chieftains. But BL is not BAT, and Landsec is not Lloyds. It’s an apples-and-pears comparison to suggest those at the helm of companies with a few hundred employees should be paid on a par with those employing tens of thousands. The bosses of Savills and Knight Frank should, by this measure, be paid as much as those they serve.

There is a slim possibility that empire rebuilders will be appointed at both firms. Job description: surgical intervention on retail; and for God’s sake buy us into the Next Big Thing. But the probability is that a ‘safe-but-saleable’ pair of hands will get the top jobs. Maybe a crown prince – or princess. If not, an outsider with impeccable credentials, someone trusted not to bet the farm. Takeover and break-up threaten. Merger is a possibility. But the odds remain on both continuing to plough the furrow already set.