Asia Pacific property stocks lost ground in September as risk aversion gripped investors, ahead of a US presidential election and continued concerns that a global economic recovery remains volatile.

Investors went on the defensive, even as the region remains on a stronger footing. Markets in Asia, as tracked by the MSCI AC Asia Pacific Index posted the first decline since March, ending the month in the red, as anxiety over valuations soared.

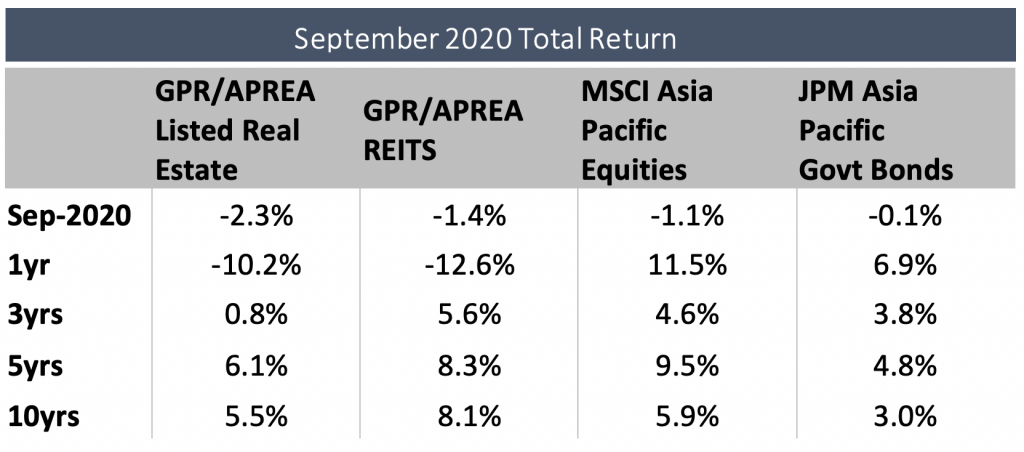

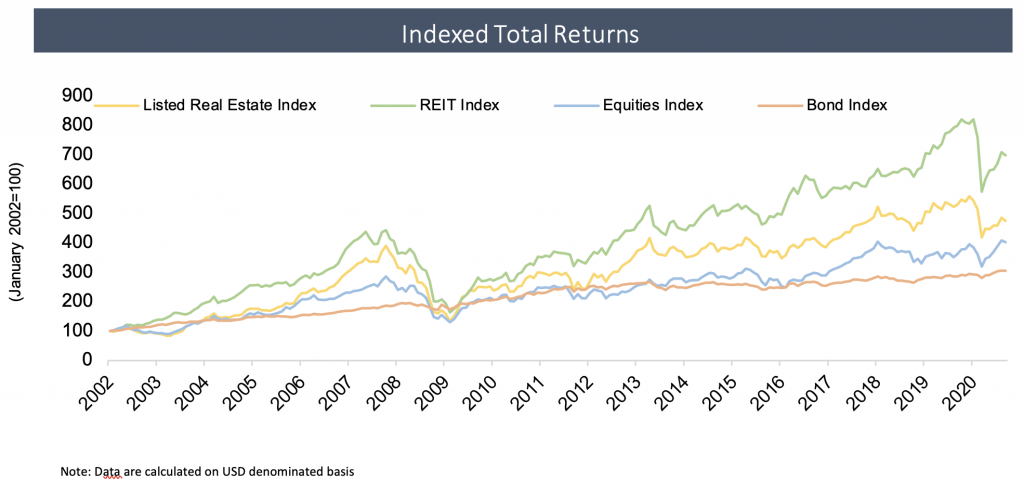

The GPR/APREA Composite Listed Real Estate Index fell 2.3%, underperforming the wider market. Regional heavyweights China and Hong Kong both retreated by more than 3% as debt concerns and increasing government scrutiny weighed on developer stocks.

To tackle unbridled borrowing in the sector, China has proposed caps on debt ratios. Dubbed ‘the three red lines’, Chinese regulators outlined limits for a company’s debt-to-cash, debt-to-assets and debt-to-equity ratios. While no official announcement was made, market watchers expect the rules to kick in by early 2021.

The pullback in equity markets was not lost on the region’s REITs. The GPR/APREA Composite REIT Index lost 1.4% in September, snapping a string of monthly gains since April, underperforming the wider market, which declined by a smaller 1.1%. A broad-based fall was recorded across most sectors, with only the hotel and healthcare sectors posting positive returns. Residential REITs contracted by the most, due largely to the pullback in Japan.

To tackle unbridled borrowing in the sector,

China has proposed caps on debt ratios

Australian REITs, meanwhile, were the hardest hit in the region, with a 4% decline. Retail REITs bore the brunt as concerns over the economic impact from the pandemic revived. The region’s largest markets all registered losses, with only Singapore managing to eke out a marginal gain. While China’s economy has continued to rebound from its pandemic lows, much of the region is still lagging.

Global capital markets are expected to remain volatile as investors turn their attention to the looming US presidential election. Investors are increasingly expecting a rough ride, bracing for the possibility that the result could remain unresolved on polling day. However, against an uncertain geopolitical and economic backdrop, Asia Pacific REITs will continue to shine as defensive plays.

Supported by low interest rates and higher debt capacity, the region’s REITs are turning acquisitive and resuming stalled deals. According to Real Capital Analytics, the region’s REITs expended over US$4.1bn in acquisitions in the third quarter, after posting a record low quarterly volume in the second quarter since 2010.

More than a third of deals occurred in Japan, with logistics assets a favoured play. Many expect Suga, who took over in September, to continue with Abe’s policies to revitalize the Japanese economy through monetary easing, fiscal stimulus and structural reforms. This will continue to benefit the nation’s REITs.

India is set to see more listings. Brookfield Asset Management filed a draft offer document with market regulators to monetise its Indian rental assets via an IPO, which is looking to raise US$600m. India’s third listed REIT, Brookfield India Real Estate Trust could debut by year’s end.