Conducive global developments placed financial markets on a risk-on mode in the final month of 2020. The prospect of widely available coronavirus vaccines, the US bipartisan agreement on fiscal stimulus, and the EU-UK post-Brexit trade agreement’s conclusion provided the necessary fillip to sentiment, sustaining momentum for real estate stocks to conclude on a positive note.

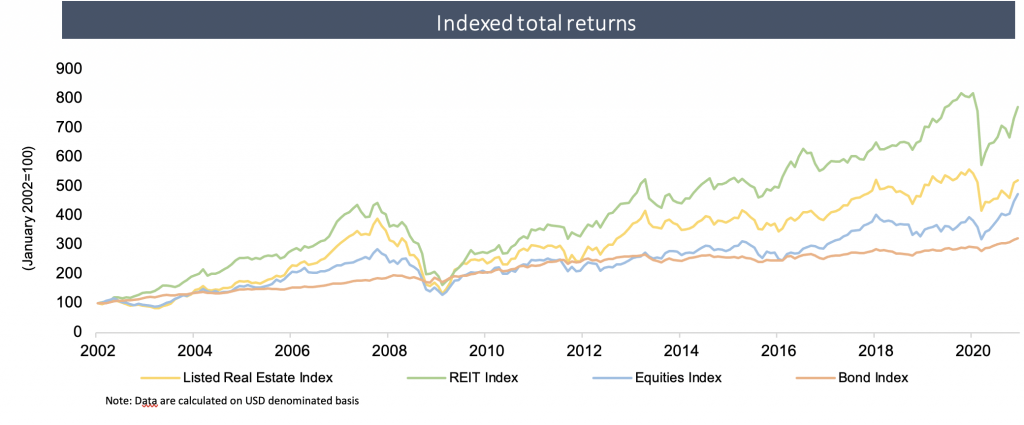

However, for the whole of 2020, real estate stocks continued to lag the wider equity markets, which have been supported by tech and pharma counters. Property cycles will eventually chart the sector’s own way out of the crisis, which although historically it lags an economic recovery, will be longer-lived, sustained by the region’s enduring structural fundamentals.

Listed real estate

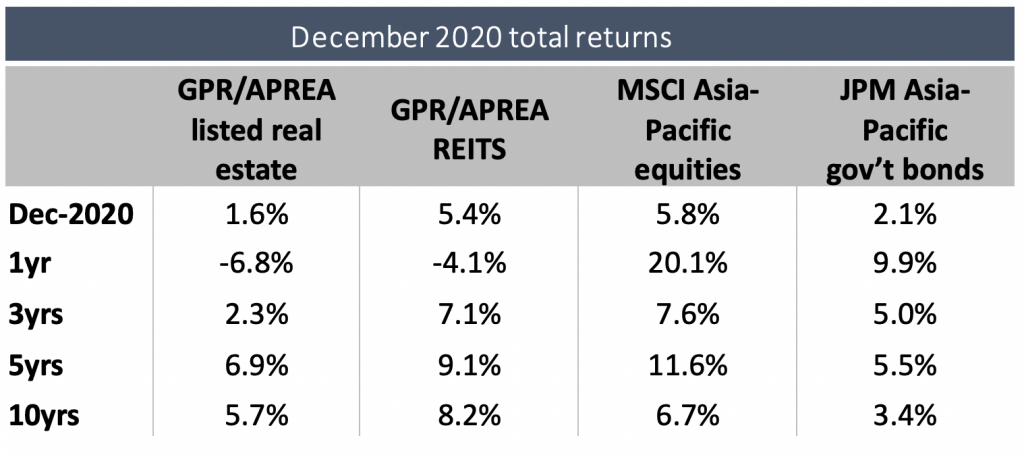

The GPR/APREA Listed Real Estate Composite returned 1.6% in December, underperforming both the region’s equity and REIT markets, as the tepid performances in China and Hong Kong weighed on the sector. Among the region’s heavyweights, property stocks in China and Hong Kong posted the largest declines on an annual basis as policy risks amplified the drag on valuations. In addition to the so-called ‘three red line’ limits on developers, mainland regulators made further moves to cap bank loans to the property sector, including curbs on mortgage lending, which will inadvertently subdue home purchases.

REITs

In contrast, Asia-Pacific REITs, as tracked by the GPR/APREA Composite REIT Index, advanced over 5% in December with broad-based gains. Still, this could not lift Asia-Pacific REITs into growth territory for 2020. Notably, rotation towards higher-risk segments propelled retail to rise by 6.5% in December. On an annual basis, hotel REITs suffered the biggest contraction, shedding 21.1% for the whole of 2020. This is in contrast with industrial’s strong performance, which chalked up over 20% in gains in the same period as investors sought safety in logistics and digital assets.

Gains in December were broadly positive across countries, with Thailand an exception, as a resurgence in infections depressed sentiment. Despite experiencing a similar surge in cases, J-REITs still managed to carve out gains. The government has announced fresh stimulus measures amounting to JPY73.6tn in December, signalling a resolve to pull the country out of its coronavirus crisis-induced slump. This follows the over JPY200tn budgeted from two previous packages.

Meanwhile, South Korea is emerging to be a growth catalyst for REITs in the region. ESR Cayman Ltd announced the successful stock exchange listing of ESR Kendall Square REIT on the KOSPI on 23 December 2020, marking the first publicly listed institutional quality logistics asset focused REIT in South Korea.

Following the latest quarterly rebalancing of the GPR/APREA index series, 11 REITs were added, including debutants on the Indian and the Philippine bourse. Representation in the industrial sector also expanded.

Outlook

Monetary policies are expected to remain accommodative to prop up economic activity weakened by the pandemic. This has historically fuelled REIT valuations. As the world continues it vaccine rollout, more upside potential in the region’s retail and office sectors is expected, along with the prospects for the reopening of borders. However, the emergence of mutated strains, which adds a new dynamic to the uncertainty, is likely to rein in expectations. This will continue to fuel gains in the ‘anti-pandemic’ industrial REITs, which have served as portfolio hedges.