It always comes back to supply and demand.

- Inflation in small doses can stimulate property markets, diverting investor demand out of fixed income, but harmful should it lead to rate hikes.

- Property offers long-term core investors considerable inflation protection, but is not a short-term ‘hedge’.

- Core investors need to align to wider future societal trends to access inflation protection.

- Commodity price-spike driven inflation also negatively affects prospective developer profits and value add returns via higher construction costs.

- Where value add and opportunistic investor projects are in the right locations and sectors, potential exists to be premium rent setters and not price takers.

It is scarcely believable that a solution to the global pandemic has been found so quickly. This early reopening blindsided a deliberately heavily sedated global economy and has meant new order backlogs, supply chain bottlenecks, and surging global commodity and input producer prices. These cost-push inflation pressures tend to be one-off and with European labour markets still fragile, inflation should eventually subside. Yet many investors are now more hawkish and the hunt for investments offering an inflation ‘hedge’ is now on.

Inflation in small doses can be stimulating to property markets, diverting investor demand out of fixed income towards real assets like property. However, should it lead to rising interest rate expectations, it rapidly turns harmful.

With one or two minor exceptions (eg, Australian retail), globally the correlation between inflation and property returns and rents is typically quite weak. Property is therefore not a ‘hedge’ in the true sense, like say a TIP or index linked gilt. Yet it is widely understood that property rents and prices tend to rise with economic activity and therefore inflation over the longer term.

Core property investors are in the business of long-term investment and the savvy ones look to focus their hunt for appropriate assets in locations and property sectors where the structural trends (ie, demographic, technological and ESG) are most favourable. These will be where prospects for long-term rental income growth will be best and where scope for future inflation protection will also positively align.

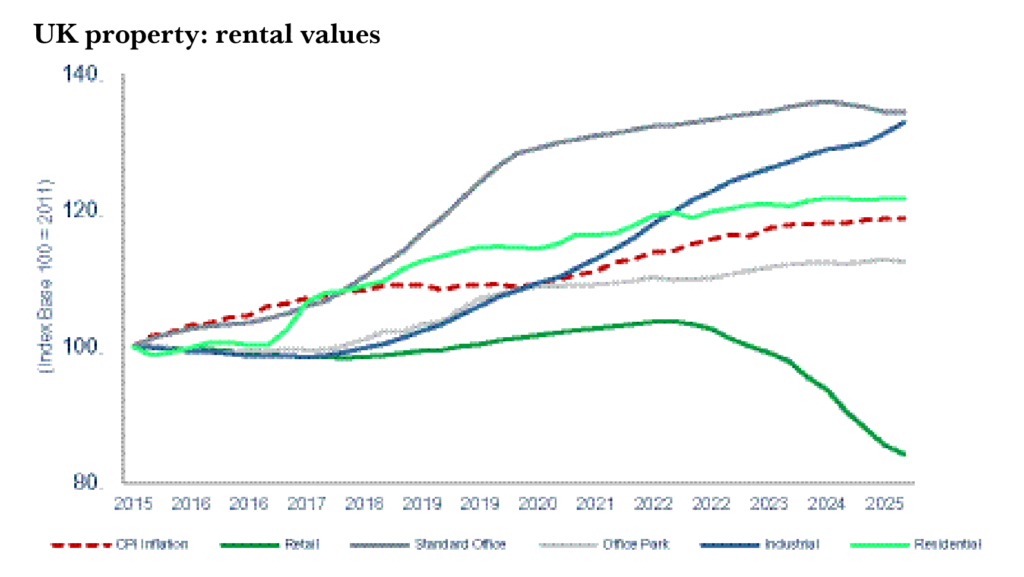

In practice, looking at the historic UK rental data (see chart), while residential and logistics income have offered protection against inflation, retail and hotels have fallen short. Offices appear to have provided the best inflation protection over the past decade, but that picture is distorted due to rents recovering from an abnormally low post-GFC trough through the period.

This has all been readily apparent in the rental growth data for the past decade, suggesting that the pandemic has amplified pre-existing trends, not derailed or created new ones.

Investors seeking long-term inflation protection from their core real estate allocation therefore need to ensure their stock selection aligns with societal changes (demographics, technology, ESG).

“In locations where the long-term structural outlook remains genuinely favourable, developer returns might well be enhanced”

Inflation can negatively affect prospective developer profits via higher construction costs. Higher build costs and material shortages resulting in lengthening development periods will have negative implications for project profitability/IRRs. However, in locations where the long-term structural outlook remains genuinely favourable, developer returns might well be enhanced. Such ‘developer profit hotspots’ will have the same attributes as the core-end investor market picks discussed above, ie, locations with positive demographics in property sectors with technology and ESG tailwinds.

Embedded structural supply shortages/inelasticity (eg, site shortages, protracted planning processes, etc) will also be key to ensuring the ability for developers to be ‘price setters’ – able to charge premium rents and still meet and exceed their return expectations. This contrasts with sub-optimal markets, where developers will be ‘price takers’, unlikely to achieve their required returns/profits, with no alternative but to mothball their plans or maybe even consider alternative uses.

How do sector and location impact inflation protection prospects?

Logistics A huge pandemic beneficiary with an accelerated structural shift to online shopping. European vacancy is around 5% and current speculative development is less than 2% of existing modern stock. This supply compares with our in-house demand estimates that an extra 20-30% of modern logistics stock will be required by 2024 to accommodate the growth of ecommerce. Rental pressures will be considerable in most markets, but especially in the UK and Sweden.

“To absorb higher build costs and meet required project returns, projects situated in ‘developer profit hotspots’ will be able to unlock this rental premium”

Our analysis of developer ‘break-even rents’ suggests logistics rents could be 20-30% under-rented in the very best ‘final mile’ and top super-regional logistic hubs. To absorb higher build costs and meet required project returns, projects situated in ‘developer profit hotspots’ will be able to unlock this rental premium. That sort of potential reversion could put a new perspective on record low logistics yields that have some investors worried about sector pricing sustainability.

Residential Sustained price growth, driven by low interest rates and housing shortages, means home ownership affordability is problematic. Locations where the house-price-to-rent-ratios (HPR ratios) are well above 25x will be where the financial incentive to rent will persist and thus user demand greatest. For house builders, given the high wood content of a typical new build home, rising timber prices and supply issues will challenge profit margins. To meet required returns, we estimate that developer ‘break-even rents’ on the strongest schemes potentially have a circa 10-15% premium waiting to be unlocked. This will only be possible where demand consistently exceeds supply, buyer affordability is strained and modern specified units are hard to find.

Offices Corporates will likely embrace hybrid WFH/office working practices, suggesting less demand for space. Although a ‘flight to quality’ is expected, with flexible, ultra-hygienic modern buildings with strong ESG credentials more keenly sought than ever before. Many European cities already suffer from chronic shortages of quality space and that will only worsen. Recent JLL research (Jones Lang La Salle: The impact of sustainability on value [2020] https://www.jll.co.uk/en/trends-and-insights/research/the-impact-of-sustainability-on-value) suggests that central London tenants might already be willing to pay 5-10% more rent for higher ESG rated office buildings. With the pandemic pushing the pre-existing trend towards wellness and social responsibility centre stage, this green rental premium will only widen.