The mortgage crackdown caused the Great Recession and the 2008 financial crisis. When Ben Bernanke assured us that the subprime crash was contained in 2007, he was correct. The Fed was responsible for the decline in residential investment up to that point. The decline wasn’t necessary....

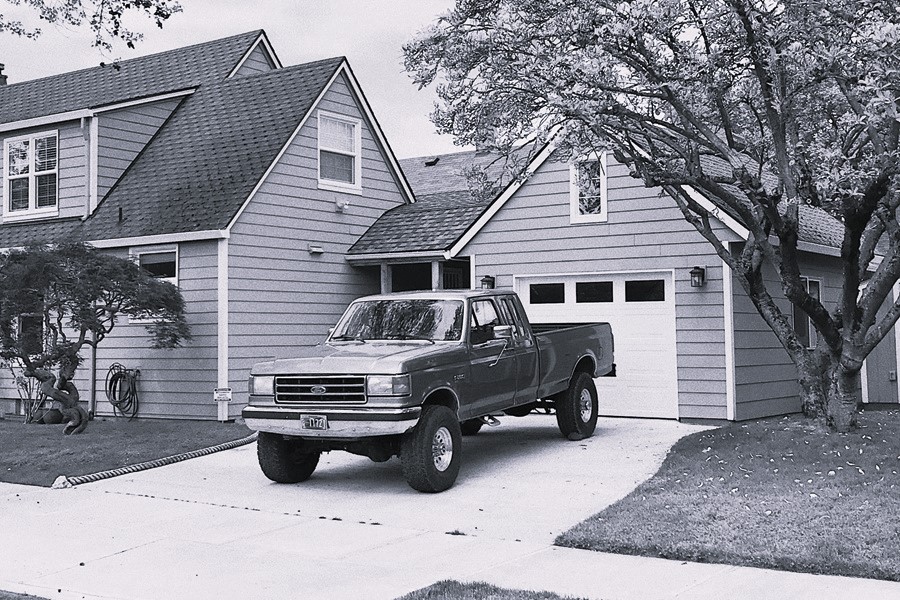

Residential Investor