The National Council of Real Estate Investment Fiduciaries (NCREIF) tracks the performance of over a half trillion dollars of commercial real estate in the US. Because the properties are marked to market every quarter for financial reporting, NCREIF can provide quarterly returns as a benchmark for institutional investors as well as other trends from the database. The total return was 0.71% in the first quarter which was a decrease from the 1.55% return for the prior quarter. This is the lowest return since the fourth quarter of 2009 which was the midst of the financial crisis that lead to the Great Recession. This is an unleveraged return for what is primarily “core” real estate held by institutional investors throughout the US and includes apartment, hotel, industrial, office and retail property sectors. (The industrial sector is primarily warehouse properties.)

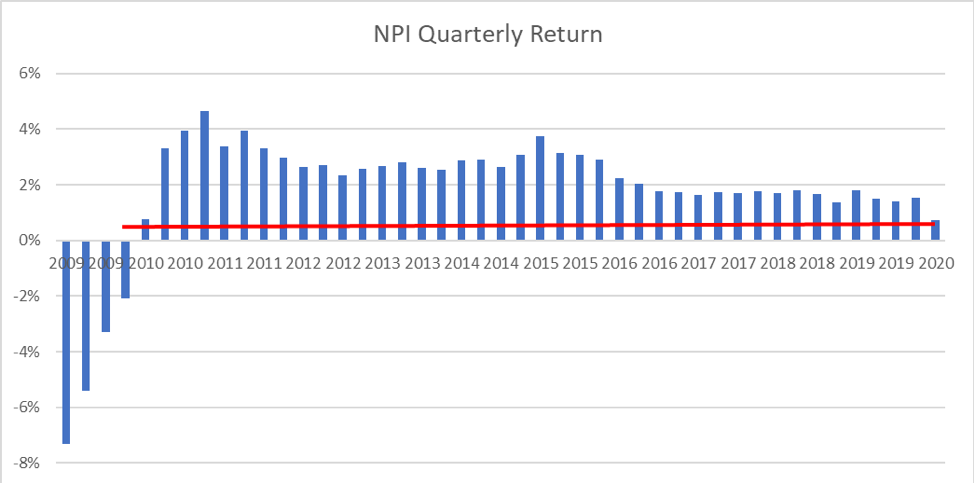

NPI Total Returns Since Great Recession

The total return of 0.71% consisted of an income return of 1.10% from net operating income (NOI) and a capital return (change in value net of capital expenditures) of -0.39%. This is the first negative capital return since the 1stquarter of 2010. That said, returns were considerably lower during the height of the financial crisis as seen at the start of the chart in 2009.

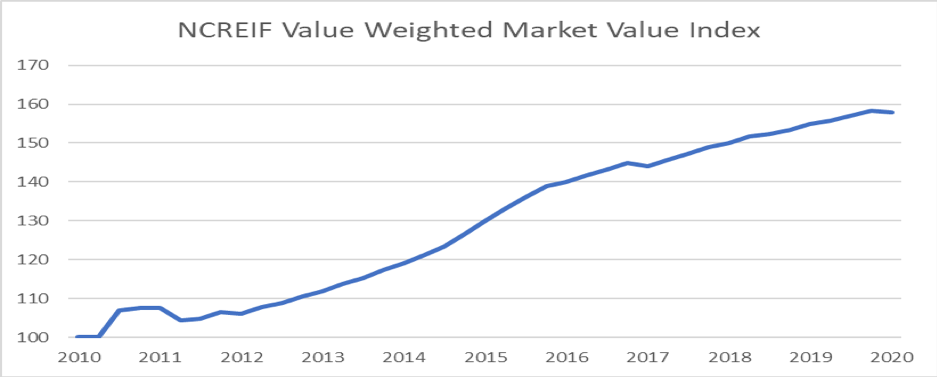

Market Values Peaked

The NCREIF Market Value Index (

NCREIF Market Value Index

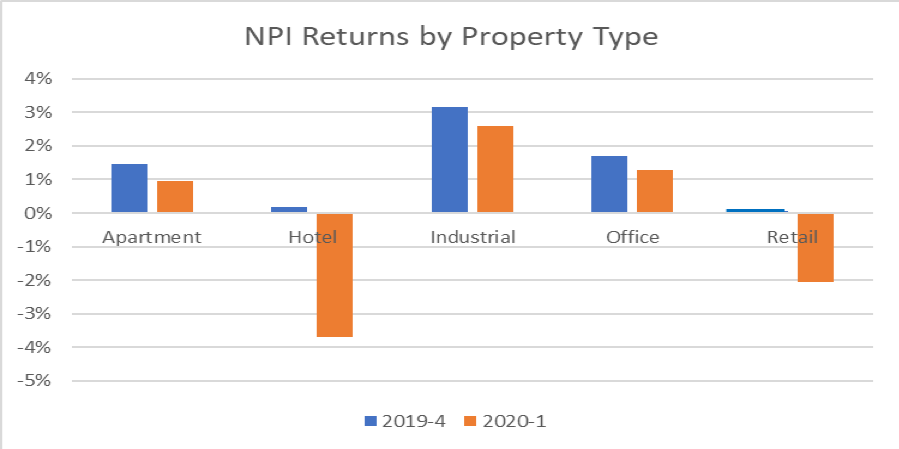

Returns Drop for all Sectors

Returns dropped for all property types this quarter with hotels being impacted the most at a negative 3.86% return for the quarter. This was followed by retail with a negative 2.06% return. The other property sectors were positive even though they all dropped from the prior quarter. Industrial properties (primarily warehouse) continued to be the top performer with a quarterly return of 2.58% followed by office at 1.28%. Apartments managed to have a slightly positive return of 0.95% for the quarter.

NPI Total Returns by Property Type

It is too soon to know the extent to which values and returns will continue to fall as a result of COVID-19. There wasn’t a sufficient amount of transactions for appraisers to make much of an adjustment to values for the quarter ending March 31. It is likely we will see further declines in the second quarter as there is more price discovery in the market.