1) A summary of Q3 performance

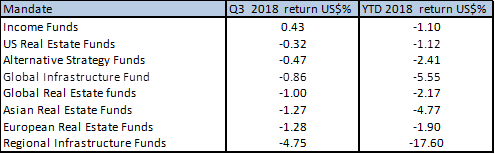

As can be seen from the table below, (which is ranked by average Q3 returns for each main mandate) The third quarter proved a difficult one, with only Income Funds moving into positive territory, and average YTD returns now all negative.

2) Fund Flows

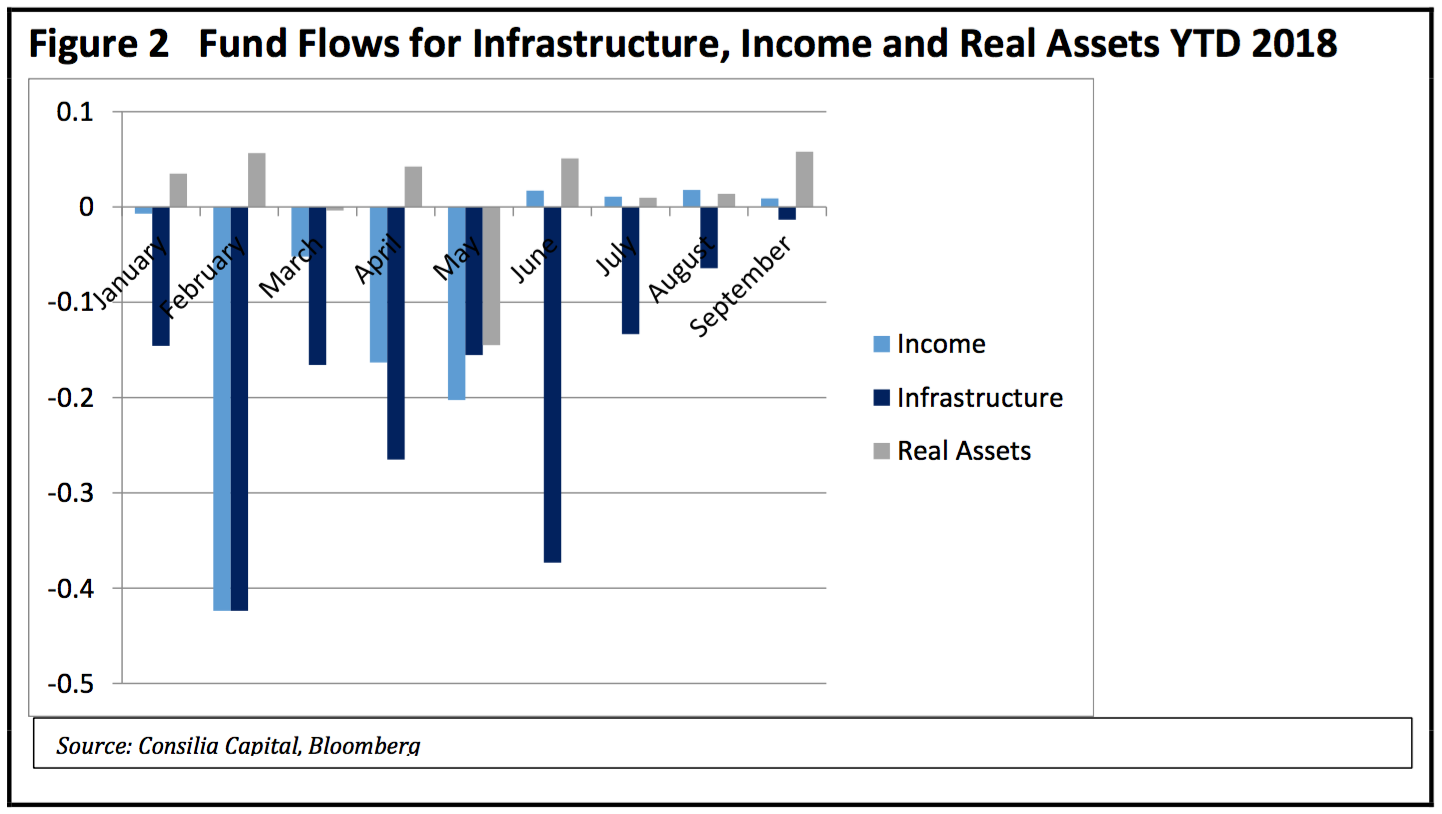

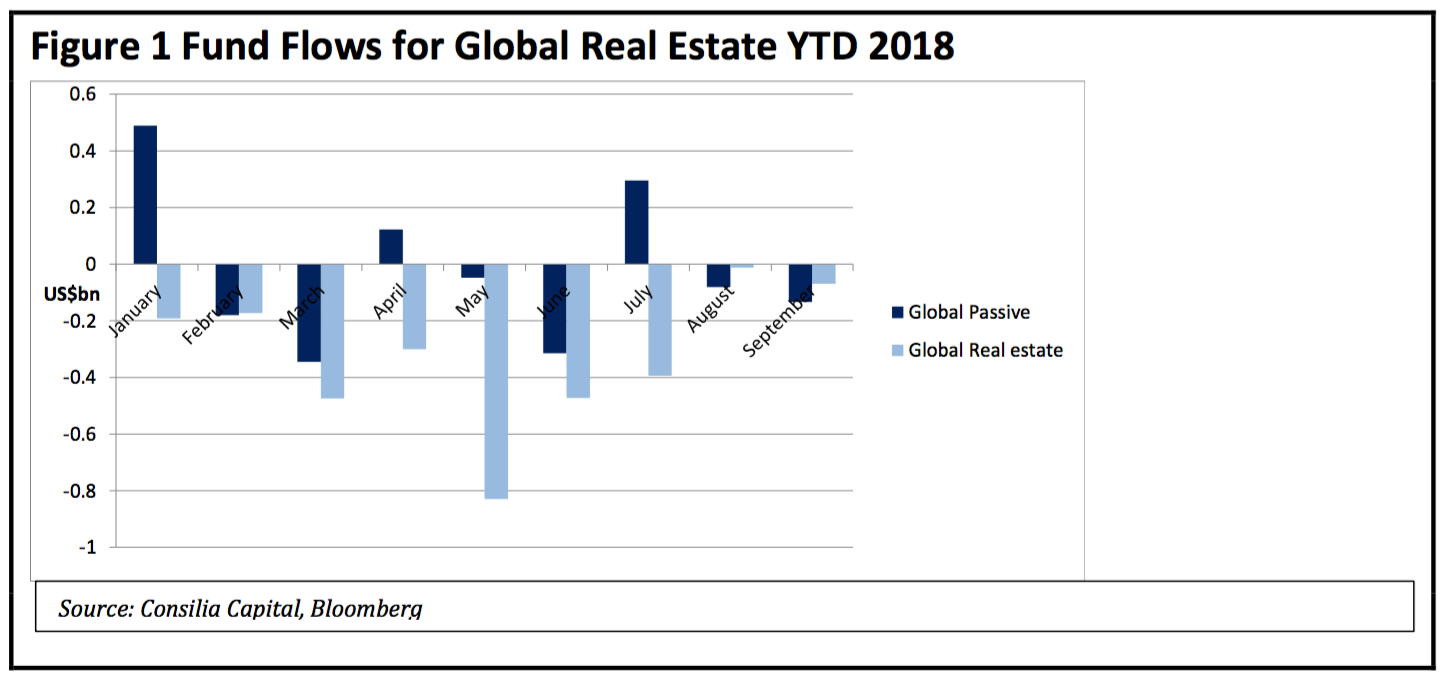

September saw outflows for both active and passive global real estate funds, while real assets funds saw modest inflows.

As part of our interest in analysing the importance of fund flows on performance we have grouped together the largest funds in our database for each of the major mandates to determine the general direction of flows. The mandates we have chosen are: Global Real Estate (Active and Passive), Global Infrastructure, Income, and Real Assets. We have then summed the daily flows to provide a monthly (net) total with a view to providing an indication of the trend over time. We are aware that there are some potential flaws, namely that we have only used a sample of funds, and that we have not included US Funds which are a particularly active market. However, we believe that the charts below are useful trend indicators and we will be publishing them on a regular basis going forward.

After a brief period of inflows in July, global real estate funds saw outflows in August and September.

Real assets fund continue to see modest inflows.