Dear Friends and Colleagues,

1. Will agriculture finally out-perform energy?

This Commentary explores the likely pathways of food vs. energy commodities in the 2020s and ‘30s. It explores key factors including renewable energy and synthetic food technologies that are likely to drive their relative performance. It concludes that prices of food commodities are likely to out-perform those of energy in the years ahead.

2. Why may relative commodity prices matter in a post-Coronavirus world?

The world economy is currently reeling from the Coronavirus shock to the real economy (which via business losses will, in turn, hurt the financial and insurance industries). The responses of Governments to Coronavirus are significantly impacting discretionary sectors (particularly services)*. For example, it is estimated 25% of jobs in the UK are likely to be either made redundant or furloughed in 2020.

* See the Craigmore commentary “Analysing a Possible Coronavirus Recession”

To counter falls (estimated at an annual rate of 10% to 20% for at least two quarters) in GDP of the advanced economies, widespread income support is being made available by governments to citizens. In the UK it is likely that the income of approximately 5 million citizens will be supported by the government to maintain their solvency and some of their spending power.

For this period the productive capacity of the UK economy will be smaller (due to the lost services of e.g. restaurants and tourism that were until very recently part of GDP). If we assume that those who are supported do not save all the handouts, the question then arises; on which goods and services will citizens spend this borrowed (or will it be printed) income?

Putting it another way, since citizens will not be able to spend as much on foreign holidays or restaurants this year, where will they spend that part of their income they do not use to repair their bank accounts?

As before they will of course spend some of it on consumer staples, like food and energy. As before, if well supplied, prices of these will not necessarily increase. However, if the supply of energy or food falls short in coming months, then it is likely a population with the same spending power as before yet fewer things on which to spend it, may bid up any such “tight” commodities.

This is the reason why we focus in this Commentary on the likely path of supply and demand for commodities, to seek to identify which are likely to remain abundant, and which might go into short supply?

3. What has been the history of food commodities vs oil?

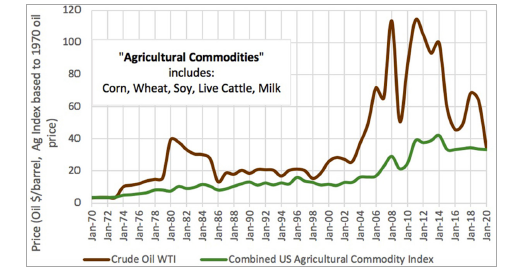

The graph below plots the relative performance of oil, as the benchmark energy commodity, vs. a simple basket of US$ spot prices of Corn, Wheat, Soy, Live Cattle and Milk over the 50 years since 1970.

As can be seen oil significantly out-performed food commodities for most of this period creating a shift in the allocation of world incomes to the oil sector. While the wealth and influence of rural landowners languished. Basically “Dallas” replaced “Downton Abbey”.

More recently, however, oil prices have “returned to earth”. Indeed, as can be seen in the graph, indices of energy and food are level-pegging again in 2020, for the first time in 50 years (in fact this graph is a 2-year moving average showing an oil price of around $35. In fact, oil has traded as low as $20 in the last few days).

Looking more closely at the (less volatile) price of food commodities these spiked in 2010-2013 (a period of US and Russian droughts coming immediately after the world had eaten up the subsidy driven excess food stocks of the ‘80s and ‘90s). At the peak of this short

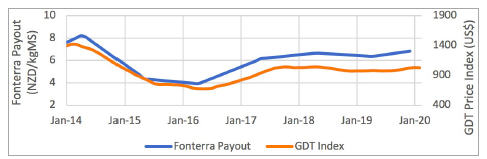

The US$ has however risen more than 25% since then against many currencies (the US$ TWI index has risen 26% from 102 to 129 in the six years since 2014). As a result, as can be seen in the graph below, farm-gate prices received by most non-US farmers, including in New Zealand after its currency softened over the past three years (as it brought interest rates into line with those of other countries), are right “on trend” i.e. close to as good as they have ever been.

4. What drives the “terms of trade” of commodities?

Prices of both energy and food commodities are of course primarily determined by changes in the volumes of supply and demand. Increases in productive capacity should lower prices whereas increases in demand for a commodity should lift them. Until 1970 this situation applied in both the oil and the food markets. Large numbers of oil companies and large numbers of farmers competed to supply their commodities to growing markets. And large numbers of consumers paid intermediaries (oil and food companies) for the respective end products. This “Adam Smithian” arrangement remains the case in the (highly fragmented) agricultural markets i.e. prices there continue to be driven almost entirely by supply and demand. Particularly by supply since food demand tends to be fairly constant whereas production varies in the short term as a result of climatic, political and economic events (including, we may soon discover, measures designed to protect human health but which have unintended consequences in terms of labour supply to agriculture, and hence food production).

However, from 1970, the energy markets were transformed when the major oil exporting nations, led by Saudi Arabia, began to influence supply, not in the traditional way (by allowing many companies to each make their own capacity decisions) but by “rigging the market” via the OPEC oil cartel. The cartel actively restricted supply to lift oil prices from $3 per barrel in 1970 to $40 by 1980. Such has been (until recently) the concentration of global supply of oil from the Middle East, that OPEC was able to heavily influence movements in the price of oil for 44 years, from 1970 until 2014. However, as can be seen from the brown line on the graph, since 2014 the price of oil has significantly fallen, especially in the past 10 weeks (when it has fallen from $63 per barrel for WTI Crude on 6th Jan to a price range between $20 and $30 in March, 2020).

2014 was the year that oil (and gas) from fracking began to surge and put the US on track to become the largest oil producer in the world and a net energy exporter (which was achieved in 2019). This pressure, plus the rise of cheap and attractive renewable energy alternatives has effectively broken the OPEC cartel, further damaged by the withdrawal of Russia as an OPEC observer and ally. It seems likely, now that there are many competing suppliers each making their own decisions on volume of production, oil prices will return to being set, “at the cost of marginal production” (presumably of extraction via fracking in the US mid-west, west and south). Given how rapidly fracking and renewable energy technologies and regulations are advancing, it does not seem likely that these supply (and demand) decisions, at the margin, are now going to drive up the price of oil.

Therefore, I conclude that abundant supplies of energy make it unlikely the current crisis will lead to sharp rises in prices of oil or other energy commodities. On the contrary, energy and especially oil are likely to remain cheap (and in so doing create a transfer of wealth from energy exporting countries to net importers). Before discussing prospects for food commodities in Section 6, the next Section will review the historic correlation of the two sets of commodity prices.

5. Are farm commodity prices correlated with oil?

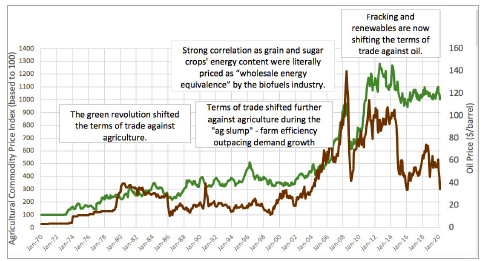

As we saw in the previous section, in the 1970s oil prices increased by over 12x. Over the same period farm commodity prices increased by 2.5x. In the 1960s and 1970s a “green revolution” in crop production was sweeping world farming, raising yields and efficiency via improved genetics, fertiliser and machinery. This meant that, although farm commodities kept pace with the high inflation of that decade (the US CPI also increased by 2x during that decade) they did not outperform in line with oil.

As can be seen in the graph below, this period of significant out-performance by oil in the 1970s was then replaced by 30 years, from 1984 until 2014, when oil and food commodities traded in lock-step. There were good reasons for that. The green revolution had made farming so efficient that in some countries the price of ethanol from crops was cheaper than that of ethanol from oil. The produce of the two industries traded on an effective “wholesale energy equivalence” basis for most of those three decades.

From 2014, as noted, farm commodities, although soft (down about 25% in US$ terms), significantly outperformed oil, which fell 75% from $100 per barrel in early 2014 to, say, $25 today.

Might food prices now revert to their previous high level of correlation, i.e. “follow oil down”? This is the topic of the next sections.

6. Supply factors for foods

We farmers are our own worst enemies. For two centuries we have over-produced and lowered our terms of trade:

• In the nineteenth century we discovered the “new world” prairies, invented refrigeration, and massively lowered farm relative incomes (from about 70% to 10% of GDP) as a result.

• In the last century we added only very little new land, and this continues. However, we have adopted technology after technology to produce more grain, meat and dairy from each of those hectares. These techniques have also increased productivity per labour unit and per $ of capital employed. Meanwhile subsidies to farmers in most wealthy countries protected farms against the odd bad harvest –encouraging further over-production.

Those two centuries period of declining terms of trade for agriculture ended up in the year 2000 with farmers being rewarded, as the rest of the economy grew but our share did not, with farm incomes of less than 1% of GDP in the industrialised west.

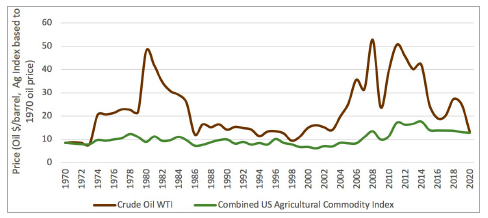

However, pleasingly for us farmers in the first 20 years of this century this “fall” in real prices of farm produce has levelled off and indeed real prices of farm produce has increased (the graph below replicates the indices from the first graph but deflated by US$ inflation i.e. shown as real prices).

What is the reason for this improvement in farmers’ pricing power?

The two main reasons for improvements in real farm produce prices are:

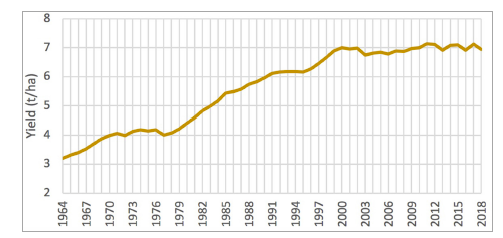

1. Yield growth per hectare, while still increasing for some crops (e.g. US corn or NZ dairy), has

2. Diets are significantly changing around the world as, for example, the E Asian middle-class rockets from 500 m people in the year 2010 to 1.5 bn now and heading to 3 bn in 2030. Despite concerns in the west with health and the environmental impacts of animal protein, these newly wealthy people want infant formula, yogurt, cheese, pizzas, chicken nuggets and hamburgers just as do their counterparts in the west. And, since average protein consumption in many of these countries is below the levels experts believe are optimal, it is hard to see how rich western countries, even if they are able to bring down their own (in many cases excessive) consumption of “land intensive” proteins, are going to be able to prevent the populations of these countries gaining the health benefits of moderate amounts of protein in their diets?Since it takes a lot more land to grow animal rather than vegetable protein estimates are that the production of the world farming industry will need to grow by 25-70%by 2050. In order to persuade the “marginal producer” of food to deliver this increase it is likely higher prices will be needed.

7. Substitutes for “farmed foods”

Hopefully, for environmental reasons, some of the demand of this emerging middle class for protein will be met with synthetic foods, e.g. re-constituted soy into burgers, oats into milk substitute. However, it seems unlikely, as plant based and highly processed foods seldom have the same nutritional density as animal protein, that these synthetic proteins will take over the roles of especially the low-cost parts of the current protein value chain i.e. dairy farming (cheese and fresh milk are after all a big part of the diet of most vegetarians) and also white meat production. We will discuss red meat in the next and final section, below.

8. Environmental factors

Mankind’s attempts to combat climate change are driving energy innovation to reduce energy costs and substitute production away from fossil fuels. As discussed in Section 2 this is likely to lower the terms of trade of energy products, especially fossil fuels such as oil.

Many urge a parallel shift in protein production from livestock systems to vegetable protein and synthetic foods. And especially away from red meat, since ruminant animals are more polluting per kg of nutrition than animal protein from dairy, poultry or fish. If implemented (as discussed not all of an emerging middle class will accept limitations on their right to beneficial nutrition) this may, other things equal, also be a negative for the equilibrium prices of conventionally grown food.

However, as readers will be aware, there are simultaneous environmental imperatives for planting trees. Conveniently these are most suited to the same class of land (extensive rangelands) that grow cattle. This fact may make the environmental calculus for farming different from fossil fuels. There are no other uses for oil wells and refineries than

to produce and then distil their production into a series of chemicals, most of which will be burned. Forestry and other forms of biological sequestration (e.g. low input, low stocking rate regenerative farming to sequester carbon into pastoral soils) represent viable alternative land-uses in a world that is seeking to address climate change. Therefore, if a reduction in demand for farmed red meat does eventuate, then prices of these and other agriculture products will only fall if demand for land shifted to biological sequestration does not fully off-set reductions in demand for land for red meat.

To illustrate this point with a brief case study; Craigmore Sustainables, on behalf of our investors, has been an active purchaser of marginal sheep and beef country in NZ for afforestation i.e. livestock have been retired from this land and it has been planted with trees. The rise in the NZ carbon price (to around NZ$25 per tonne) over the past three years has lifted the price of such land from around $8,000 per hectare (fair value for pure sheep and beef growing) to now around $11,000 (fair value to forestry investors). If this approx. 35% gain in economic returns and land valuations is reflected in other regions as environmental measures are rolled out, we may find land use industries no longer accrue such a derisory share of GDP. It seems logical to this author, and borne out by NZ’s carbon forestry experience, that if mankind really wants to address climate change (and we must) then society will need to reward farmers with more than 1% of GDP. As soon as this is done then, as argued in the Craigmore commentary In “Praise of Trees”, the farm/forest industry is ready and willing to use our skills to off-set climate change using some of our land to sequester carbon, and enabling us to either sell the credits from this or, indeed, to produce carbon neutral produce.

9. Conclusion

Shifts in tastes toward (more land intensive) animal protein as well as population growth itself are forecast to require an approx. 50% extra production from the same amount of land in the next 30 years. This is achievable, but it seems logical that society, especially if we wish to raise our game to address climate change, will need to pay farmers more than the 1% of developed country GDP to get this.

It is too early to know whether the Coronavirus slump and massive governmental fiscal and monetary responses to it are likely to cause inflation (this risk will be the subject of a future Commentary), however, the above analysis suggests that if this occurs it is foodstuffs, not energy (or at least not fossil transport fuels i.e. oil) that would be more likely to exhibit those rising prices.

Environmental imperatives do not, I believe, change this analysis since biological sequestration will compete with food for land resources, further “tightening” capacity of the global farming industry.

It is these factors, which may lift the real prices of farm produce in coming years, that should allow farm commodities to continue the break in their historic correlation with energy prices, which already began with the scaling up of fracking and renewable energy substitution, from 2014.

www.craigmore.com