Inflation is skyrocketing in practically the entire world. Central banks are getting scared and beginning to announce the end of expansionary measures, also known as tapering.

Why do central banks find themselves in a dilemma? Why has inflation risen so much? What is a bottleneck? What does tapering mean and how could it affect us? The objective of this article is to answer these, and other, questions.

Inflation skyrocketing around the world

Central banks have one explicit mandate: to maintain the purchasing power of money. This is the main goal of monetary policy. Another mandate of some central banks is to sustain the level of economic activity (and it could be argued that they all have this as an implicit goal).

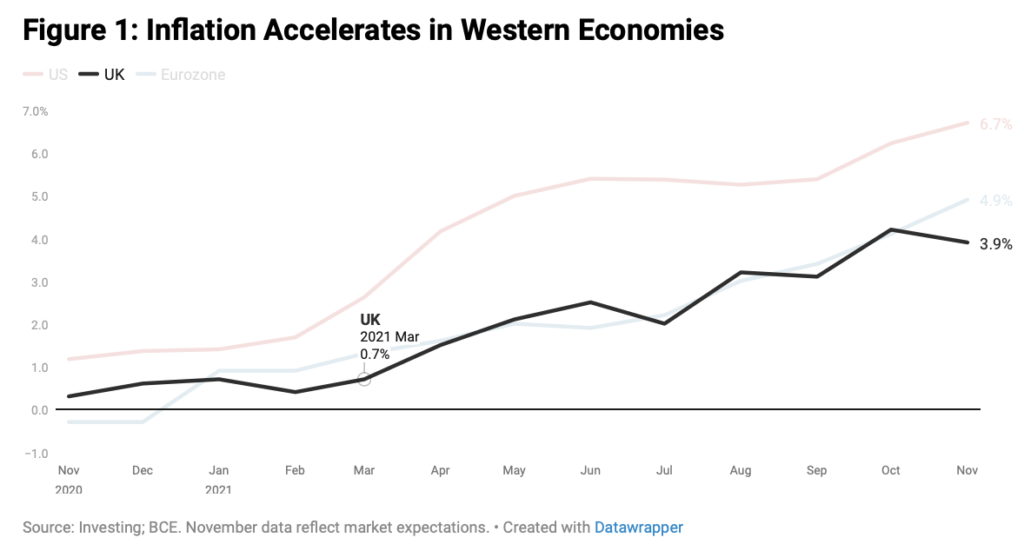

In developed countries, central banks’ inflation target tends to be 2% and in developing countries it tends to be 4% (while central bankers assert that these targets maintain purchasing power, in reality they denote lost purchasing power). Inflation is clearly higher than the targets in most countries.

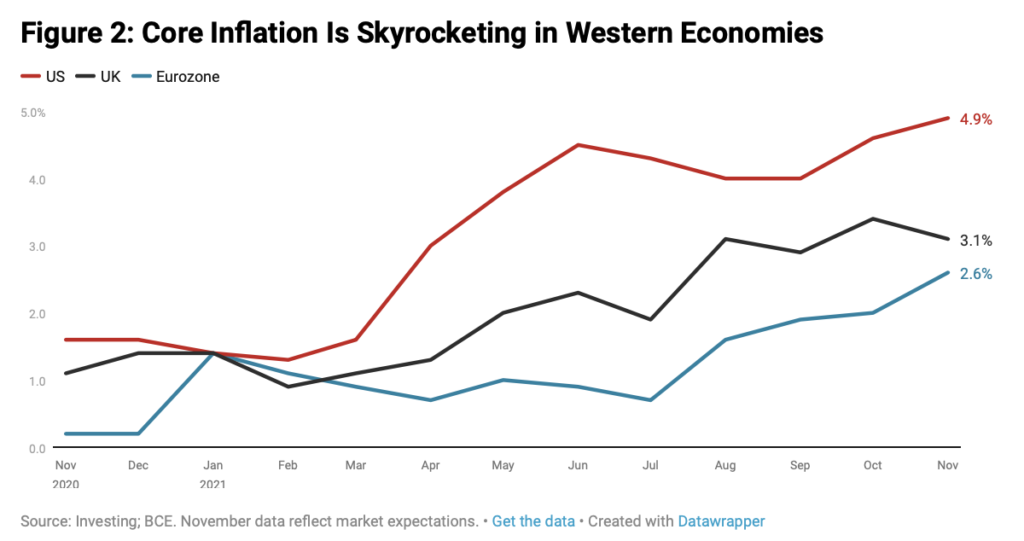

Core inflation (which excludes food and energy) is displaying a trend similar to that of general inflation, although core prices are growing somewhat slower than general prices.

Inflation and bottlenecks: what Is the real cause of inflation?

Most analysts attribute the inflation to bottlenecks. A bottleneck is what happens when a sector that lacks idle capacity and needs capital investments (including investments in human capital), which take time to bear fruit, has problems increasing production in the face of a sudden rise in demand.

But what has caused the bottlenecks? We see three factors:

- An increase in demand.

- A change in the makeup of demand.

- Production restrictions resulting from Covid 19.

Increases in demand

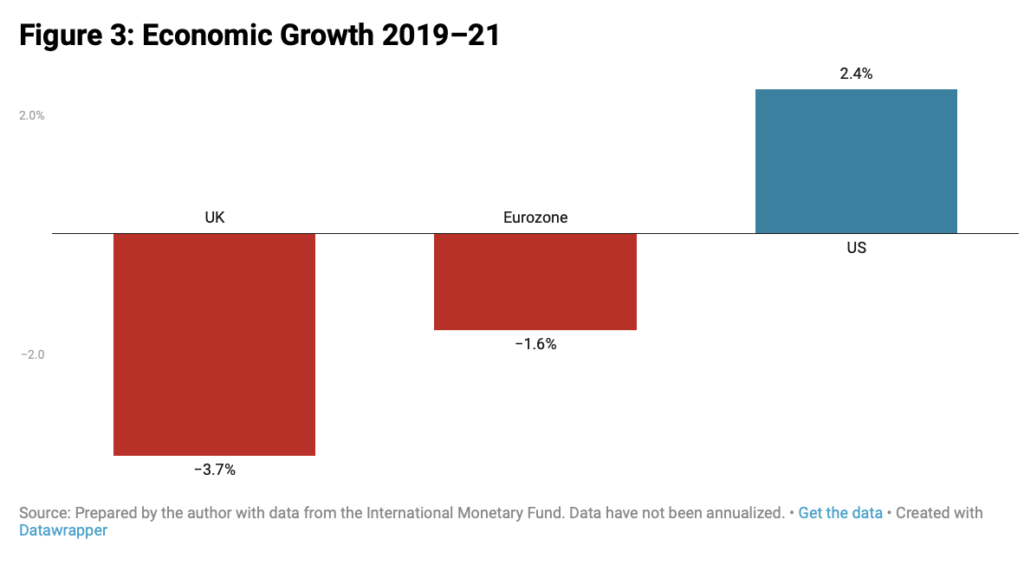

Many analysts consider the increase in demand to be a signal of economic recovery and of the global economy’s dynamism. A person’s ability to demand goods is usually predicated on their previous ability to sell or produce something of value (as Say’s law asserts). However, because of the pandemic, economic growth has been minimal or negative from 2019 to 2021 (for the economies analysed). Accordingly, this enormous increase in demand cannot be an indicator of prosperity.

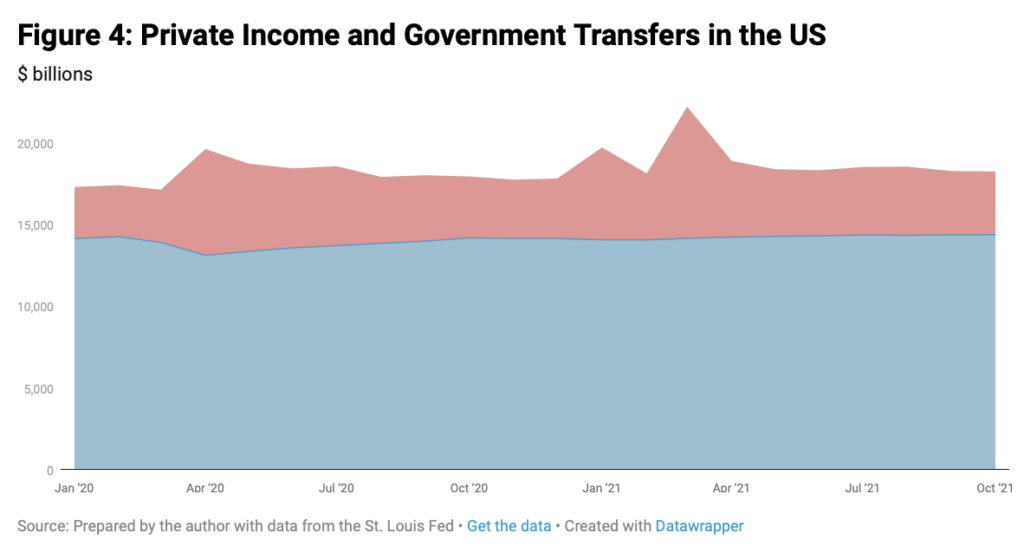

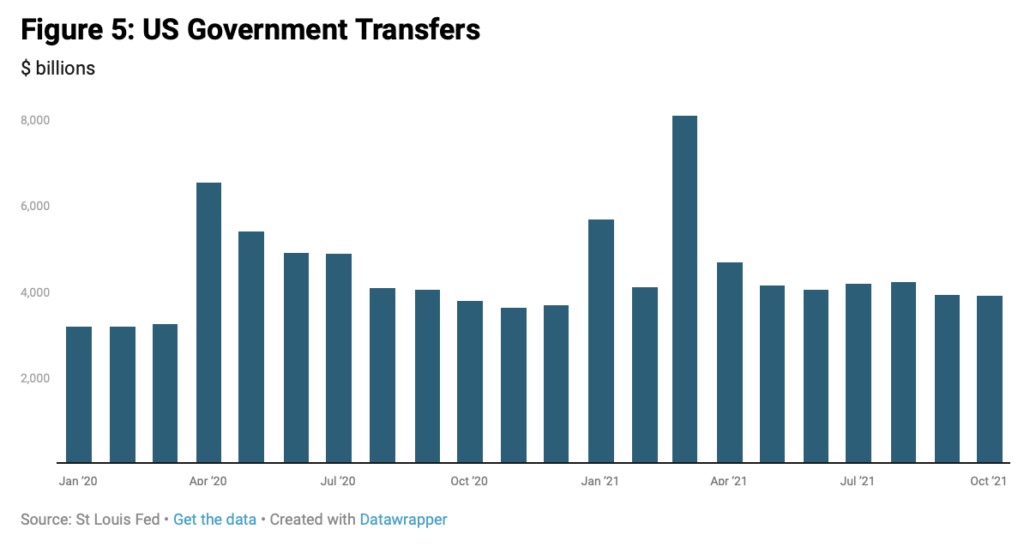

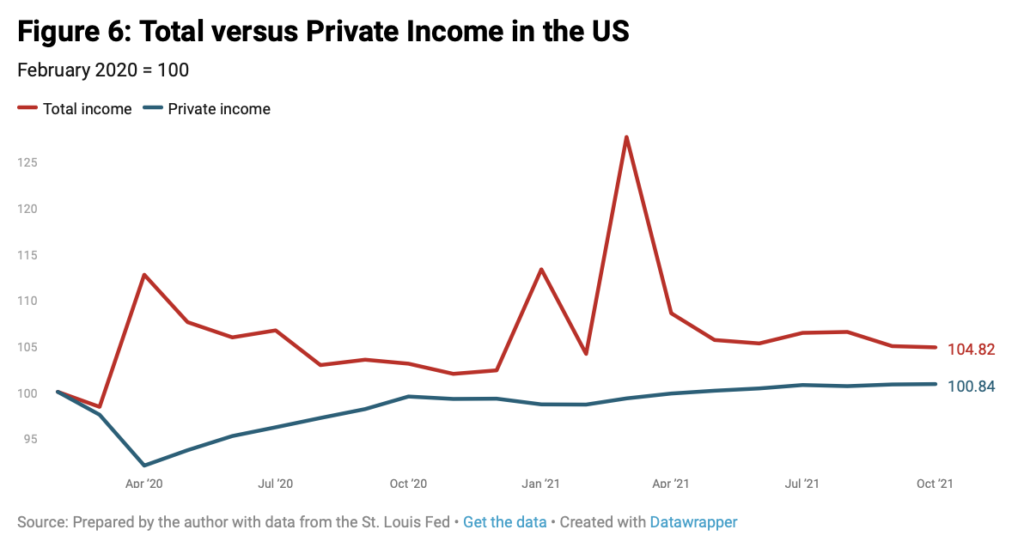

In fact, in the US, the country with the best economic performance, private income did not rise to its prepandemic level until May 2021 and it is currently almost as low as that in February 2020. What has increased significantly – and thus increased demand and caused bottlenecks – is government transfers.

Total income (which includes government transfers) is now almost 5% higher than in February 2020 and was almost 30% higher than that baseline in March 2021 (which saw the second large transfer under the Biden administration). In other words, US citizens do have a greater capacity to demand goods and services, but that capacity is simply a byproduct of the government’s issuance of stimulus checks.

In Europe, in many cases, governments have transferred money to companies to avoid layoffs. However, the effect is similar because the money then went to citizens, who then used a portion of it to increase their demand for goods and services.

Changes in the composition of demand

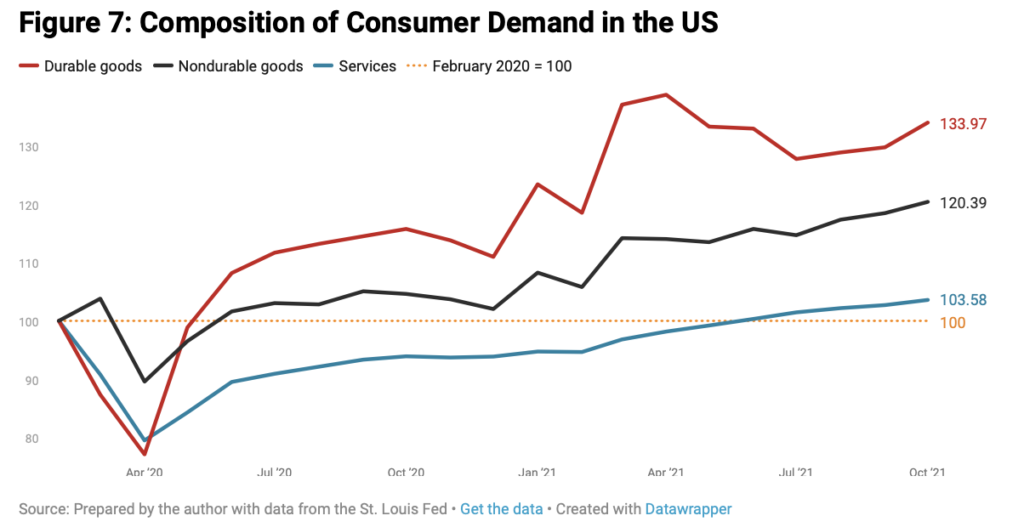

Unsurprisingly, the composition of household spending has changed drastically as a result of pandemic restrictions. Two obvious examples are the positive effect of school closures on demand for computers and the negative effect of travel restrictions on demand for airline tickets.

Another reason that the composition of demand has changed is that the recipients of government transfers have changed their spending pattern.

The changes in composition of demand have led to large expansions in some durable goods industries (for example, technology) and contractions in other industries, such as leisure and other services. Still, suppliers have been unable to fully adapt to the changes.

Covid 19 restrictions

The deterioration in supply chains worldwide has been enormous in 2021. It is being blamed for inflation. Covid 19 restrictions at ports are one cause of the deterioration. Additionally, in the US, the government’s indiscriminate issuance of stimulus checks (under both the Trump and Biden administrations) has made it increasingly difficult to find people to work at ports and in land transportation. For details, see this fantastic article by Olav Dirmaat.

The restrictions and stimulus checks have made it difficult for suppliers to keep up with demand. Furthermore, because the prices of goods are rising faster than those of services, profit margins are narrowing, in turn discouraging production in some areas and contributing to stagflation.

Central banks’ responsibility

Thus, government policies are to blame for the bottlenecks, as they contributed to the excess demand, the change in the composition of demand and the dearth of dynamism on the supply side. But are central banks to blame, too?

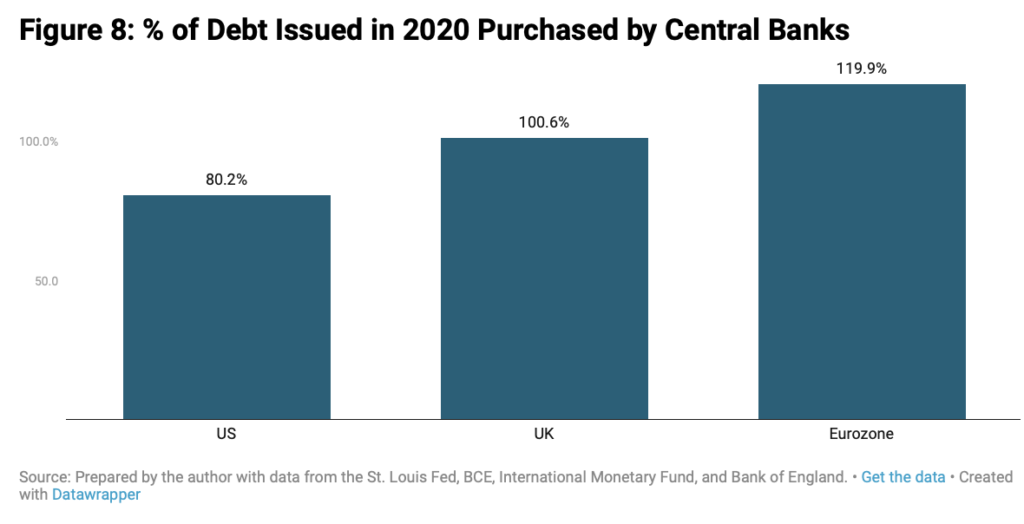

Because of the pandemic, governments have spent vast amounts of resources they lack. One way to gain control over resources is to turn to debt markets. However, governments have rarely chosen this option. Instead, they have financed spending with central bank loans. In 2020, the Fed purchased 80% of new US debt; the Bank of England, 100% of new debt in the United Kingdom; and the European Central Bank, 120% of new debt in the eurozone.

This is the main reason interest rates on public debt have remained low. Some central banks even bought more debt than their countries’ governments needed to fill the huge budget gaps in 2020. This has not changed in 2021. The consequence of the low cost of financing is inflation.

In sum, central banks have given resources they did not have to governments, governments have given these resources to citizens (unlike in 2008–13) and this is generating bottlenecks throughout the economy.

The central banks are scared: will they roll back the stimulus?

The acceleration of inflation is putting central banks in a difficult position. Their mandate is to stabilise prices, therefore, it would seem they should be doing something to avoid this price acceleration. But, as we have seen, a large part of the blame for the acceleration lies with the central banks.

The world’s major central banks have announced the coming of much-vaunted tapering – that is, a restrictive monetary policy of ceasing to purchase bonds from governments and private companies, and also possibly increasing interest rates.

However, central banks will face two significant problems when they try to taper.

- Runaway public deficit

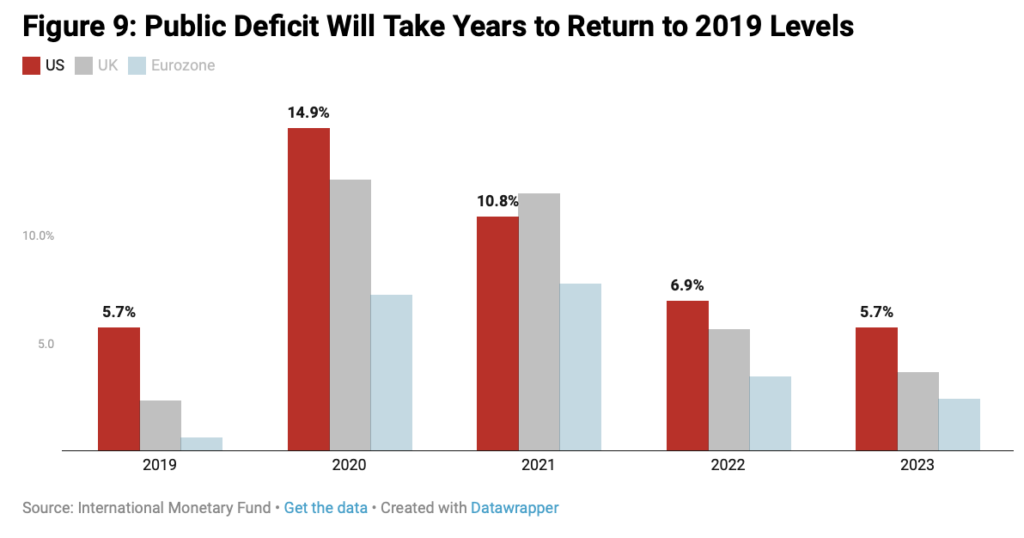

First, not only are governments hyper-indebted because of their irresponsible spending in 2020 and 2021, but it will take them years to reduce the deficit to that of 2019.

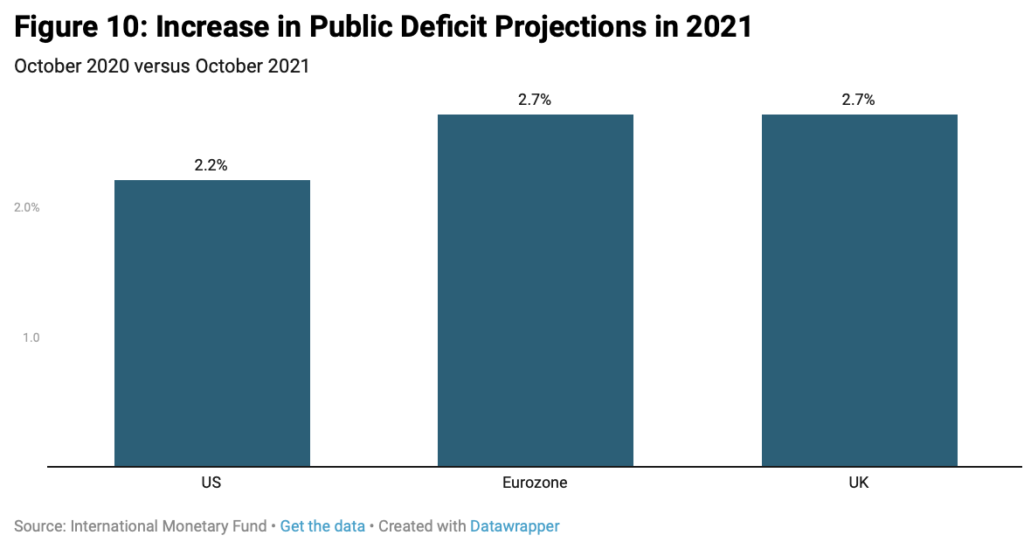

But public deficit projections are constantly revised, almost always upward, so governments will almost certainly end up spending more than estimated. The public deficit in the US will be 2.2% higher in 2021 than the International Monetary Fund estimated at the end of 2020, and the deficit will be 2.7% higher than estimated in both the eurozone and the UK. Politicians promised to stop spending in 2021 what they overspent in 2020, but breaking their promises is easier than cutting expenditures.

If central banks stopped buying public debt, they would force governments to decrease spending. This, in turn, would slow the economy in the short term. Central banks and governments want to avoid this outcome at all costs.

- Zombie companies

As discussed in another article, extremely low interest rates have generated a wave of unsustainable private corporate borrowing and created zombie companies. An increase in interest rates would bankrupt these zombie companies and trigger massive layoffs. Central banks and governments want to avoid this outcome.

Central banks’ dilemma: death by inflation or tapering?

High inflation helps erode the value of debt not indexed to price indices. This helps the hyper-indebted governments and zombie companies. The problem is that debtors have been accumulating debt faster than inflation has grown in recent years, so real debt has continued to increase.

We need to return to more sustainable levels of debt. It seems there are two options for pursuing this goal.

- Allow inflation to continue increasing

This option is very dangerous, but it seems the more plausible one. For months, central banks have been preparing us for this option without giving much detail (for example, they have been talking about a 2% inflation target in the long term, not every year). The president of the Fed has suggested we should stop using the term ‘transitory’ when discussing inflation.

An increase in inflation is dangerous because it causes the demand for currency to fall, which gives rise to accelerating prices (see here for a detailed explanation).

- Make monetary policy restrictive, and let companies and some governments go bankrupt

This second option is less plausible, but would probably be the healthier one.

Higher interest rates and restrictive monetary policy would bring down the entire part of the economy that is generating less value, which would free up resources to realise new ideas and embark on new business projects. These policies would also lead some governments to go bankrupt, which would be traumatic, but could establish a principle of discipline for other governments and the bankrupt governments themselves to follow in the future.

In other words, the healthiest thing is to be disciplined. Unfortunately, financial discipline is a principle forgotten almost completely in the public sector and nearly forgotten in a private sector too accustomed to cheap debt.

Conclusion

Being a central banker at the beginning of 2022 is one of the most difficult and least satisfying jobs in the world. Central banks are going to receive fierce (and well-deserved) criticism, whatever they do.

If they protect the value of the currency, they will create an economic crisis, and if they try to avoid the economic crisis, they will destroy the value of the currency (and cause a monetary crisis anyway).

Pick your poison: inflation or bankruptcy.

Originally published by The American Institute for Economic Research and reprinted here with permission.