If you’ve seen the film Forrest Gump, you’ll probably recall that the central character ends up the multi-millionaire owner of a shrimp-fishing business and an investor in the nascent Apple computer company (I hope he held on to those shares!). And all with an IQ of just 75.

To what extent does income relate to intelligence in the real world? Or, at least, how does it relate to the best proxy we have for intelligence: level of education? We thought it would be interesting to explore this question, particularly as we are adding education and income data into version 2 of the REalyse platform.

Degrees of separation

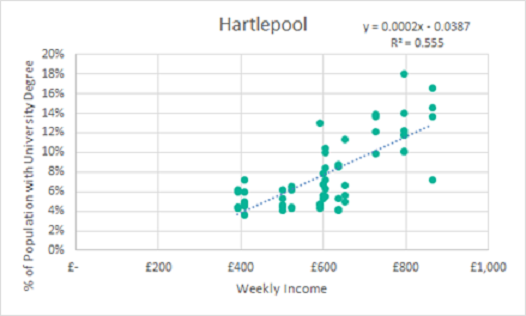

Taking the County Durham town of Hartlepool as a random example, we can see in the below graph that there is a clear positive relationship between the level of education (as measured by the percentage of the population in each ward with a university degree) and weekly income.

The trend line shows that for every 1% increase in the number of people with a university degree, there is a corresponding £50 increase in average weekly income.

Hartlepool house prices

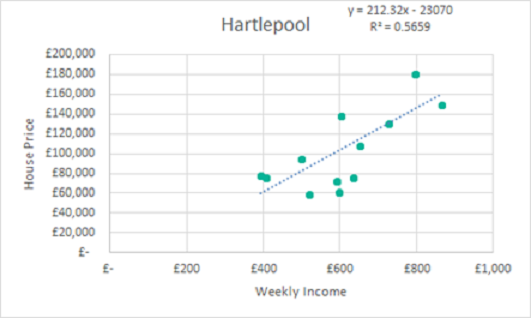

Lining up weekly income with house prices in Hartlepool shows a tighter relationship (nb There are fewer matches in the below graph because we are comparing Middle Layer Super Output areas [MSOAs] as opposed to wards, of which there are more.)

Here it seems that for each £50 increase in weekly income (£2,600 per year), there is a corresponding £10,000 increase in house price. This makes sense if we apply a typical 75% loan-to-value (LTV) to purchases. Each additional £2,600 of individual purchasing power (net of tax) would equate to £10,400 in leveraged purchasing power.

So there are no big surprises here. We would expect to see ‘more-educated’ areas with higher incomes and consequently higher house prices. It is, however, interesting to note the areas below the trend line that have relatively low house prices compared to the level of income. These may emerge as areas of price increases in the future.

Maybe it’s because they’re Londoners?

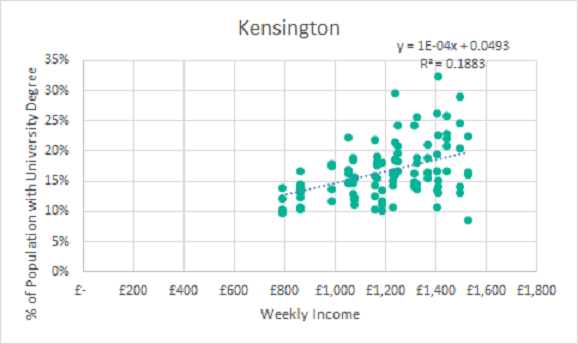

Moving to another part of the country, this time Kensington in West London, we find that there is a far less clear relationship between income and education, although both the level of education and earnings are significantly higher (see below graph). Could this be the ‘topping out’ of the education effect on earnings as a result of diminishing returns? Or perhaps it signals that the income of those living in Kensington has less to do with their education and more to do with other factors? That said, for every 1% increase in the population with a university degree, there is a £200 increase in average income, with a much higher dispersion in the levels of education.

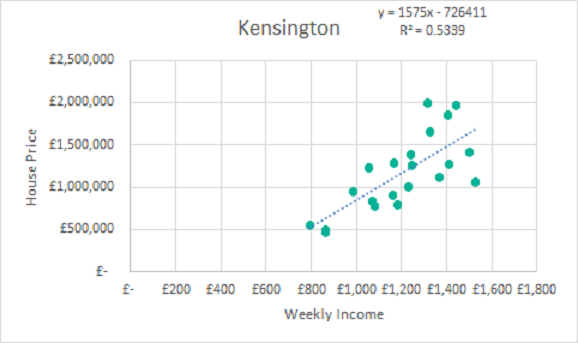

When looking at house prices in the area (see below graph), we find that each £200 weekly (£10,400pa) increase in income is matched by a £315,000 increase in house price, nearly 30x more. This relationship doesn’t make much sense in the normal context of increasing income and purchasing power, unless purchasers are leveraging to 97%, which is unlikely.

So why is there such a clear relationship between income and house prices in Kensington and yet the entire area is considered ‘unaffordable’? There could be a variety of explanations – however it would seem most likely that local buyers have other sources of wealth that don’t make up their regular income, and such wealth increases in relation to their income. This matches up with a cursory review of numerous studies showing that wealth is increasing at a faster rate than income, retaining a non-linear correlation. The impact of foreign buyers, whose purchasing power has no relation to the local levels of income and education, should also be considered.

Perhaps unsurprisingly, the ‘most well-educated’ place in the UK was the City of London, with Nottingham and Bristol coming second and third respectively.

But where is Forrest Gump?

Well, our first look at the data showed that he was somewhere in Harrow, or Waverley – locations where a very small proportion of the population have a university degree, yet the average income and house prices are considerably higher than elsewhere. Then we realised that these locations were the exact locations of Harrow School and Charterhouse School, and students who live at each school but have not yet gone on to university were skewing the results!

The next potential location turned out to be an RAF airbase used by the US – again a place where the population appeared to be earning more than average despite not having degrees. But instead, many have military qualifications in this location.

Then, finally, we found our Forrest Gump. He lives immediately to the west of Manchester’s Piccadilly station, a location with a relatively high level of income, and yet a relatively low level of university education.