One of the key issues that asset allocators (particularly Defined Contribution Pension Funds) have wrestled with is how to construct a real estate weighting that combines the traditional investment benefits of diversification and security of income with the structural elements now required e.g., regular pricing/liquidity and low costs.

For several years now Investor RFPs have contained eye-watering low BP fee/cost requirements. One of the most innovative solutions to this issue was structured by Legal and General (LGIM) who constructed a Hybrid Property Fund comprising 70% Direct UK Real estate and 30% Global Listed Real Estate. This was particularly successful and adopted by NEST (which is the workplace pension scheme set up by the UK Government for auto-enrolment) as part of its real estate allocation.

Ten years ago, we wrote a paper outlining the performance benefits of this approach (Moss and Farrelly, 2014). Clearly, some things have changed significantly in the real estate landscape since then. In 2014 UK base rates were 0.5%, the UK was in the European Union, and consumers used to shop in an institution called Department stores. Some things have not changed, however. In 2014 AI was headline news, with Google paying US$600m for a Machine Learning start up, and Russia invaded the Crimean Peninsula, then part of Ukraine.

The question I want to address is whether this blended approach is still relevant (i.e., it enhances performance) and whether the 70/30 model is still used as an investment strategy.

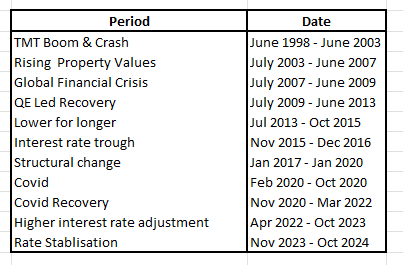

One of the main points about any investment strategy is whether it works across different periods of the cycle. I have therefore broken down the periods from the original study to the current day into the following periods (figure 1). These distinctions are obviously arbitrary but based on inflection points in the listed real estate (“LRE”) sector.

Figure 1 Defining the Cycle

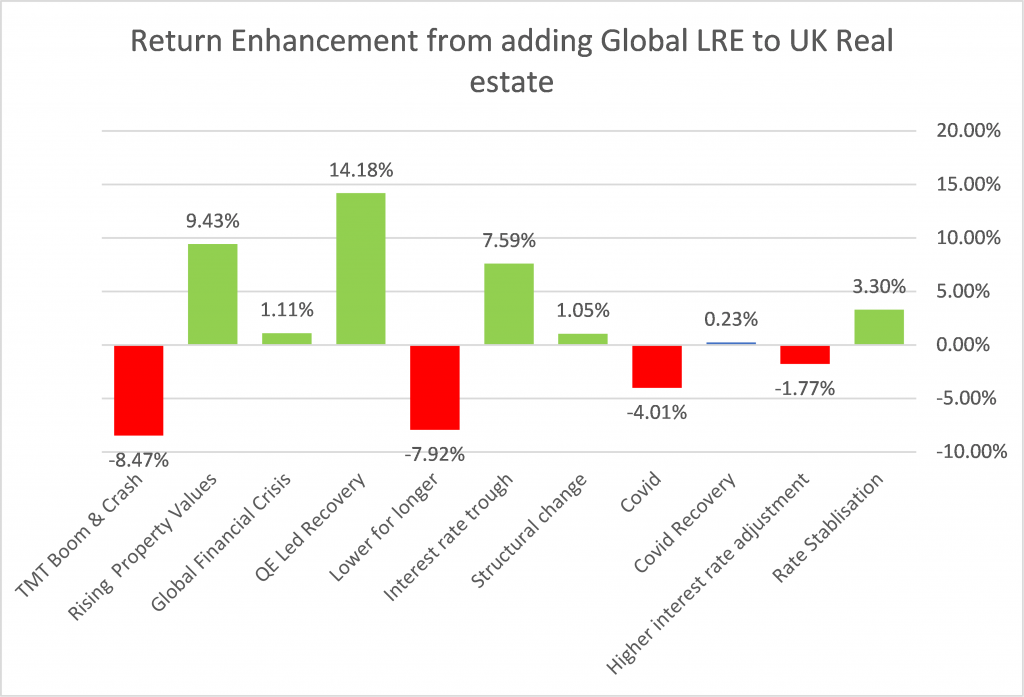

So was there a benefit to adding a Global LRE allocation to a UK direct real estate allocation. The way we measure this is by looking at the return enhancement of a blended (70/30) allocation compared to a 100% direct allocation.

Figure 2 UK Blended Performance

Source: EPRA, MSCI, Authors

The clear answer for the UK is again that there are very definitive benefits. Out of the eleven periods of the cycle seven had a positive impact of adding UK LRE and four had a negative impact. Overall, the full period the impact was significant (+76%) % equating to. 2.2% p.a.

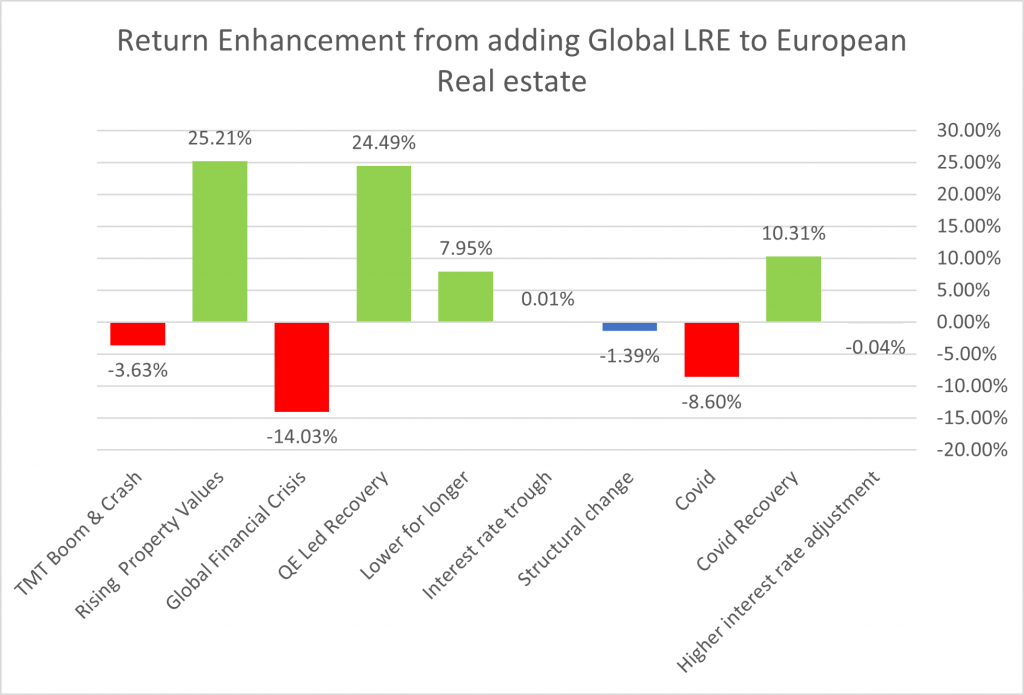

Is this also true of Europe more broadly, however? Direct market index data for the region is of less frequency (annual not monthly) But we did the same exercise and show the results in Figure 3

Figure 3 European Blended Performance

Source: EPRA, MSCI, Authors

The overall results are similarly positive to the UK, namely five out of the nine periods and a total return enhancement of 57% over the full period, being an annualised enhancement of 2% p.a. and a positive impact on six occasions.

Changing the Mix

We are aware that there have been some evolutions of this strategy since it was first started. These include reducing the listed element to form a purely private markets strategy, increasing the listed element to produce a 45% direct 45% listed 10% cash allocation (e.g., the LGIM PAIF) and combining structures for a 50% closed end fund, 25% open ended fund and 25% LRE. A good example of this latter allocation is the LGIM Private Markets Access Fund managed by their Multi Asset business with allocations to Real Estate, Infrastructure, Private Equity and Private Credit and aimed at UK DC investors.

Can Automated strategies improve results further?

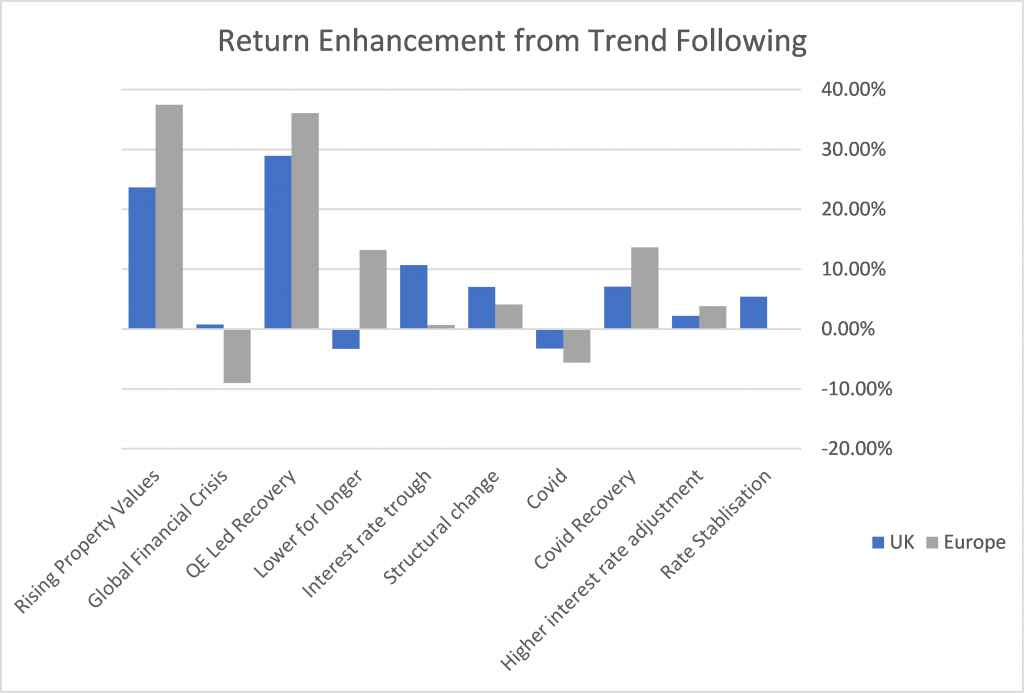

One of the issues that concerns non-specialist holders of LRE is how to time the reduction in exposure to minimise losses in a period when LRE generates negative or lower returns. In the case of blending the question would be whether it is possible to use an automated trading strategy to reduce the LRE exposure from the regular 25% in down periods and increase it in up periods? In a previous paper (Moss et al 2015) we looked at Trend Following and Momentum techniques for doing just this with very positive results. The Trend Following technique follows Faber (2007) and involves increasing weighting when the portfolio/index breaks above its 10 month Moving Average (“MA”) and reducing weighting when it falls below.

However, in that paper a constant weighting was maintained above the MA and reduced the Global REIT weighting to zero when it fell below. For this study, we decided to focus on maintaining a core exposure throughout all the periods of the cycle. Therefore, instead of zero, when the index fell below the MA the LRE weighting would be cut to 20% (compared to a core 30%) and when it went above this would increase to 40%. So, does this make a difference? For simplicity we have just used annualised returns as a comparison.

Figure 4 Impact of Trend Following on Blended Portfolios

Source: EPRA, MSCI, Authors

Source: EPRA, MSCI, INREV, Authors

Figure 4 shows the difference between the enhancement of an unadjusted LRE allocation in a blended portfolio and one adjusted using Trend following. The results show a significant improvement in most periods, and we believe this automated strategy has significant benefits in allowing a dynamic rebalancing within constraints to optimes performance through cycles.

Conclusion

These results show very clearly that for both the UK and Europe there is a clear benefit for a blended real estate strategy, combining a listed real estate allocation with a direct real estate holding.

References

Faber, M., 2007. A quantitative approach to tactical asset allocation. The Journal of Wealth Management, Spring.

Moss, A. and Farrelly, K., 2014. The performance implications of adding global listed real estate to an unlisted real estate portfolio: A case study for UK Defined Contribution funds. European Public Real Estate Association Research.

Moss, A., Clare, A., Thomas, S. and Seaton, J., 2015. Trend following and momentum strategies for global REITs. Journal of Real Estate Portfolio Management, 21(1), pp.21-31.

This article was originally published in the Spring Issue of The Property Chronicle.