The world of international trade is undergoing a revolution, as new technologies and global events disrupt traditional systems and practices. At the forefront of this change is the role of currencies, and in particular, the status of the US dollar as a global reserve currency and its domination of international trade settlements.

Back in 1944, the US dollar was established as the world’s reserve currency under the Bretton Woods Agreement. At the time, the US was one of the world’s largest economies, and it held significant amounts of gold reserves. The agreement established a fixed exchange rate system, with other currencies pegged to the US dollar, and the dollar itself pegged to gold.

This system worked well for a while, as the US dollar became a symbol of stability and reliability in the global economy. Countries around the world held US dollars as part of their foreign exchange reserves, and many commodities such as oil were priced in dollars. The US dollar became a dominant currency in international trade and investment, and it seemed like nothing could challenge its supremacy.

Although the US dollar has been historically stable, there are growing concerns about its ability to maintain its status as a “safe haven” currency. The currency faces a range of challenges today, including financial crises, geopolitical tensions, and the impact of the COVID-19 pandemic. In recent years, these challenges have intensified, raising questions about the long-term sustainability of the US dollar’s position. According to Pacific Investment Management Co, there seems to be no end in sight for the weakness of the US dollar. This is due to fears of a global economic recession easing, and inflation subsiding, which has diminished the appeal of the US dollar as a safe-haven currency. Further, the US dollar’s domination of international trade settlements seems today to stand in contrast with traditional monetary models which state that in international trade and funding prices and funds are set in the exporter’s currency. Today, China is the world’s second largest economy and the largest trading country. China and many other major developing nations desire to reduce their current reliance on the US dollar. For instance, the Malaysian Prime Minister conveyed a viewpoint that suggests a move away from reliance on the US dollar.

Moreover, the post-COVID situation has further highlighted these challenges, with many countries struggling to recover from the economic fallout of the pandemic. As a result, the US dollar’s role as the dominant reserve currency is being challenged by alternative currencies.

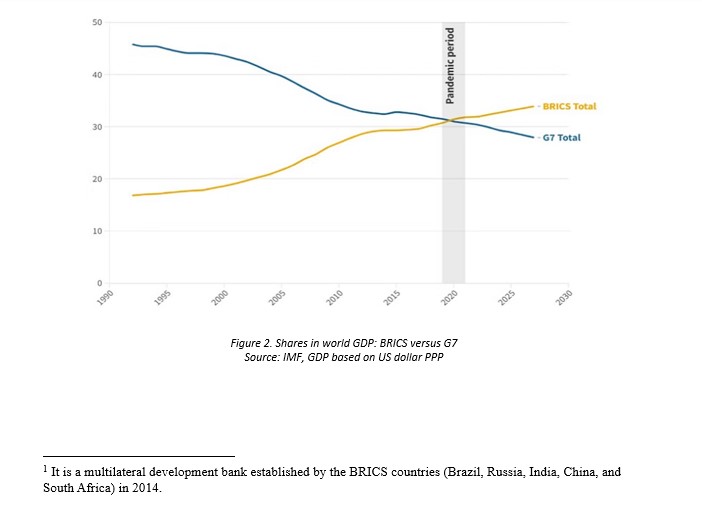

On the other hand, there has been much going since 2014, upon the establishment of the New Development Bank (also known as the BRICS Development Bank) and the project for the creation of a common currency as well as recurrent calls for de-dollarization of international trade and finance in order to reduce global markets’ dependence on the US dollar and the US economy.[1] As shown in Figure 2, BRICS five countries now contribute more than industrialised G7 countries to the world’s global GDP and they are expected to contribute over 50% of global GDP by 2030 with the potential enlargement to other major developing economies. It seems that the US dollar is in revolt and the question is, are we shifting towards a more multipolar monetary order?

Bipolar currency refers to a situation where countries shift away from using the US dollar as the dominant reserve currency and instead adopt a “bipolar” approach, holding reserves in both the US dollar and another currency. This trend has been driven by a range of factors, including concerns about the stability of the US dollar, the emergence of new economic powers, and the desire to reduce reliance on any single currency.

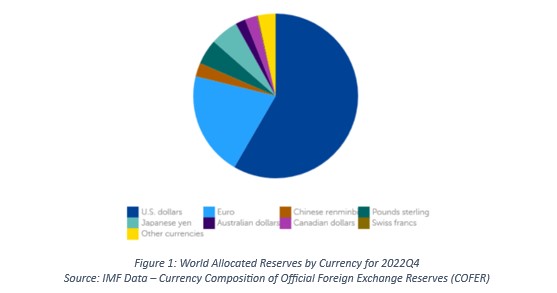

Apparently, the world is shifting form the US dollar domination. The International Monetary Fund (IMF) noticed in 2022 that national central banks were not holding the US dollar for their reserves as in the past and that the decline in the US dollar’s share was not compensated by reserves in the currencies of the other G7 nations by rather by an increase in the shares of rupee and yuan in global and bilateral trade. One of the biggest supporters to the US dollar used to be the “petrodollar” – which is slipping. Based on the latest news, we might be witnessing the petroyuan scenario. The big announcement was made by the Saudi Finance Minister at Davos, that they would consider payment of their oil in yuan. Moreover, 18 countries including United Arab Emirates (UAE) but also Germany and UK are favourable for settling trade in rupee for imports and exports with India. Furthermore, the recent declarations state that the BRICS currency is on its way.[2]

The trend towards bipolar currency is not without risks and challenges. Holding reserves in multiple currencies can be more complex and costly for countries and can also increase currency volatility. Additionally, the US dollar still dominates many areas of the global economy, including international trade and commodity pricing, and its role as the dominant reserve currency is unlikely to disappear overnight.

However, the rise of bipolar currency represents a significant shift in the global financial system that could have far-reaching implications for the US dollar and the broader geopolitical landscape. As more countries seek to reduce their reliance on any single currency, the era of the US dollar as the dominant global reserve currency may be coming to an end. The game is changing, and those who adapt to the new reality of bipolar currency will be the ones who come out on top.

Despite its long history of stability, the US dollar is facing a new era of uncertainty and increased competition. As the world continues to change and evolve, the future of the US dollar as a “safe haven” currency remains uncertain. Ultimately, the idea that money is “free” is being challenged, and the global financial system is entering a new and complex phase.

[1] It is a multilateral development bank established by the BRICS countries (Brazil, Russia, India, China, and South Africa) in 2014.

[2] A basket holding the value of five BRICS currencies: the Chinese renminbi, the Russian ruble, the Indian rupee, the Brazilian real, and the South African rand.