MedicX Fund is a specialist REIT. Like its peers, Primary Health Properties and Assura, it invests in primary healthcare property, focusing on modern, purpose-built primary healthcare assets. The key features of this specialist market are long leases, strong tenant covenants, consistently high occupancy levels and, in the UK, rent reviews that are effectively upwards only. MedicX is invested primarily in the UK but also, to a growing extent, in the Republic of Ireland (RoI) where market dynamics are similar to the UK but rental yields are materially higher. The properties in the MedicX portfolio are let mainly to government-funded tenants (c 90%) and pharmacies (c 8%) on long leases.

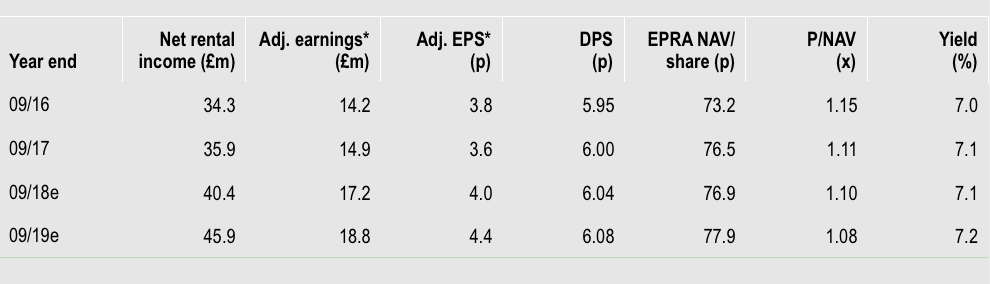

Note: *Adjusted earnings and EPS exclude deferred taxation, revaluation gains, performance fees and exceptional items. Priced as 19th December 2017.

Primary healthcare assets form part of the core healthcare infrastructure, for which there is an increasing need. They provide long-term secure and rising cash flows to support high and growing dividend distributions. Both the NHS and the HSE seek to increase the range of services that GPs are able to provide in local community settings, outside of the hospital system, and integrated with other healthcare services. In the UK, the strategy for change was set out in the NHS Five Year Forward View and Sustainability and Transformation plans, and cross-party support for these remains in place. Sir Robert Naylor’s review of NHS property and estates (published in March 2017) highlights the important role that the private sector can play in driving forward the desired changes. The recent autumn budget has made available additional resources for NHS capital investment. Independently, GPs are increasingly open to working collaboratively in larger groups so that they can provide enhanced services from typically larger, modern and purpose-built premises. The RoI faces similar demographic pressure and the Irish government continues to support the Primary Care Strategy, aimed at delivering similar modern, high-quality premises within local communities.

At 30 September 2017, the MedicX portfolio was valued at £680.4m, comprising 156 properties, of which 151 were operational and fully let and five were under development. The increase from £612m at end-FY16 includes net £49m invested in the portfolio and £19m of revaluation gains. The revaluation gains substantially reflect a further tightening of yields as well as a smaller contribution from rent growth. The net initial yield for the UK assets reduced to 5.08% from 5.25% at end-FY16. The RoI assets, mostly still under construction at end-FY17, accounted for c 5% of the total portfolio value.

Mostly reflecting acquisitions, the passing rent on the portfolio increased to £40.0m at end-FY17 from £37.2m a year earlier. The portfolio is geographically diverse and the largest asset comprises only 2.7% of the portfolio value (FY16: 2.9%), with the top 10 assets representing 17.5% of the total. The averaged unexpired lease length was 14.1 years, with the decline from 15.5 years at end-FY16 broadly representing the passage of time.

The investment market for primary healthcare properties remains highly competitive, with a wide range of investors attracted to the secure long-term yields that the asset class can provide. As a result, the spread between the yields at which the Fund can acquire properties and the cost of long-term debt and government gilts remains significant, but has narrowed noticeably in recent years, representing an increase in the cost of acquiring new assets.

In this environment it is important for the long-term success of the portfolio that the properties acquired are able to provide more than just near-term income, but are of a high quality and able to adapt to the changing needs of the tenants. We believe that the acquisition, by MedicX, of larger and newer properties is a good indication that investment quality is being maintained. The Fund has continued to source suitable acquisitions through its established relationships with investors, developers and agents in the sector, and acquired a total of six properties during FY17 with two smaller properties disposed of.

FY17 witnessed continued growth in recurring earnings. Net rental income and adjusted earnings (recurring “income earnings”) both rose c 5%, but did not fully benefit from investment in properties under construction, particularly in the RoI. As a result, with the share count increased by c 14% to part-fund investment and meet scrip dividend demand, adjusted EPS at 3.6p was lower than in FY16 (3.8p). IFRS net earnings grew 45% to £38.6m. EPRA NAV per share rose 5% to 76.5p and, including dividends paid, NAV total return was 12.7%.

Future performance will be driven by further acquisition growth and the economies of scale that these should generate, and the ability to generate rental growth, particularly on the c 70% of leases that are subject to open-market reviews. MedicX ended FY17 with a strong pipeline of investment opportunities amounting to £175m, reflecting the impact of government policies in both the UK and ROI aimed at improving primary care infrastructure. With investment adviser fees frozen until the portfolio rises above £782m, any growth should have a geared impact on earnings and dividend cover. Rent growth has been positive but subdued in recent years. However, there is a widespread industry view that open-market reviews will need to increase to take account of historical land and build cost inflation. This would have a positive effect on rental income and would provide capital value protection against any future widening in market valuation yields.

Given the nature of the tenants, MedicX’s portfolio has a low-risk profile and relatively predictable income. The quality and predictably of its portfolio income stream can be seen in the constant levels of pretty much full occupancy in its properties, an almost complete absence of speculative new building, and in the credit quality of the tenant base. Additionally, debt funding is fixed rate with an average maturity of 12.7 years, similar to the average unexpired lease length of 14.1 years. MedicX offers one of the highest yields in the sector with a 10-year record of growth. Distributions have regularly exceeded income earnings (cover in FY17 was 59.2%), but this has been more than made up by capital earnings. EPRA NAV has increased over five years with an annual compound NAV total return of 13.5%. We expect the continuation of a modestly progressive dividend policy with growing, secure income from existing assets and portfolio growth gradually improving cover.

Disclaimer – Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. This document may contain materials from third parties, which are supplied by companies that are not affiliated with Edison Investment Research. Edison Investment Research has not been involved in the preparation, adoption or editing of such third-party materials and does not explicitly or implicitly endorse or approve such content. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of publication and is subject to change without notice. While based on sources believed reliable, we do not represent this material as accurate or complete. Any views or opinions expressed may not reflect those of the firm as a whole. Edison Investment Research does not engage in investment banking, market making or asset management activities of any securities. The material has not been prepared in accordance with the legal requirements designed to promote the independence or objectivity of investment research.