Cross-border transactions now account for a third of property deals, and the most transparent markets hold the most appeal

Investment in many mature real estate markets is booming and this has been the case for about ten years now. At the same time these markets are experiencing unprecedented cross-border investment activity. In times of low returns in almost all major asset classes and despite cap rates being close to their lowest levels in many key real estate markets, commercial real estate – especially in the key European markets – continues to generate comparably attractive net yield spreads (against the respective ten-year government bond rates). Obviously, each asset class comes with its specific risk and return profile, and past performance is not a guide to future performance.

In light of this long-lasting boom, market participants are becoming sceptical about the potential for further growth. Their concern is driven by more than just market cyclicality as political factors and changes in the capital markets could also affect property investment. This network of mutually influential factors is made more complex by the importance of international capital. The search for yield remains a key motivation behind investment decisions, and there are no signs of material changes in this trend. This leads to yield compression in most regions and sectors and sustained investor demand. Despite initial yields remaining low in many mature markets, real estate prices appear not to be drifting far from their fundamental values and are priced fairly in comparison with stocks or bonds, thanks to the strong occupier demand. An interesting feature of this cycle is that demand for commercial real estate is driven not only by strong domestic investors but also by international, cross-border investors.

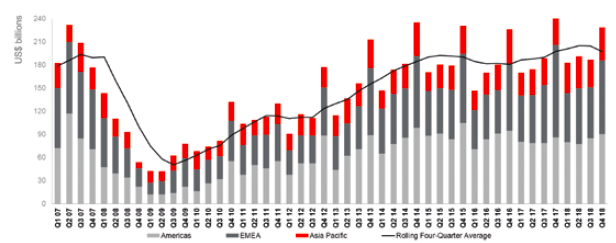

Figure 1: Direct commercial real estate transaction volumes

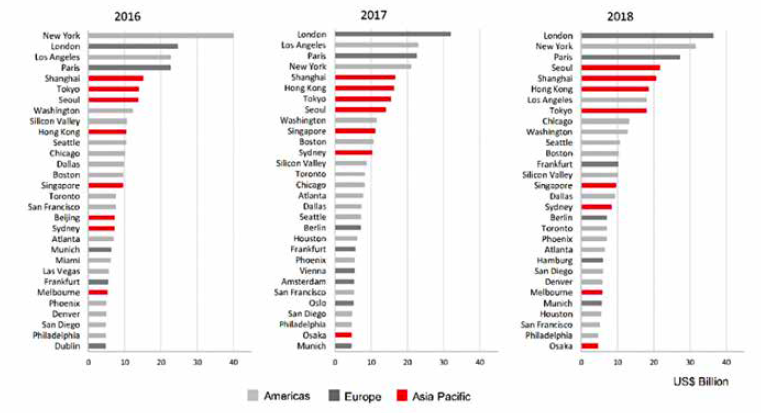

Figure 2: Top 30 cities for direct commercial real estate investment

In 2018, the total investment volume was approximately $733bn (according to JLL). This represents a 4% increase

In recent years China, Taiwan, Singapore, Norway, Africa and Latin America have become active cross-border investors. Nevertheless, North America, Asia and the Middle East dominate as sources of capital, accounting for 70% of all international transactions. Europe is a main target, with about 60% of investment here coming from non-European investors over the last ten years. Global institutional investors tend to follow the traditional 40:40:20 asset allocation strategy, investing 40% in stocks, 40% in bonds and 20% in alternatives. The last category typically includes real estate, which now accounts for almost half of alternative investments of most portfolios and is expected to continue to grow. Specifically, pension funds, insurance companies, sovereign wealth funds and real estate funds as well as large family offices continue to increase their real estate capital allocation as they look for returns and income structure to match their long-term liabilities and cash-flow requirements. In addition, many investors are underinvested relative to their real estate allocation targets.

The rate of cross-border activity is likely to be determined by political and macroeconomic conditions. For example, while international investment has (at a lower level) continued to flow to the UK after the Brexit vote, there have been changes in patterns of country of origin as well as of types of purchased buildings and investors. In times of crisis, capital flows have a tendency to reverse very quickly and return to regions, countries and cities of origin. If exogenous risks in destination countries are viewed as being too great, international investors act quickly to protect their assets. At the moment, political uncertainty is perceived as high. International terrorism, growing protectionism and populism, and effects from migration as well as conflicts are increasing economic uncertainty and creating obstacles not just to global trade, but eventually also to real estate investment markets.

Access to comprehensive local market information and attractive investment opportunities, liquidity, transparency of regulations and low barriers to entry are just a few of the factors that are important to global institutional investors. As a result, despite all of the dynamic growth in the emerging markets, the majority of capital continues to flow to the world’s established metropolitan areas. According to research by JLL, 12 cities, namely London, New York, Paris, Seoul, Hong Kong, Tokyo, Shanghai, Washington DC, Sydney, Singapore, Toronto and Munich have been listed in the top 30 ranking every year in the past decade. Those cities attract approximately 30% of all real estate investments globally.

It appears that transparency – besides market size and liquidity – is a key determinant of international attractiveness of real estate markets. According to JLL and LaSalle Investment Management’s 2018 Global Real Estate Transparency Index (GRETI), which

The ten countries identified as “highly transparent” by GRETI 2016 now account for 75% of global investment in commercial real estate. This shows the extent to which transparency drives real estate investment decisions.

In this

Transparency is especially important as historically low yields translate into high capital values. Fears of markets overheating (as at the start of the global financial crisis in 2007 and 2008) are rising largely because of the upward pressure on prices across almost all real estate markets. It appears appropriate to consider the current real estate market situation in the context of the events surrounding the global financial market crisis and the period leading up to it. Ever since the start of the real estate transaction market recovery in the wake of the financial crisis, some experts have regularly held that future growth opportunities were limited. They attributed this to

Figure 3: Inter-regional flows remained concentrated in Europe in 2018

It is important to note that high demand persists despite stricter lending criteria forced by regulators. This illustrates the level of demand from equity investors and suggests that they are under high pressure to deploy capital. On the whole, there are signs of surplus demand in the investment market. This is due to delayed adjustment effects in the real estate market compared with other areas of the capital market and – in very general terms –

Today, conscious handling of the interest rate risk is a key aspect of any sustainable approach to investment management. A large increase in long-term interest rates would have a negative impact on the real estate industry. Therefore investors are increasingly

In this context, cross-cultural negotiations are also starting to emerge as a vastly under-appreciated part of many transactions. The challenge of international partnerships is magnified by considerable differences in local practices and the growing shortage of people who can put them in a global context. The real estate industry used to focus on domestic markets, because of high barriers to entry in others. As those barriers come down, training and education on how to take advantage of this may be critical to success. Consequently, it appears that the future of global real estate markets will be defined by international capital flows to countries that can offer the greatest improvements in their investment transparency.

Nikodem Szumilo is Associate Professor of Economics and Finance of the Built Environment at UCL, University College London. Thomas Wiegelmann is a Managing Director of Schroder Real Estate, Honorary Adjunct Professor at Bond University and a member of the Harvard Alumni Real Estate Board.