A considered outlook.

International integration has faced numerous challenges over the past decade. Brexit and the Trump presidency are clear examples where traditionally outward-looking trading economies turned inwards. More recently, the tragic war in Ukraine points to a shifting world order. Meanwhile, the pandemic has severely altered the way people behave, as well as how goods move around the world. Supply chains have been disrupted by lockdowns and other restrictions. Consumers turned to shopping and working more locally, often from the comfort – or confines – of their homes.

These changes are not, in fact, isolated examples. They reflect more longstanding changes. Global export volumes as a percentage of GDP peaked in 2008 (World Bank national accounts data and OECD National Accounts data files), and trade routes had converged around regional blocs like the European Union, North America and east Asian nations.

Recent data suggests that cross-border real estate investment has lost some ground since the pandemic. Investment volumes by investors outside their own home market accounted for 19% in the 12 months to Q1 2022, according to RCA figures, down from 23% in the five years prior to the outbreak of Covid-19. Stripping out deals done within an investor’s home region, the share of deals done cross-regionally stood at 8%, also down on the five-year average.

A reasonable question to ask would be if a global approach to real estate investment is still relevant in this seemingly more fragmented and localised world?

At least some of the weakness in cross-border activity seems transitory, as many of the conditions that facilitate international property transactions were severely disrupted because of the pandemic. Air travel and business travel more broadly were severely curtailed. Despite some fantastic technological progress to inspect buildings remotely, real estate investors still seemingly prefer to view properties live and in person. In fact, a recent survey from INREV highlights that institutional investors plan to allocate more capital to property this year than last, and a significant share of this capital is destined for countries outside their home region (INREV Investor Intentions Survey 2022). Asia Pacific investors plan to deploy 41% outside of Asia Pacific, Europeans to deploy 47% cross-regionally and 19% of North American capital deployments are planned for locations outside the Americas).

Diversification remains the single-most powerful argument for investing globally. The same survey from INREV highlights that diversification in a multi-asset portfolio is the most compelling reason to invest in real estate. Unlike public equities, where large cap stocks may be domiciled in the US, but their revenue streams derive from global operations, property is influenced by the supply and demand dynamics in that city, neighbourhood or street. As a result, the push towards behaving more locally accentuates the diversification potential of real estate.

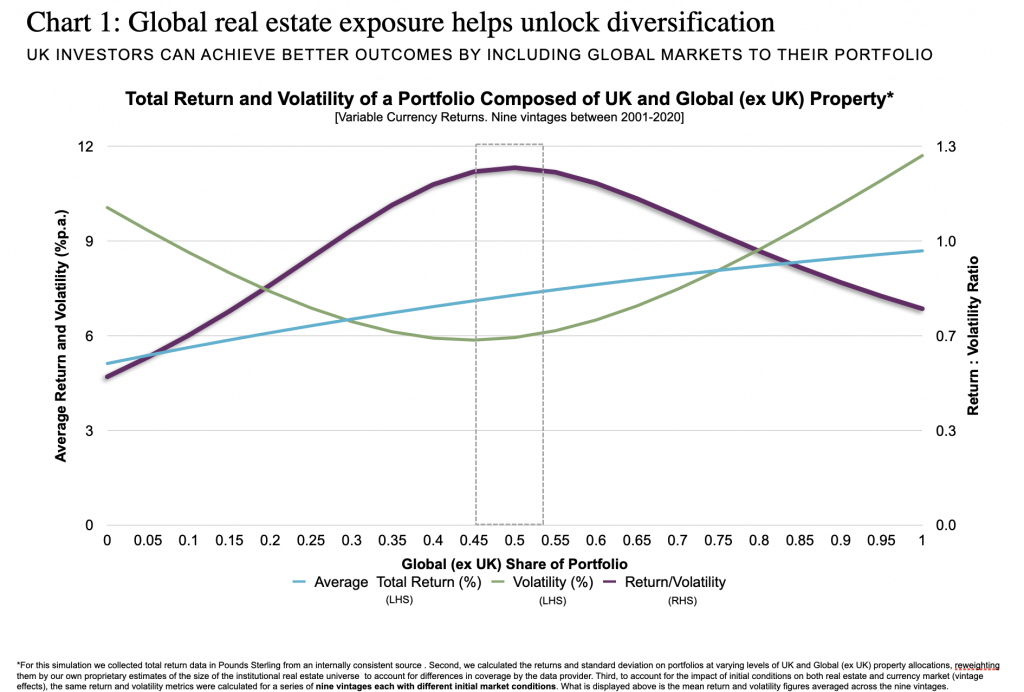

That said, to gain the diversification benefits of global investment does require a stomach for complexity. The challenges are numerous and range from currencies and tax treatment to the intricacies of local lease structures and market dynamics – all of which require a high degree of expertise. One way to approach the increasing complexity of global investment is to treat it as a balancing act. For example, a UK investor pursuing a portfolio composed of both domestic and global assets on an unhedged basis could have an optimal allocation to non-UK property of between 45% and 55% (see chart 1). The precise numbers are less important here. What is crucial to draw from this is that there is a range where the additional volatility introduced by more currency pairs is offset by the benefits of greater diversification.

No assurances are given that these trends will continue or materialize as expected. Nothing herein constitutes a guarantee or prediction of future events or results and accordingly the information is subject to a high degree of uncertainty.

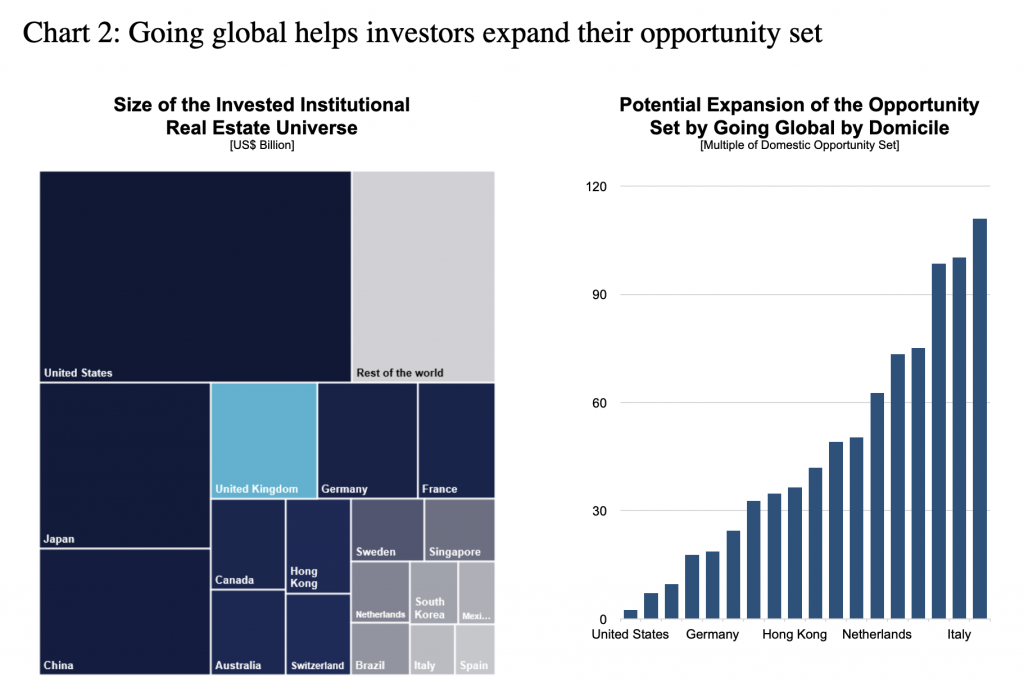

A second crucial rationale for global investment is that it magnifies investors’ opportunity sets. According to LaSalle’s estimates of the institutionally investible real estate universe, going global increases UK investors’ opportunity sets by a factor of 16x, meanwhile an investor from Singapore could see an increase of 60x (chart 2).

Source: LaSale Research and Strategy (2021).

Similarly, the range of available sectors to invest in varies from one country to the next, offering a wider array of property types than are typically available in an investor’s home market. Secular drivers of demand – like demographics, urbanisation, technological changes and environmental themes – emerge at different times and evolve at different speeds around the world. This uneven pace translates into varying degrees of maturity across property sectors. Put differently, sectors that might be considered emerging in one country are well and truly mature elsewhere.

There is no better example of this than the emergence of multifamily residential in the US in the 80s and 90s. The same sector is at much earlier stages of maturity in Europe and even more nascent in Asia Pacific. In a similar vein, many alternative sectors, which tend to be highly specialised and operational in nature, are most developed in the US. These gaps in maturity provide investors with a global lens, opportunities from additional diversification, as well as higher potential returns as they gain institutional acceptance.

In short, my view remains positive for global property investment. Of the two main pillars of the logic for global real estate investment, they remain either unaltered or solidified in a less global world.