We all know the classic four categories on the risk-return graph, Core, Core+, Value-Add and Opportunistic. These investment strategies are widely used, but are also arbitrary as investors define Core, Core+, Value-Add and Opportunistic strategies differently. So, in this article, we will outline a new factor investing approach and compare this with the conventional private real estate strategies.

WHAT IS FACTOR INVESTING?

Factor investing is an investment approach successfully used in fixed income and equity investment management. The approach identifies multiple factors that explain excess returns compared to the market portfolio. Initially, these factors focused on small caps, value and growth stocks, but then expanded in scope. By identifying the most relevant underlying factors, investors can benefit from market inefficiencies in a rules-based and transparent way. If you consistently select stocks, bonds or sectors whose performance have been driven most by factors delivering excess return, you should beat the market benchmark in the long term.

HOW IT IS APPLIED IN REAL ESTATE?

We introduced a rules-based Factor investing framework with three steps. Firstly, we defined the six most relevant conceptual factors based on our review of academic and industry literature as Yield, Value, Growth, Quality, Liquidity and Volatility. Secondly, we selected the most appropriate available data series to represent each of these six factors, normalise these based on their Z-scores and identify each office market’s exposure to these underlying factors. For example in the case of Growth, we select GDP growth, general and FIRE employment growth and office rental growth as underlying factors. Thirdly, we created the historical total return series for each Factor for each quarter over the last 15 years using the 80th percentile of our market universe.

WHAT IS THE BEST PERFORMING FACTOR?

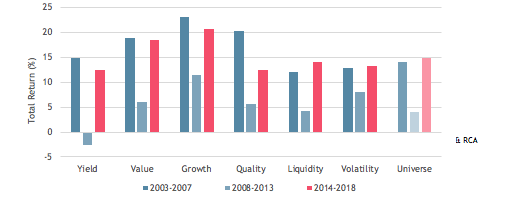

When reviewing our different Factor portfolio results, we considered three phases in the cycle: the run-up to GFC 2003-07, 2008-13 and the most recent period 2014-18. For each factor, we considered both returns and risks. In the run up to the GFC, we are seeing good relative performance for both the Growth and Quality factors. These results seem sensible, as economic and rental growth were strong, driving returns above the long-run average. In the 2008-13 period, all portfolio returns suffered, but Growth and Quality showed relatively strong performance. In the last five year period, Growth and Value both showed better returns, but at only moderately higher risk levels. When we combined the return results for all three periods, Growth and Value consistently outperformed the other Factors and the Universe. However, Growth is well ahead of Value in all periods.

GRAPH 1: GROWTH & VALUE SHOWED BETTER RETURNS RELATIVE TO UNIVERSE AND OTHER FACTORS

Sources: AEW, CBRE, JLL, Oxford Economics & RCA

HOW DOES FACTOR INVESTING COMPARE TO TRADITIONAL STYLES?

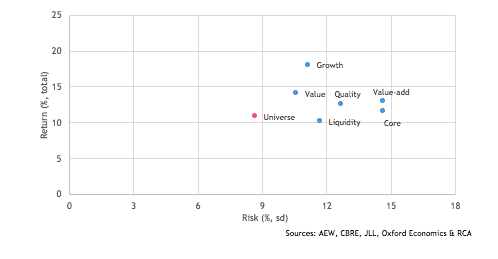

To allow us to compare factor investing with the traditional core and value-add investment styles, we selected two factors that best fit these styles. In our opinion, Quality and Liquidity are the best-fit factors for core style investing while Growth and Value fit best with the traditional value-add style. Based on this, the selected top three core markets (London, Paris & Frankfurt) and value-add markets (Budapest, Warsaw, Dublin) confirm our style-focused factor selections. The value-add style portfolio offers better return than core at a nearly identical risk level over the period. But, our pure Growth and Value Factor-based portfolios produce better returns at lower risk than both traditional style portfolios.

GRAPH 2: GROWTH & VALUE SHOWED BETTER RETURNS THEN TRADITIONAL STYLES AND OTHER FACTORS

Sources: AEW, CBRE, JLL, Oxford Economics & RCA