The real estate market in Dubai (or for that matter, the entire Gulf Cooperation Council countries, which includes the UAE – Abu Dhabi and Dubai – Saudi Arabia, Bahrain, Kuwait, Qatar and Oman), has not been a happy place to be invested in these past few years. Across the Gulf, prices are down around 30% from peak, regardless of sector or country. In this context, you might have thought that the causes of the decline would have been fully dissected and understood.

Yet, surprisingly, while there has been much discussion in the media (and a lot of finger pointing), the blame, especially in Dubai, is being apportioned to the wrong thing. In short over-building is an auxiliary, not the main, problem; the real issue is weakening demand.

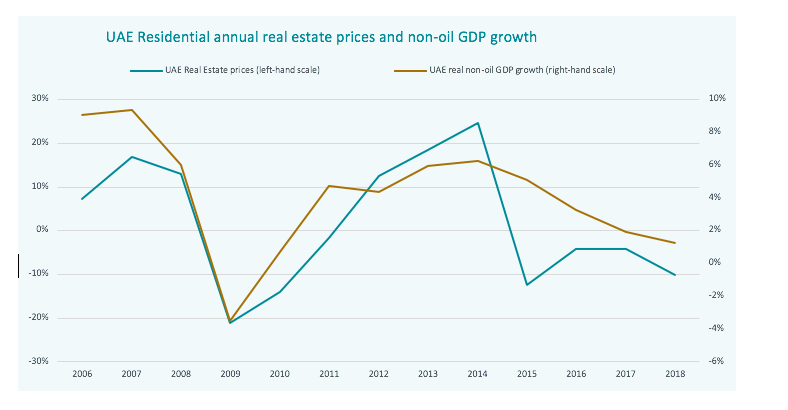

Take a look at the chart below, which shows annual non-oil GDP growth and annual changes in real estate prices. No doubt, you’ll also have noticed that the two lines are highly correlated (to be exact, there is an 80% correlation). There are a couple of important reason why. Firstly, non-oil GDP growth is effectively a proxy for household and business income growth. When the rate of income growth falls, households and businesses, quite rationally, make downward adjustments to their spending and investment decisions.

More importantly, however, in the Gulf, a slowdown in economic growth not only means

So, what is driving slower domestic demand? Answer: fiscal controls imposed by Governments in order to address the deficits that arose after oil prices fell off a cliff in the latter half of 2014.

Between 2011 and mid-2014, oil prices were very high and, as a result, GCC countries were able to rely on oil and gas revenues to fund, on average, 90% of government spending. At the same time, excepting Bahrain, all the countries ran healthy budget surpluses – Saudi Arabia and UAE, for instance, posted surpluses to the tune of 6% of GDP.

But each government’s reliance on oil and gas came at a price; for as the oil price fell, those large and healthy surpluses turned to deficits: Saudi Arabia’s deficit in 2015 was around 15% of GDP. In other words, Saudi experienced a negative 21% percentage point swing in their fiscal position. To put this in perspective, UK government finances saw a negative swing of 7.5 percentage points after the global financial crisis.

In response, Governments across the Gulf have imposed significant austerity, mostly in the form of subsidy elimination, lower investment spending, increased fees and charges and the introduction of 5% VAT. And, as a result, deficits have been significantly reduced: UAE’s general government deficit was effectively eliminated by 2018; Saudi’s deficit was reduced to 5.9% of GDP. This very real fiscal control, while entirely necessary, has taken its toll on the domestic economies of the Gulf; and, as a result, the real estate market.

While my next article will delve into more detail on what we can expect in the near future from the market; it should be clear that with oil prices unlikely to rise much about $60 for a barrel of Brent, fiscal pressures will persist in the region for the foreseeable future. Investors in Dubai’s real estate should not expect another boom any time soon.