How did WeWork get such a high valuation if its making such big losses?

After some debate in the office and lots of commentary from various talking heads about the subject, I sat down and read the company’s S-1 filing and kept reading until I’d figured it out because it was driving me nuts. And the fact is, yes they do make money, and yes they probably will make a lot more.

Here’s how.

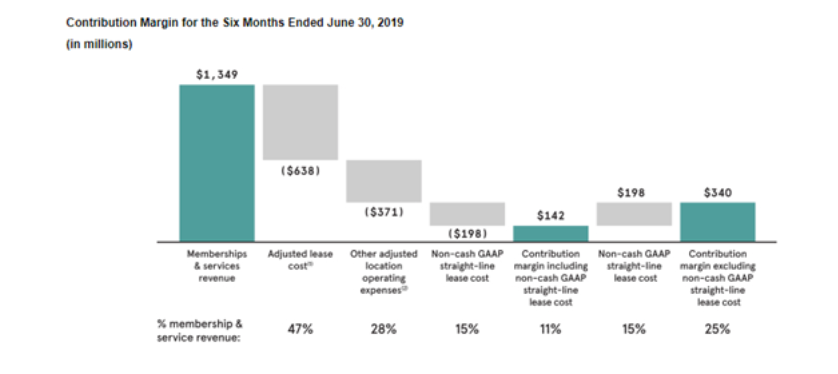

See that little green bar in the middle, that’s their real operating profit on each location or ‘Contribution Margin’ as they like to call it. Out of $1.349bn in revenues, they made $142m in cash operating profits. And if they consider rent free periods in the calculation then from an accounting perspective that profit goes up to $340m. Realistically a 10%-25% operating margin on each building, and the buildings are largely self-sustaining after stabilisation, and have 15 year leases. So that’s 15 years of 10%-25% operating margin.

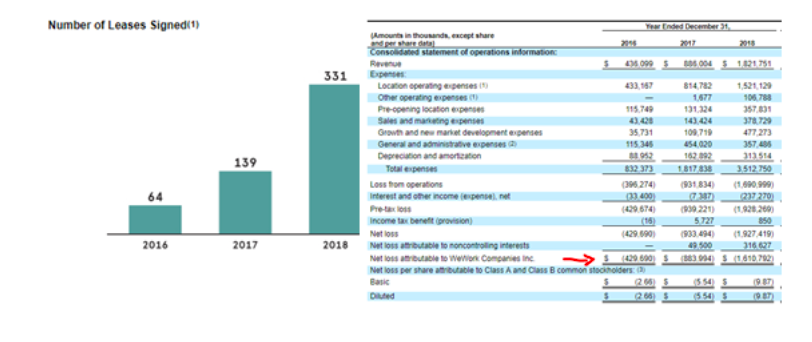

But the company is more than doubling its number of locations every year and spending huge amounts on marketing which result in the heavy losses which are so widely reported. Notice how the revenues and the losses are doubling almost in lockstep, as the number of leases signed also doubles. (you may have to squint, the copy is a bit low-res)

So in theory, if WeWork were to stop expanding, get rid of all the marketing expenses, centralised costs etc etc then it might actually be profitable today.

If we take that $140m and multiply it by a price/earnings ratio of 20 (pulled it out of a hat, slightly higher than the S&P 500 average) then you’d get a present day valuation of $2.8bn. But the company is doubling in size every year, if it keeps doing this every year for the next five years, then the valuation would actually be more like $90bn in five years time. Now doubling every year sustainably is probably unrealistic and it is probably going to be more like 100%, 100%, 90%, 70%, 60% which if you follow, ends up with a valuation of $58bn, which if you discount back to today’s present value using 5% discount rate, gets you a valuation of $46bn…which is not far off what is being quoted for the company.

The question really is how long can the company keep adding locations, because if it can actually double every year for five years then the valuation will be far higher than what is quoted today, and of course, if it can’t shake the marketing/expansion costs or expand so rapidly then the opposite may also be true. But either way, if the above is correct then I think some credit is due to Mr Neumann and Softbank and I hope this helps others make sense of what is going on. Comments welcome.