A five-year review of the real estate debt demand

Twenty-nineteen marks five years since Laxfield Capital, a commercial property lending company, released their first report on the demand for debt in the UK property market. Such a report, named the Laxfield UK CRE Debt Market Barometer, sought to explain the nascent asset class to institutional investors struggling to find information from which they could benchmark risk and identify opportunity in the sector. Since then, we have release nine reports based on information collected from £130bn of loan requests and across 2,995 deals. Understandably, tracking demand for debt has been a good way to comprehend market evolution, as well as drawing attention to risk signposts and hotspots.

The fifth anniversary since our first report provides an opportunity to reflect on changes over the last half decade – and note where progress has been slow in an era of fast technology.

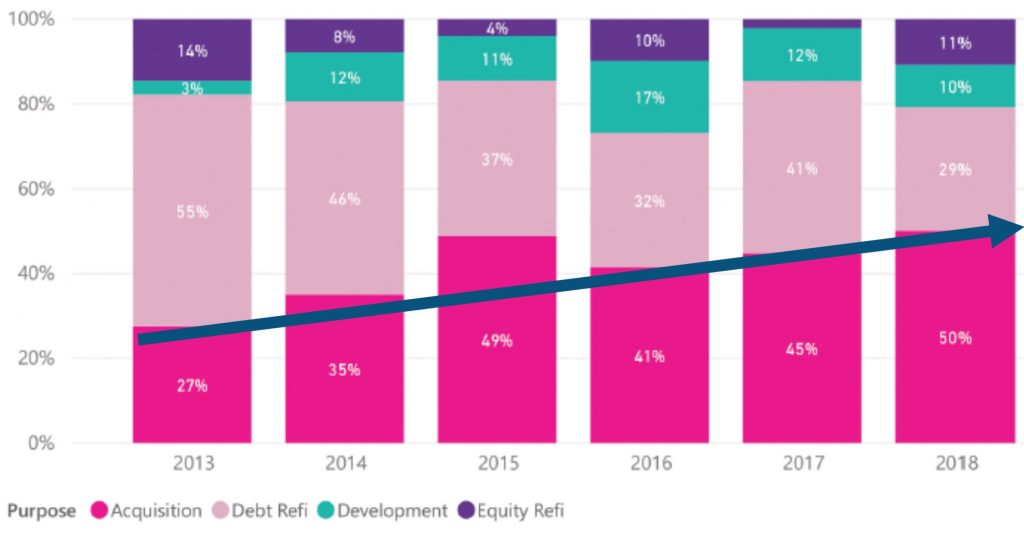

One very marked change since 2013 has been the shift in demand from refinancing to acquisition loans. In 2012, a large inventory of loans sought refinancing solutions to loans in breach of covenants. Borrowers also had little trust that lenders could meet an acquisition timetable, as bank processes were slowed by additional layers of credit control. While in 2019, with a variety of capital at work, there is more confidence in acquisition finance being delivered on time, non-bank lenders in particular have differentiated their offer by emphasising speed – for which some borrowers are prepared to pay a premium.

In one part of the market, however, there has been a full circle back to 2012 conditions, with many retail loans seeking refinancing against pressured covenants, and a much-reduced pool of debt liquidity available as the market struggles to find its new base.

Loan Requests (Volume) by purpose 2013-2018

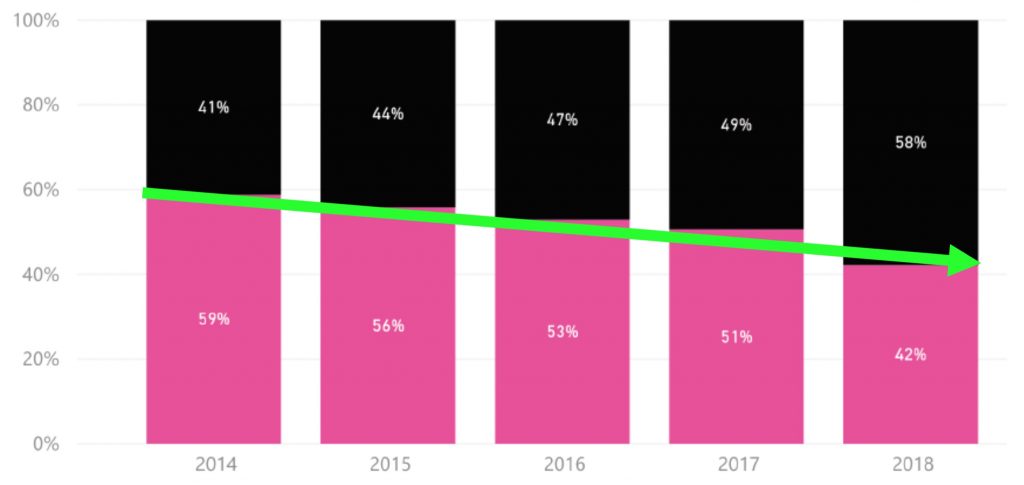

Moreover, the demand for finance has become much broader, spreading out from London to the regions, and from core sectors to a greater variety of assets. In this way, office demand is more widely spread through the largest ten cities that have become more actively traded with debt, whilst some buyers in London are utilizing the UK’s secured debt markets less.

Loan Requests (Volume) – London vs. Regions 2014-2018

For some time, lenders have been adapting to a world of shorter leases, and with this, the need to understand space as a service. As tenants demand less bland, more differentiated, property that adds to their appeal as an employer or a retailer, so the lender needs a greater understanding of the borrower’s ability to anticipate and respond. Good credit underwriting means going well beyond the cashflow and assessing both operational capabilities and business plan of the building owner. Careful thought needs to be given to how the underlying security will maintain tenant appeal and be re-financeable, rather than redundant, in five years.

Next, a huge rise in demand for finance against operational assets with a residential component has arisen in the past five years. Student housing, let residential and hotel financing have attracted strong investment, requiring lenders to take on complex underwriting of operational businesses. Whether or not the rented rooms which now form a substantial pool of security for lenders will be defensive in a downturn remains to be seen, but there is no doubt that it has become more mainstream over the period we have been monitoring the market.

In what feels like the blink of an eye, retail has become the most challenging sector on a lender’s pipeline. Not only are many lenders exposed to assets that the current market has little appetite to refinance, but with the acceleration of CVAs, it appears that cashflows derived from assets outside prime locations have little legal certainty. Lenders are not well equipped to enforce security and assume ownership of retail assets where highly specialised skills and investment are needed to defend a struggling shopping centre. A very sharp increase in expected pricing against retail assets is evident, as well as a higher leverage ask as borrowers seek to replace debt against a backdrop of falling values. It feels the sector has a long way to go before it finds a new equilibrium, and there is real danger of debt withdrawal compounding the problem.

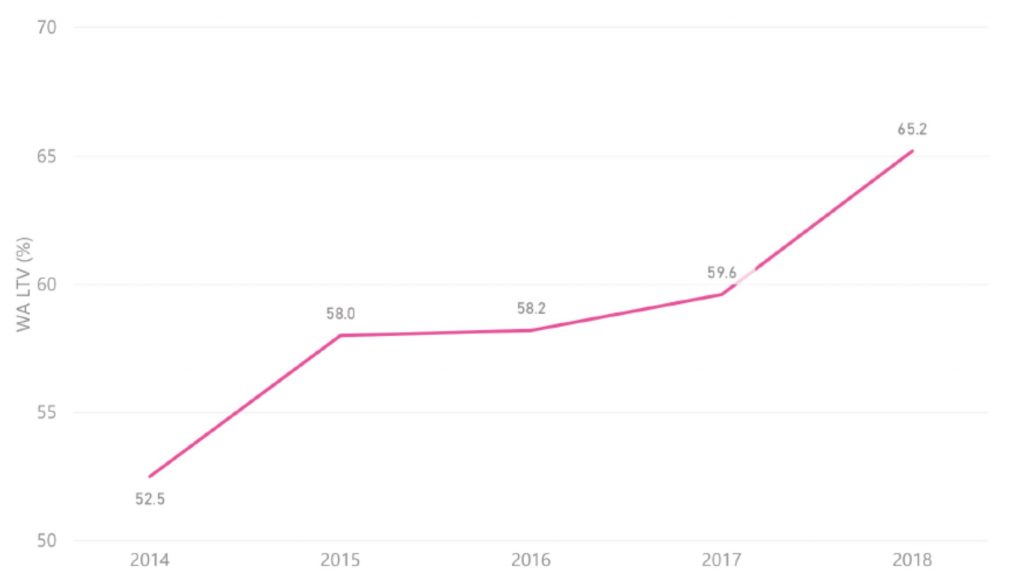

Weighted average LTV requirement – isolated by retail sector 2014-2018

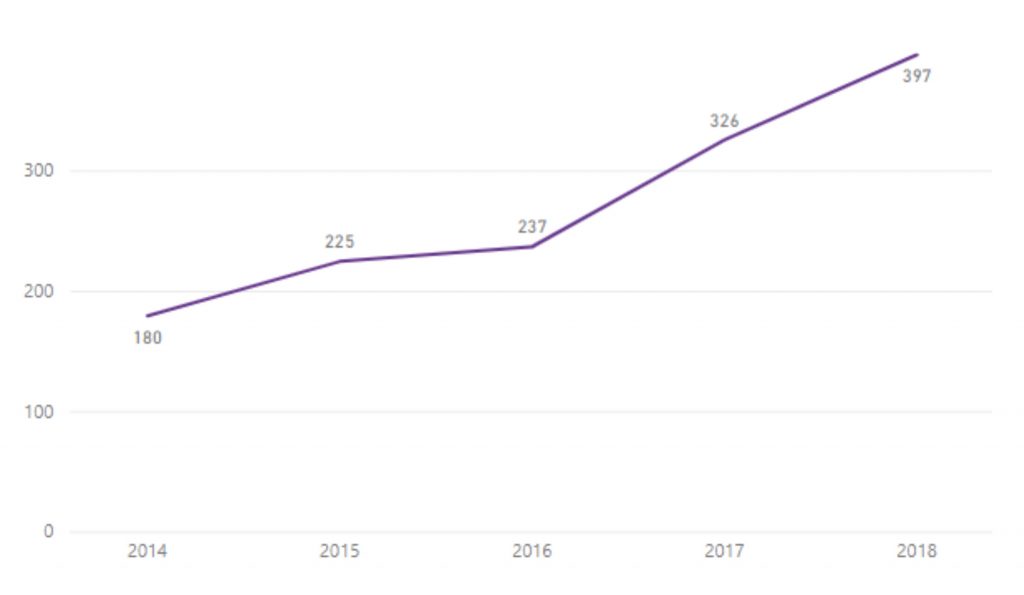

Weighted average margin – isolated by retail sector 2013-2018

Post the financial crisis, overall levels of debt are substantially reduced, with borrowers and lenders alike recalibrating the upper level of the senior loan market at to c.60% LTV. Above these levels, borrowers must generally pay substantially more for their financing, with a recognition that this is eroding the equity cushion.

Post the Global Financial Crisis, overall levels of debt substantially reduced, with borrowers and lenders alike recalibrating the upper level of the senior loan market to c.60% LTV. Above these levels, borrowers must generally pay substantially more for their financing, with a recognition that this is eroding the equity cushion.

Since the GFC, five-year LTV demand across the pipeline of loan requests has been 57%, indicating that borrowers have largely resisted higher leverage debt. The average LTV request surpassed the psychological barrier of 60% in the past 12 months, with more borrowers seeking finance in the 65-70% LTV bracket (retail being a notable component). This is something we will continue to monitor closely. There is good availability of finance to meet this demand, but the risk premium remains high; and whilst that differential remains, the warning bells are not yet deafening.

Finally, to Brexit and liquidity interruption. Few would say that the unresolved political backdrop is helping the UK property market at any level, and debt is certainly seeing its share of lenders on go-slow, as well as debt funds reporting international investor interest on hold. Some counter-cyclical debt investors see this as a good time to get additional return, or compete for core loans they would not normally be able to access, but the current impasse isn’t good for borrowers, with reports of less reliable credit decisions and margins on the up. Our assessment of the overall capacity of the market is that whilst half the lenders in the market are British, when the capital which supplies the entities is taken into account, as much as 70% of the capital funding UK property loans may be from overseas. An isolated economic downturn could be bad news for debt liquidity.

And how little some things have changed.

In an era of fast changing technology, it is remarkable that almost nothing has progressed in terms of loan underwriting – which involves intensive, repeated and ultimately expensive tasks. Asset level comps have improved and tenant financial analysis is somewhat simpler, but otherwise detailed skills and judgement are required to put in place a loan which protects interests of lender and borrower through a real estate cycle. When will AI find an underwriting solution for a variable product secured by non-uniform, underlying assets against a constantly evolving backdrop? We wait in hope.