And it was awesome. Random Walk is interested in s-mid caps that stand to benefit from an increase in the secular demand for energy, with a bias towards natural gas, given that renewables and nuclear both have near-term challenges.

I looked for companies with strong operating margins that had the opportunity to grow through some combination of top-line growth, improved margins (both via operating efficiency and pricing-power), and multiple-expansion.

Lo and behold, I found one.

And then I used ChatGPT o3 (plus a little AlphaSense) to help me understand and model the investment case. o3 didn’t write this, but I excerpted liberally to demonstrate the sorts of questions that me an my robot pal iterated on.¹

In the end, I got comfortable enough to open a small position (and o3 is truly a force-multiplier, to put it mildly). The upside is real, and the downside is manageable.

Mostly, this is an experiment, and I’m excited to see how it plays out, for better or for worse.

As per always, all feedback is welcome. There’s a non-zero chance of stupid mistakes, given how quickly this came together, and there’s an even higher chance of more subtle mistakes, because that’s the nature of things.

OBVIOUS DISCLAIMER: DO YOUR OWN HOMEWORK. THIS IS NOT INVESTMENT ADVICE, OR A RECOMMENDATION TO BUY, SELL, OR HOLD A SECURITY. NOTHING SHOULD BE RELIED UPON. EVERY WORD OF THIS IS PROBABLY A LIE. RANDOM WALK HAS CONFLICTS UP THE WAZOO AND ZERO SCRUPLES, TO BOOT.

Have you ever heard of outsourced gas compression? Yeah, me neither, but you’re gonna love it.

The company I settled on Archrock, Inc. $AROC ,

The very short version of AROC is “outsourced natural gas compression.” If that sounds super-sexy, it’s because it is.² Basically, if you need to move gas through pipes, you need to compress it. You can either buy and operate the equipment yourself, or you can lease and service it from a company like Archrock.

Now, Archrock is a very profitable company that’s looking to get even more profitable. The company just revised 2025 guidance upwards (which is already priced-in), but investors do not appear to be valuing any growth beyond that.

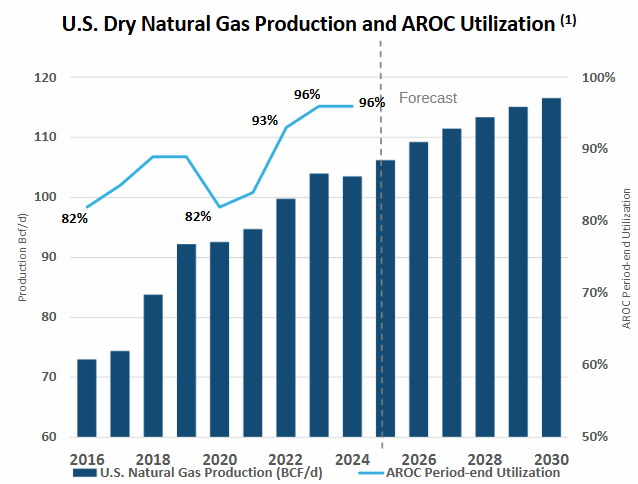

And yet here’s the thing: utilisation rates for existing inventory are historically high, implying there is not nearly enough compression to go around.

That matters because if you believe that natural gas supply will increase, then so too should demand for compression. And again, utilisation rates are already historically high, and the company’s 2025 backlog is already fully spoken for. To me, that sounds like compression demand meeting a compression shortage, not just for 2025, but for 2026 and 2027. The good news for Archroch, is that the company has more than a few growth levers at its disposal.

From the stock’s perspective, though, growth in 2026 and beyond is pure upside (and therein lies the opportunity).

There are, of course, some challenges, but not everything needs to go right for even a 20% irr. And that’s not bad.

Let’s dig in.

I. Archrock is already a very solid company

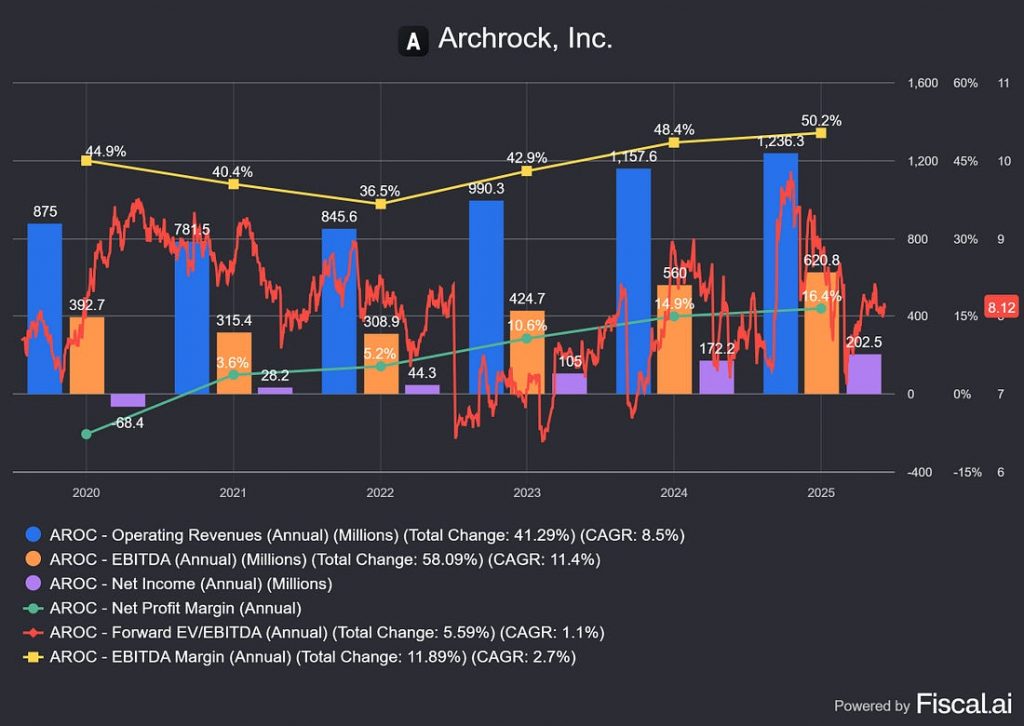

Archrock is already a very profitable business, priced at a slight discount to peers:

- $AROC is valued at ~8x EV/EBIDTA (compared with peer valuation ~10x);³

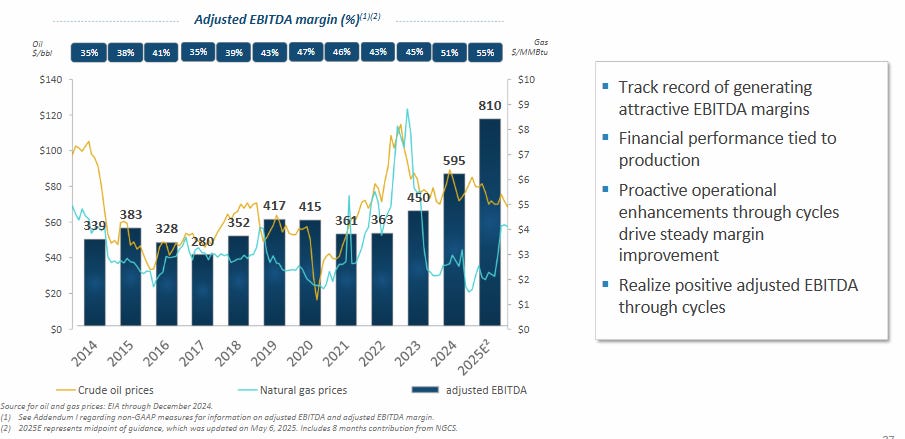

- ~50% EBIDTA margins, and 16.4% net margins;

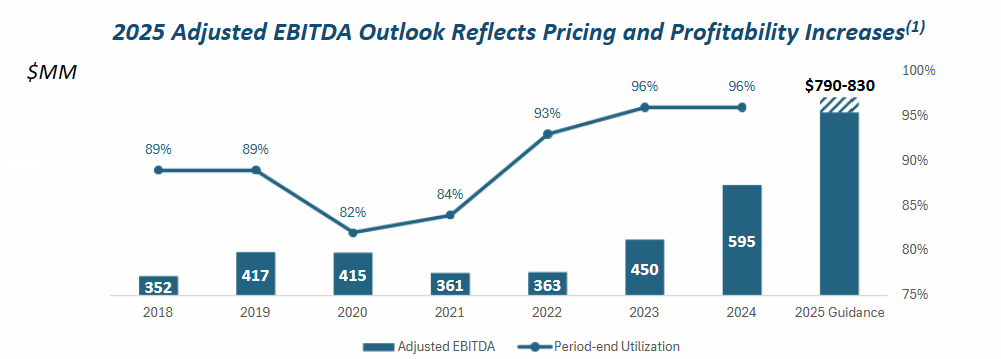

- $595M Adj. EBIDTA (51% margin) for 2024, with $790-$830 (~55% margin) guided for 2025.

A snip from the most recent guidance:

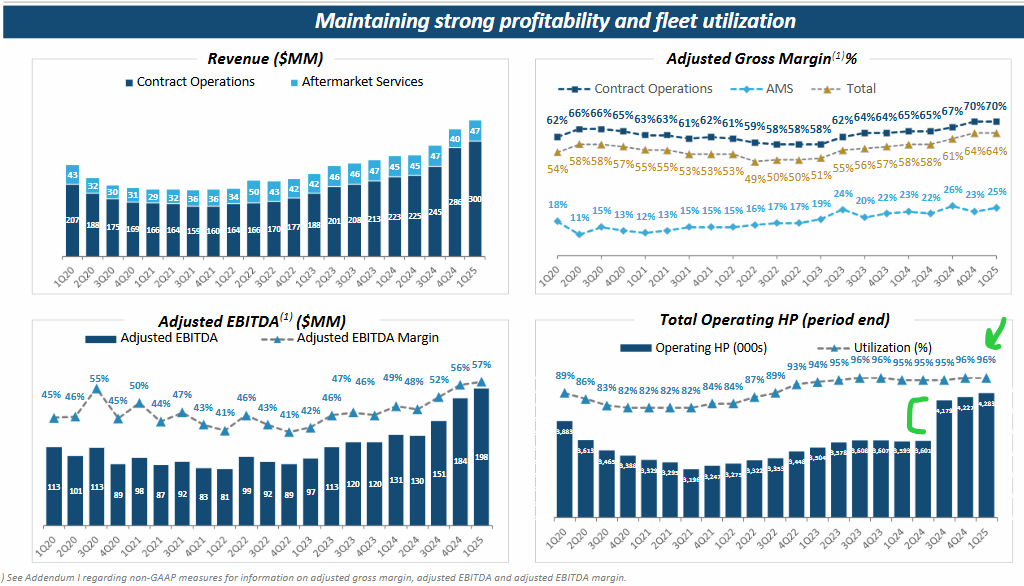

Those are pretty healthy operating margins, and the company generates plenty of free cashflow as a margin of safety (and a meaningful dividend/buyback).

The key drivers of late have been (a) the aforementioned historically high utilisation rates of ~96%; and (b) a recent acquisition of two smaller competitors to grow their inventory by ~0.9m hp (~+20%).

Basically, the company is leasing more compression more of the time, with pricing pressure to boot.

Good times.

II. The tailwinds

That’s right now. What about going forward?

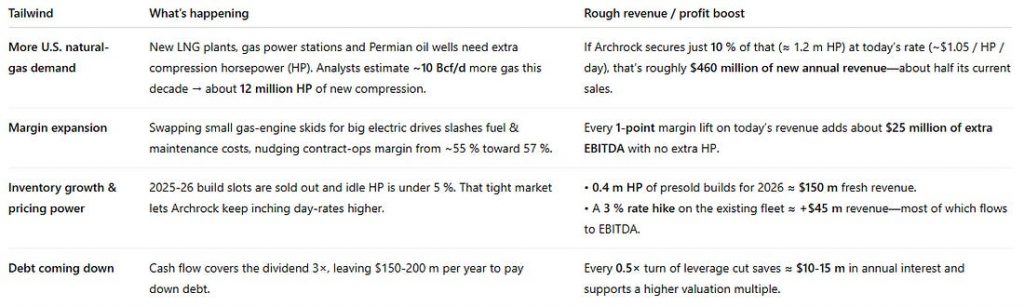

Going forward, Archrock benefits from:

- increasing demand for compression;

- rotation from smaller, gas-powered “skids” to bigger, electric-powered skids that cost less to build and maintain (i.e. mix-shift to higher margins);

- tight supply with robust demand: 2025 inventory adds are fully-spoken for, and 2026 contracting is already underway—high utilization rates and fully-booked forward demand come with pricing power, as well;

- steady debt reduction that improves free cashflow and leads to a re-rating to close the valuation gap relative to peers

As summarised by ChatGPT:

Now, one thing to observe is that it’s a nice diversified set of tailwinds that aren’t mutually exclusive, e.g., even if the company stops adding new contracted compression units, it can still benefit from mix-shift and/or pricing power.

Archrock stands to benefit even if new natural gas capacity stalls out because, as wells age, they tend to need more horsepower to maintain pressure, so there’s some physics on AROC’s side, as well.

The other thing to keep in mind is that these compression agreements are pretty sticky. Not only is contract term-length growing, but once a customer pays for the physical delivery of one of these compression units (which they do, even when they’re just leasing), it’s a sunk cost. So even if they later decide “hey we’d like to bring compression in-house for operational savings,” they’re going to have to eat the initial transport cost, plus the cost of hauling the old unit away, plus the cost of bringing in the new one. At that point, it’s hardly worth the trouble.

More broadly, it’s good to have a positive future, without needing everything to go your way.

III. Valuation and upside

In terms of valuation and upside, the company’s 2025 mid-point of guidance is already priced-in. Everything after that is pure gravy. To keep moving onwards and upwards, Arch has a few levers to pull, but in the best-case, it needs to:

- maintain those historically high utilization rates, combined with modest price increases (reflecting tight supply);

- add inventory at roughly the same rate as 2025 (i.e. ~5-7%); and

- continue the mix-shift towards higher margin electric compression.

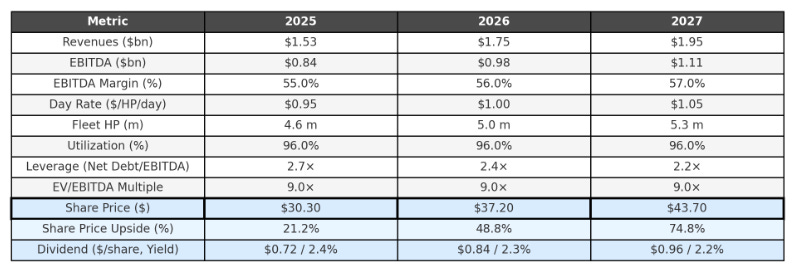

If it does those things, Archrock can grow earnings (and pay down its debt) at a healthy clip, leading to higher EV and a higher multiple. The bull case for $ARCH has 20+% upside in 2025, with 75% upside through 2027:

$AROC Bull Case

- improved margin profile to 57% (mostly via electrification);

- moderate increases to pricing;

- fleet-expansion of ~0.7m hp (consistent with current levels of capex);

- consistent 96% utilization; and

- a gradual improvement of leverage, leading to a very moderate re-rating of ~9x

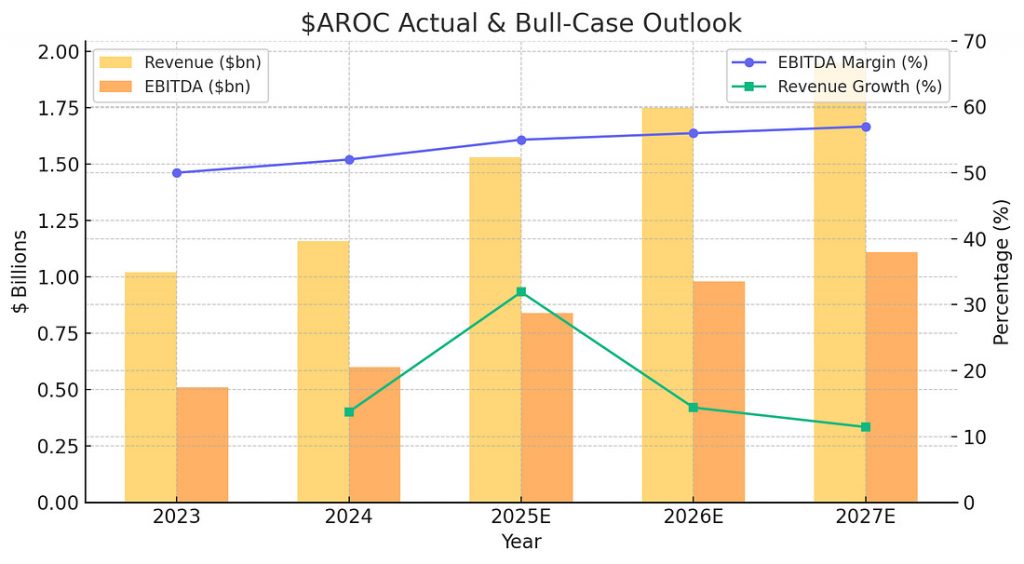

From a revenue and EBIDTA standpoint, the bullish scenario looks like this:

Top-line growth doesn’t have to be that crazy (just north of 10%) to make this happen. In general, ~75% upside isn’t bad for an already very profitable company, riding a massive secular tailwind.In fact, there are reasons to be even more optimistic.

- The company could add more inventory (and pricing power) through acquisitions, similar to the ones it completed last year;

- Price increases could increase more quickly than ~5%/year (especially considering 2024 saw 15% yoy price increases);

- Outsourcing could increase its share from 30%⁴

- Continued growth in the after-market service business that’s currently ~15% of revenue.

That isn’t to say the bull case is conservative, but it’s not as bullish as it could be. Again, EIA estimates that natural gas production will increase 4-5 Bcf/d by 2027.

That additional supply will require an additional ~12m HP of compression—that incremental demand is 2.6x Archrock’s entire fleet (~4.6m hp).

To repeat, the amount of additional compression demand expected to come online is 2.6x the entirety of Archrock’s already ~96% utilised fleet.

the amount of additional compression demand expected to come online is 2.6x the entirety of Archrock’s already ~96% utilised fleet.

If ~30% of that 12m hp is outsourced, that leaves 3.6m hp of net-new compression demand.

The bull case above assumes that Archrock adds just 0.7m hp, or equivalent to 20% of that net-new demand, which is not a stretch for the biggest player in the space.

Looks pretty good, right?

IV. ‘Every shortage becomes a glut’ and what else could go wrong

In terms of what might go wrong, well, every growth lever has some downside potential.⁵

- gas production may not increase;

- new inventory may get delayed;

- customers may not accept price increases;

- utilization rates may decline;

- shift to higher-margin electrified units may stall on the lack of grid-connections;

- debt may not decrease, and/or borrowing costs might increase, which would negate multiple expansion (and might lead to multiple contraction).

So, there’s plenty of things that can go wrong.

To break down the risks, it’s helpful to group them into two buckets:

- execution risks (includes mix-shift to electric units, and inventory adds); and

- supply-demand, whish is really everything else.

Execution risk: Electrification stalls

The execution risks are mostly out of Archrock’s control, but neither keeps me up at night.

On electrification, the challenge is that big electrical compression units need to be connected to the grid, and as you might have heard, grid-connections are no sure thing. The beauty of these units is that they cost less to make, less to maintain, and have longer operating lives—hence the margin improvement—but if they can’t get them hooked up to the grid, then it doesn’t happen.

The good news is that the company is already ~20% of the way there, and is only guiding “mid-20s%” by 2027, so the company’s goals aren’t that ambitious on that front. If, however, the plan stalled outright tomorrow, the impact to margins would lead to a ~$35M haircut on EBITDA.⁶

Not the best thing, but certainly not the worst thing, either.

Execution risk: delivery on the backlog

Here again, the situation is pretty straightforward.

- The company has said its ~$350m is “fully contracted” for 2025, with 2026 contracting already underway.

- New compression hp is the primary source of additional revenue, again, with ~350-400k anticipated for 2025 (and equivalent amounts in ‘25 and ‘26, according to the bull case, although management has not guided that far ahead).

- Every 100k = ~$35M in revenue, and ~$25M in EBITDA.

So, that’s ~$100M in EBITDA per year riding on those deliveries.

Lead times for new equipment are ~42 weeks, with basically four main suppliers (Caterpiller, INNIO, Waukesha, and Ariel). Add assembly and delivery, and “door to field” lead time is ~12-18 months.

If something goes wrong, well, it will be much harder for Archrock to hit those growth goals, at least without substantial acquisitions. Things have gone wrong in the past, so the risk is real, and ChatGPT estimates a $40-60m hit to EBITDA, for every 6 months of delay (or $30-40m assuming some remedial measures).⁷

But, just because things have gone wrong before (especially during the sudden post-pandemic ramp up), doesn’t mean things have to go wrong now. Plus, less supply means even more pricing power on the supply already in-place. Finally, it’s a question of timing—EBITDA might be delayed, but it will come.

So, supply-chain issues are risks I can live with.

Supply-demand risk is the big one

The bigger risk, of course, is that the supply-demand dynamics that currently comprise the “compression shortage” shift.

That shortage is the crux of the thesis, so this is where the biggest leap of conviction lives.

If conditions move from pro-supply to pro-demand, then any or all of the following could happen:

- utilization rates fall;

- new bookings slide (and payback on capex slows);

- pricing power goes backward.

That would mean less growth, slacker margins, and more leverage—basically all the growth levers (outside of mix-shift) take a big hit. ChatGPT did a sensitivity analysis, but it’s pretty academic: less utilization at lower prices is no bueno.

Again, it’s not enterprise risk—the company is still plenty profitable, but the growth story goes away.

Now, why would dynamics shift from supply to demand?

Nat-gas demand falls and/or prices collapse

Well, one reason is that natural gas demand does not, in fact, increase. That’s definitely possible, but for all the reasons that Random Walk has written about previously, let’s assume that’s not likely.⁸

Another possibility is that nat gas demand increases, but so does supply, causing prices to fall. If prices fall too much, energy companies may decide that additional supply isn’t worth it, or operating margins don’t justify the cost of compression, and so they take wells offline.

That too might happen, but Archrock is more insulated from energy prices than one might think:

Other than the big drop in prices back in 2016, neither utilisation or EBITDA bears much correlation to the ebbs and flows of energy prices.

But again, the thesis depends on a secular increase in demand for energy that will be met, in large part, from natural gas. Prices may fall, but the gas must keep flowing, and that’s bullish for Archrock.

Could that be wrong? It might be. Another thing to watch are foreign suppliers of natural gas, as well. But that’s just a risk we’re going to have to take.

The good news is that even if US throughput remains even, there are still plenty of ways for $AROC to make money (just not as much as before). ⁹

The competition turns a shortage into a glut

The other reason why supply-demand dynamics may shift in favour of demand is that Archrock is not the only game in town.

Other out-sourced compression suppliers are also competing to meet demand, and they too are bringing more supply on-line. If everyone adds new hp all at once, the shortage rapidly becomes a glut, and all the pricing power, utilization rates, and attendant revenue growth and margin expansion go poof.

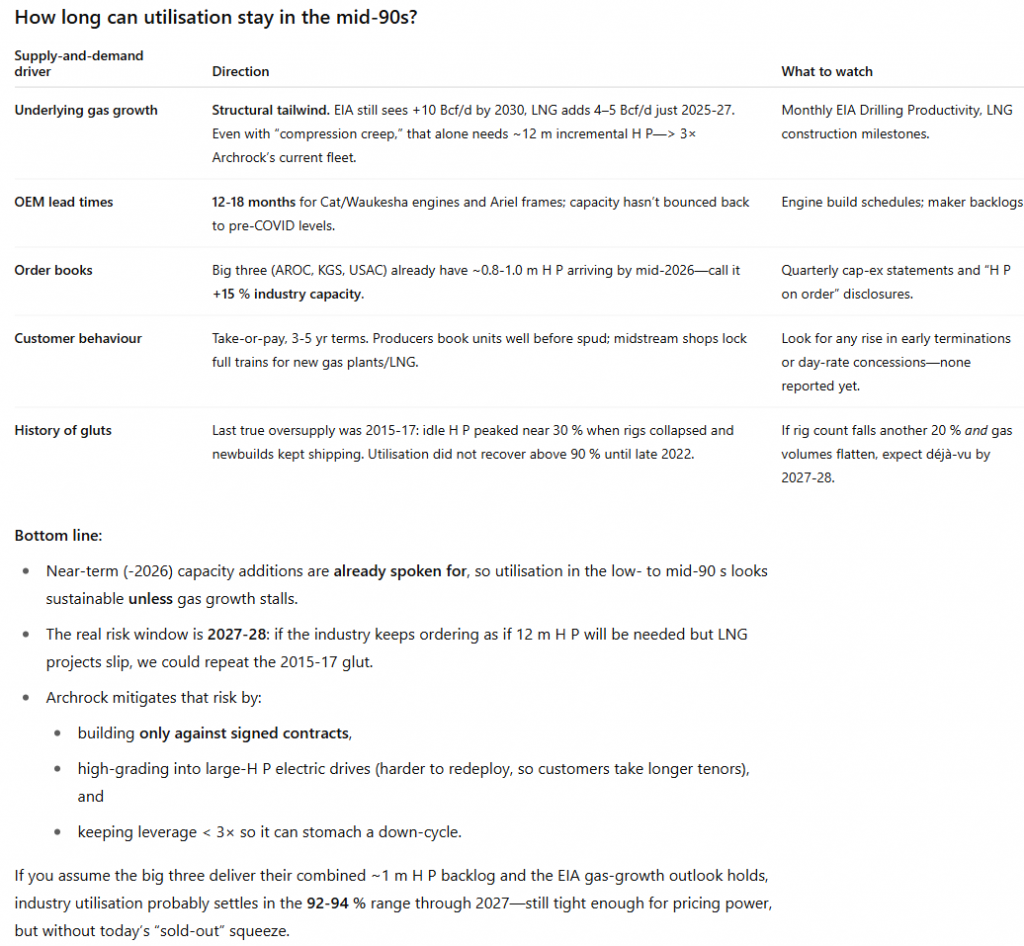

In other words, is it really realistic for the industry to maintain historically high utilisation rates for quite so long?

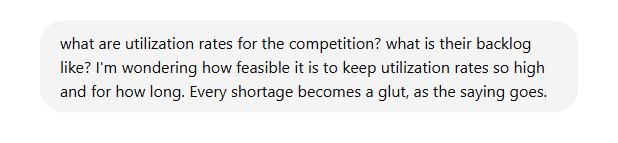

Well, yes, it is, and here too, ChatGPT was extremely helpful.

I asked:

It answered:

Utilisation is high everywhere—supply is truly tight.

Good to know.

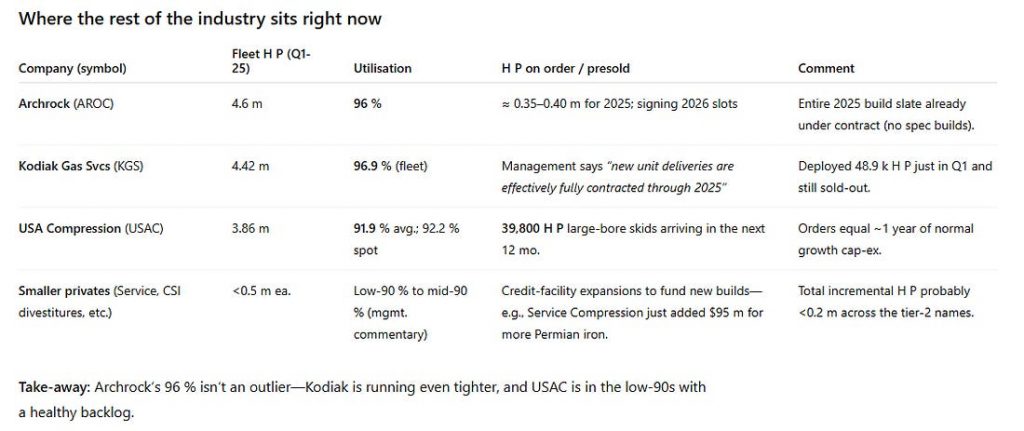

And how long can one reasonably expect that to last?

Industry-wide utilisation rates in the 92-94% range through 2027, but 2027 might have some hair on it.

The risk of oversupply is real, but it’s a few years out, and AROC has taken some steps to manage its downside (which it does, in fact, call out, as per the robot).

So is the 96% utilisation rate a sure-thing?

No, it’s not, but it’s not crazy either, given that the entire industry is running historically high utilization rates, and the supply backlog is what it is—it takes 12-18 months “door to field” for new supply.

Plus, the real risk of oversupply is ~1+ year out, so it shouldn’t effect 2026 at all (and again, ChatGPT offered some useful warning signs to track).

Finally, a drop in utilization rates isn’t the end of the world.

Holding all else equal, every percentage point drop in utilization translates to ~$10M in EBITDA. Depending on whether the multiple holds at 8x or expands to 9x, that shaves ~2-4% off the share price, which isn’t nothing, but I’m not losing sleep over it, either.

Verdict: potential glut is a risk I can live with.

V. Conclusion: Going Long $AROC

This started out as an experiment, but I’m sufficiently convinced to give $AROC a whirl.

The stock is already a bit cheaper since when I started writing this, so even more upside to be had!

- Do I know much about refining? No, I do not.

- Is there more homework that I’d like to do? Yes, there is.

- Have I massively oversimplified the model? Yes, I have.¹⁰

But I’m bullish enough on the natural gas/energy tailwind, and the basic operating profile of the company that the downside seems pretty modest, and the upside seems genuinely plausible.

And using o3 to navigate the “diligence” (and summarise the key points) was, at least, an 100x time-saver, if not more (for better or for worse).

My biggest concern, naturally, is that both demand slackens and supply increases concurrently, i.e. the shortage cycle may already have peaked. But, it’s still a good company, even if that’s true, and if the company is still on track to hit the high end of its guidance when it reports in month, then there’s likely to be a 10-20% bump right there.

Either way, we’ll know soon enough.

OBVIOUSLY DO YOUR OWN HOMEWORK. THIS IS NOT INVESTMENT ADVICE AND/OR A RECOMMENDATION TO BUY, SELL, OR HOLD A SECURITY. DO NOT RELY ON ANYTHING THAT YOU READ HERE. IT’S ALL A LIE, PROBABLY.

This article was originally published on Random Walk.