Demand projections for the next five years point to a huge drop in income streams as occupancy and rents fall.

This is not the first time the property press has predicted the end of the office as we know it, with a switch to remote and flexible working; it was also a major theme following the dot-com crash. But could this latest shock to the sector finally make it happen? Assuming that covid concerns are over in two to three years, we have attempted to model what the future of office demand could look like by the end of this decade and what it might mean for occupancy and rents. The context for our analysis is of course the recent sharp rise in remote working, which appears to have broken down many of the barriers to wider take-up of flexible working practices. Nevertheless, the starting point for such analysis is to consider the outlook for employment.

Employment in sectors that tend to be classed as office-based will take a hit in the short term, but their downturn is set to be smaller than that for the whole economy. What’s more, in the years post-covid, we expect jobs growth in these sectors to show greater acceleration than total employment. Compared with 2019, we expect office-based jobs to increase by more than 10% in the US, 7% in the UK and 4% in the eurozone by 2030. But the problem is that much of this growth will not take place in the office.

Even by 2030, after the strong supply reaction

predicted, income streams would

still be below their 2019 levels

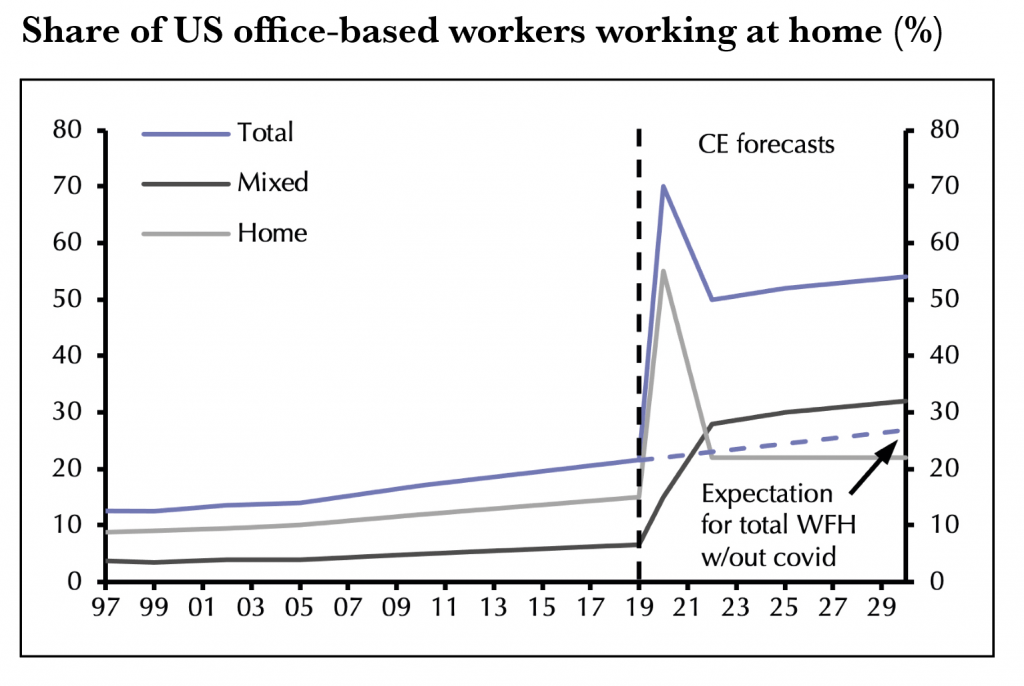

Prior to covid, the share of remote working in office-based sectors was close to 20%. That figure has spiked temporarily to around 70% this year. Based on surveys conducted in recent months, along with a pinch of salt, we think that by 2025 up to 50% of office workers will work remotely at least once a week.

The implied fall in occupied stock over the next five years from such a change would be dramatic, even assuming a steady level of average space per worker, with firms scrambling to adjust their physical footprints as soon as lease events allow. In the US, this would imply a reduction in occupied stock of around 7% to 8% by 2025. That would drive vacancy sharply higher by 2025. Indeed, even if there were an exceptionally strong supply response, with large swathes of obsolete office inventory being converted or demolished in the second half of the decade, vacancy would still be above its 2019 level at the end of the decade.

Rising vacancy would hit rents. In the US, we could see asking rents drop by 10% by the end of 2025, with net effective rents seeing an equivalent fall of around 15%, before staging a decent recovery thereafter. Despite the improvement later in the period, asking rents would only just return to their 2019 levels by the end of the decade.

The combined effect of higher vacancy and lower rents would be to thump portfolio income streams, which could be down by more than 20% in 2025 compared with 2019. Even by 2030, after the strong supply reaction predicted, income streams would still be below their 2019 levels, with vacancy still elevated and effective rents still lower. Not all of this would be recouped by 2030, leaving office investors looking at a rough decade.

In summary, the enforced remote-working experiment of recent months is likely to cause a dramatic demand shift in the office sector. Even with a heroic supply response, vacancy rates are set to rise markedly in the next five years and still be elevated by 2030. A combination of reduced occupancy and lower rental values will mean that income returns in an average office portfolio are likely to be down by more than 20% by 2025, only some of which will have been regained by 2030.

This paper is part of Capital Economics’ Future of Property series looking at the impact of Covid-19 on real estate over the next decade or more.