This article was originally published in November 2020.

Australian is sometimes referred to as the lucky country. While a generalisation, Australian commercial real estate (CRE) has enjoyed strong investment demand from both local and offshore investors over the past decade. Over the ten years to December 2019, yields had fallen to record lows and transaction volumes achieved record highs. The covid-19 pandemic ended the upswing, bringing the first recession in 29 years and more than halving transaction volumes. However, many of the factors that supported investment in 2019 should return as the economic recovery and pandemic containment process continue to gather pace.

In 2019, Australian CRE transaction volume achieved a record total of AU$45.5bn. Demand was supported by solid and stable economic growth, attractive yields, low interest rates, and an open and transparent economy. Economic growth is expected to recover strongly in 2021 and relatively high CRE yields suggest that investment demand can recover once the pandemic is contained and borders reopen.

Australian real GDP growth fell by 7.0% in the June quarter. While this was the worst quarter on record for Australia, it was a relatively robust performance compared with many other developed nations. The OECD reported Q2 declines of about 10.5% for both the G7 and OECD national averages. Economic growth is expected to be positive again from Q3 in 2020, with the government forecasting, at the 2020/21 Federal Budget in October 2020, real economic growth of 4.25% over 2021. The above average growth is supported by total pandemic-related government stimulus of over half a trillion Australian dollars or 25.6% of GDP.

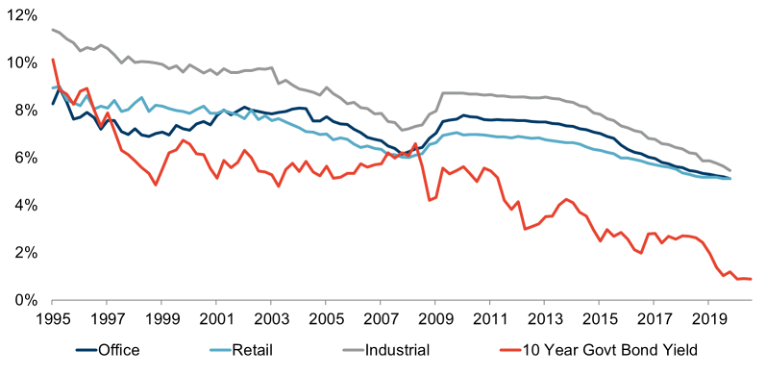

Over the past ten years, yields for many Australian CRE sectors have fallen to record lows. The declines were driven by falling interest rates and strong investment demand. MSCI reported that the average Australian office capitalisation rate fell from 7.8% in March 2010 to 5.1% by December 2019. Over the same period, the average retail and industrial capitalisation rates declined from 7.0% to 5.3% and from 8.5% to 5.4%, respectively. For investors seeking yield, with the ten-year Australian government bond yield averaging around 0.90% for much of 2020, property/bond yield spreads are well above average. However, cyclical and structural changes have increased uncertainty and property risk premiums.

Cyclical declines associated with the recession and falling employment have resulted in rising vacancy and falling rents in many office and retail markets. The pandemic has also accelerated the adoption of agile working. While workplaces are yet to return to normal, many employees have expressed a desire to continue working remotely one or two days a week post-pandemic.

Our research shows an emerging office ecosystem, encapsulating the office, home and third spaces. It also highlighted that physical offices remain a significant driver of organisational culture. As a result, we expect offices will continue to play a central role and leasing fundamentals will improve as more workers return to the office, albeit tempered by an uplift in flexible working.

The retail sector has also been affected by structural change with an acceleration in e-commerce during the pandemic. The National Australia Bank reports that online sales accounted for 9.3% of total Australian retail turnover as at December 2019; however, by August 2020 that had increased to 11.5%. While physical shops should continue to dominate the retail environment, increasing online trade is likely to restrain future tenant demand.

Conversely, the headwinds impacting the retail sector have proved to be tailwinds for industrial property. The rise in online trade, as well as a desire to modernise supply chains, has driven strong demand for industrial property from both tenants and investors. As a result, for only the second time in the history of our series, industrial recorded the highest level of transaction volume of the CRE sectors in Q3 2020.

Australian CRE transaction volumes are likely to remain below average until an effective and widely available vaccine is found. However, a recovery in investment demand is expected from late 2020 and early 2021, supported by the relative strength of the Australian economy, attractive yields and the low interest rate environment. These factors suggest that while ‘lucky’ might be something of a misnomer, quality Australian CRE should remain an attractive investment option for both local and offshore investors.

Australian commercial real estate capitalisation rates and the government 10-year bond yield