A quiet shift is gaining momentum in Japan which has the potential to reshape the country’s commercial real estate landscape.

After years of slow progress, corporate governance reforms are starting to shift how Japanese companies manage their balance sheets, which could bring a large and often overlooked pool of corporate owned real estate assets to market.

The catalyst has been a push by Japan’s Financial Services Agency to improve capital efficiency and transparency. Listed companies are now under increasing pressure to explain how they use their assets, especially those that deliver weak returns or trade below book value. One of the most immediate outcomes has been a broader reassessment of corporate real estate portfolios. Not only are companies being encouraged to act, but the financial incentives are now stronger than ever.

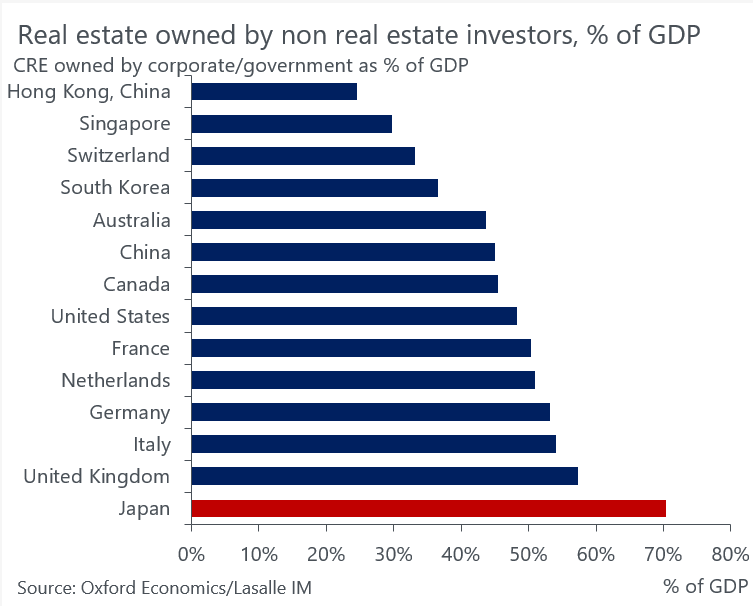

Japanese corporates hold more commercial property as a share of the economy than any other major market. Many of these assets have remained on balance sheets for decades. They include office buildings, logistics centres, industrial land, and legacy assets such as employee housing or leased hotels. In many cases these assets are not essential to daily operations and have not been evaluated based on financial performance.

The accounting treatment adds another layer of distortion. Under Japanese standards, real estate is recorded at historical cost, less accumulated depreciation. This means that book values continue to fall even as actual market prices rise. Land appreciation is not captured, and mark-to-market valuations are ignored. As a result, many companies are sitting on assets that are worth far more valuable than their financial statements would suggest.

For investors, this gap between book value and market value presents a rare opportunity. As companies begin to divest these non-essential holdings, a range of acquisition paths are opening up. These include direct asset sales, sale and leasebacks, and brownfield redevelopment.

The financial logic for divestment is strong. The return on equity (ROE) for many listed companies in Japan far exceeds that of their real estate holdings. Selling non core property allows capital to be redirected toward higher value uses such as business reinvestment, debt reduction, or share buybacks. For companies trading below book value, unlocking real estate can also help improve financial ratios and attract investor interest.

This trend is not limited to large cap firms, as smaller companies are often more exposed. They tend to have weaker governance structures and lower price to book ratios. They also may be less equipped to manage complex property portfolios and more responsive to external pressure. Investors too are taking notice. Private equity funds, activist shareholders, and institutional buyers are all exploring ways to access these opportunities either through direct acquisition, hostile takeovers or strategic influence via gaining board representation.

Corporates holding real estate assets are also broad in nature. Rail and utility companies are among the most prominent landholders in Japan, with large commercial footprints around transit nodes. Manufacturing firms as well frequently hold older production sites on valuable sites that would suitable for redevelopment and repurposing. Even professional service firms and banks continue to own large real estate portfolios, spanning corporate head offices, and sometimes employee dormitories. These worker dormitories were once a standard across corporate Japan, but have since declining in importance and are a potential target for those seeking multifamily conversion strategies.

There is also a large pipeline of assets held by companies that are completely unrelated to business operations. Hotel and multifamily assets are often held by companies include beverage producers, steel companies, retailers, and telecommunications providers. Beyond the domestic market, many Japanese corporates also own real estate overseas. These assets were often acquired during earlier phases of expansion and are now seen as non-essential. With the yen remaining weak and pressure growing to improve balance sheet efficiency, international properties may be among the first to be divested. For global investors this opens a second channel to access high quality assets at attractive valuations.

A shift in corporate mindset is also taking place. Japanese companies are increasingly recognising that leasing can provide greater flexibility and lower risk. Owning real estate comes with capital expenditure requirements and operational burdens that are not always justified. Sale and leaseback structures are gaining traction as a way for firms to retain operational control while unlocking capital. Japan’s leasing environment offers strong tenant protections and long-term rental stability, making these structures appealing for both parties.

Corporate real estate divestment in Japan is emerging as one of the most compelling investment themes in the region. With regulatory pressure building, capital efficiency under scrutiny, and sellers increasingly willing to act, a substantial volume of assets is coming to market. For commercial real estate investors, this is a clear and actionable opportunity to access scale, quality, and value in a shifting corporate landscape.