SUMMARY

‘There is always an easy solution to every problem – neat, plausible, and wrong.’ HL Menken

Act one: Amend Compulsory Purchase Order law to allow authorities to buy land at existing use value on sites zoned for homes to generate Land Bounty. Use 80% of Bounty to fund Half Market Rent (HMR) homes. Councils spend 20% on local improvements. Bounty realised by JV with private sector or Housing Assocs. Equity in HMR slow-released to occupant.

Act two: Set aspirational 5-year target of 300,000 new homes a year. Aim for consensus. Accept aim leaves 70,000 shortfall. Accept downturn will hit aim. Burgeoning Built to Rent (BTR) sector included in Bounty initiative to boost numbers. Embed Bounty powers into urban development and New Town corporations to galvanise building programme and cut public spending.

Orchestration: Decry factoids, such as: ‘more new homes will lower prices’; ’fixing planning will fix the crisis’; ‘prefabrication, hurrah!’ Re-score mood music from regretful to rousing. Prime Minister to echo the Churchillian message, ‘Build the houses for the people.’ Bounty lets more people ‘step up’ the equity staircase and buy. Bounty bonus – it supercharges New Towns programme.

Added political options: Go Right: Offer the landowner a fixed percentage of the uplift, determined at time of sale by independent valuer and subject of appeal. Compress time scale to allow occupants 100% equity in 2 to 3 years. Go Left: No HMR Homes. All money goes to pay for homes rented in perpetuity. Go down: Let individual councils decide Left/Right options.

ACT ONE: Lead actor, Planning Minister

‘Democracy is the art and science of running the circus from the monkey cage’ H. L. Mencken

Allow the state to benefit from the uplift in land values conferred by granting planning permission. Not a new idea. The concept of ‘Land Value Capture’ has been around since 1909. A June 2018 paper by planning QC, Richard Harwood, gives the full inglorious history, up to the present-day Alice in Wonderland rules, which attempt to define and divide unrealised gains between seller, buyer and state.

A Commons Select Committee on Land Value Capture reported on 13th September 2018 concluding ‘the present right of landowners to receive ‘hope value’ – a value reflective of speculative future planning permissions – serves to distort land prices, encourage land speculation, and reduce revenues for affordable housing.’ The Committee called for a ‘significant portion’ of any uplift ‘to be available to the state.’

What are the chances for a Land Bounty that simply pays the owner the current value of their land, rather than trying to figure and apportion mythical profits? Labour’s housing spokesman, John Healey is pushing for a variant of the plan and Conservative MP, Nick Boles, has written in favour. But it will need a politician of great courage to risk saying ‘why not just pay the current use value?’ But look at the rewards:

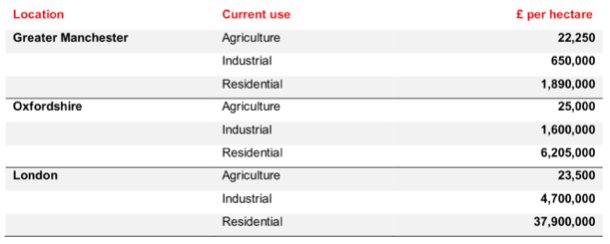

Housing land differentials.

Government Land Value estimates for policy appraisal.

Prevent abuse, promote consensus

There must be rules to prevent the spoils wrested from an existing landowner being speedily divided among those who profit from selling homes. First, to ensure the idea meets the ‘politically possible’ test – being acceptable to both main parties. Even the threat of repeal by either will kill the idea in the womb. Second, to mute uproar from landowners. Harder to argue against spreading wealth via home ownership.

Land Bounty can turn renters into owners, slowly

Therefore 80% of the Bounty should go towards providing Half Market Rent (HMR) homes. The remaining 20% to be spent on local amenities. Equity in units sold to occupants under the government Affordable Home Ownership scheme. Equity released for sale over 10 to 15 years to prevent profiteering. Result? ‘Slow release’ of Land Bounty to allow stable renters become stable owners.

Who gets to build HMR homes? Any willing supplier. If the private sector wishes to joint venture with a planning authority which has bought land at existing use value, then, fine. The Bounty can be used as equity. The number of HMR homes built then form part of the negotiations and subsequent planning obligations. Same goes for deals done with Housing Associations.

Newcomers to provide more rental stock

Newcomers to the market offer a way to provide additional HMR homes, albeit rented in perpetuity. Legal & General and M&G and U.S. supplier, Greystar are all investing heavily in Built to Rent (BTR). The British Property Federation estimates (Oct ’18) the pipeline of BTR Homes being developed by financial institutions had risen by over 30% in one year to 132,000, with completions up 45% to 25,600.

Build to Rent projects are exempt from providing affordable homes. But the National Planning Policy Framework, published in July, makes the direction of policy clear, quotas are coming. A quote: ‘For Build to Rent schemes, affordable housing for rent is expected to be the normal form of affordable housing provision. To be known as Affordable Private Rent (APR).’

Build to Rent can help toward target of 300,000

Allowing BTR suppliers to participate in Land Bounty would boost the nascent sector and provide additional homes. Good, because there is a much bigger target, mentioned by then housing minister, Dominic Raab in April. ‘The 45% increase in build-to-rent homes is good news, but we’re restless to do more. Our revised NPPF is a crucial next step in helping to deliver 300,000 homes a year by the mid 2020s.’

ACT TWO. Lead actor, Housing Minister.

‘Politics is the ability to foretell what is going to happen…. And to have the ability afterwards to explain why it didn’t happen.’ Winston Churchill

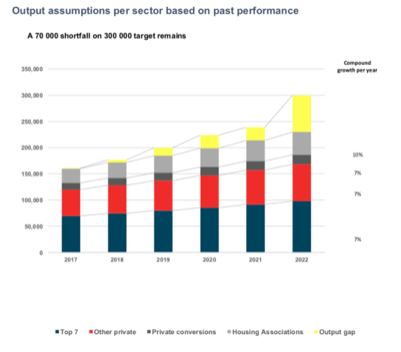

Reaching 300,000 is stretching. Later you will see performance figures I have compiled for the top seven house builders (Tables 1, 2 & 3). The extrapolations to 2022 below are based on the compound rate of growth of completions achieved between 2012 to 2017 of the top seven, stacked over similar assumptions for rest of the market. The result is a 70,000 shortfall on the totemic target. A gap that needs political minding.

Don’t hit those accused of breaking market

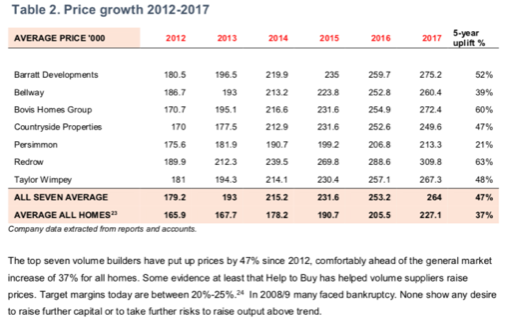

In March, the Prime Minister said, ‘Our broken housing market is one of the greatest barriers to progress in Britain today.’ Indeed. But why admonish those risking private capital? Theresa May demanding ‘builders and developers step up and do their bit.’ is not good for trade. Top seven completions were up 55% between 2012 and 2017, from 44,685 to 69,470 (Table 1). Quite a bit.

Let history repeat itself, but in a different way

Take courage from Harold MacMillan. This from his memoirs: “Churchill asked me to ‘build the houses for the people.’ What an assignment! I know nothing whatever about these matters, having spent six years now either on defence or foreign affairs.” In 1953, 318,000 houses were completed. An achievement that helped MacMillan become Prime Minister in 1957.

What should the current prime minister do? Ask the Home Builders Federation to scale down their 2016 ‘statement of intent‘ to reach 218,000 units by 2020. Settle for 168,000: the top seven up from 70,000 to 98,000 and smaller private fry from 50,000 to 70,000. Any objections? Point out the 7% growth per year target matches the compound 55% achieved over the past five years. (Table 1).

Aim for consensus…

If they don’t agree, adjust the figure. Consensus is the aim. The idea of offering up a five-year plan has begun to p’ercolate. On 5 September 2018, Barratt said they were planning to raise completions by 3.5% per year over the next five years. Ask housing associations if they can grow by 10% p.a., from 27,000 to 42,000, as suggested in the previous table ‘Output assumptions per sector based on past performance’. If they don’t agree, adjust the figure, or their budget.

… then charge for goals

The next step will take the courage of Churchill. Stick with the overall target of 300,000, even though the consensus figure is bound to fall short. Fix a firm date rather than the current mid-twenties target. Let the players see the goal. Then introduce another goal. A vision of what will expand home ownership. The use of the Land Bounty to galvanise new town building.

Galvanise New Towns – and save public money

Allow urban development and New Town corporations full rein to buy land at existing use value. The finalists in the Wolfson ‘Garden Cities’ prize urged land value uplift to be harnessed more effectively. Between 1947 and 1957, the first ten new towns were able to pay very restricted compensation. Formulae of Byzantine complexity are now used to compensate land owners.

A 500 Ha site for a new town between Oxford and Cambridge, along the planned Varsity Line? The numbers stagger. The price of cornfields, £12.5m. The value of land which is oven-ready for new homes, £3.1bn. There’s no need for government funding and there would be plenty of private lenders willing to fund the ten to 20-year gap at this huge differential in value. This is the same for any one of the current Urban Development Corporations.

Orchestration: Prime Minister.

‘There are some ideas so wrong that only a very intelligent person could believe in them.’ George Orwell

It’s no good just promising to build 300,000 new homes. Demolition of received wisdom is required. Nine Labour and eight Conservative housing ministers since 1979 have sung Left and Right versions of the same song. Each promises variant of ‘we will build!’ Both blame the planning system. Labour promise unaffordable affordable homes. The Conservatives supply state aid to voters and demand the private sector abandon market caution.

The PM should lead, by decrying what Norman Mailer called factoids. “Items of unreliable information that is reported and repeated so often that it becomes accepted as fact.” There are more factoids circling Planet Housing than moons circling Jupiter.

A housing minister looking to be PM will need to zap the factoids held dear by special interest groups. Here are just four egregious examples:

- ’Pre-fabrication will speed everything up and lower prices’

Cost and efficiency savings accrue to the seller and the idea that the buyer or renter will benefit is wishful thinking. Why should the supplier sell or rent for less than the market rate? Secondly, the idea that because you can build more quickly means you will sell more quickly is silly. It does not matter that the home has been factory built. The only real advantage lies with the speed at which BTR developers can build. - ‘Help to Buy will continue to help’

Help to Buy (H2B) has proved beneficial. But evidence is building that developers charge more for Help to Buy Homes. My evidence (Table 2 ) supports the contention, showing that new home prices are up by 47% since 2012, ahead of general increase of 37%. Negative tales on how it helps richer buyers and enriches builders is corroding confidence. The policy is turning from a help to a political hindrance. - ‘Build more homes to bring down prices’

No. But, before coming to the reasons why not, it is useful to gain a deeper understanding of how the housing game is played, at least by the private sector, which builds 80% of all homes. Government statistics need to be compared alongside private sector metrics; company output, sales rates, average prices, land supply. The main message is that the private sector dances to its own tune, not that of government.

Take a deep breath, dive in…

Fallacy of more homes for less pounds

There are 27.2m homes in the UK. An additional 147,000 were completed in 2017, sold at an average price of £264 000, which was 17% above the £227,000 price of all homes (Table 2).

Demand is elastic and springs to the tune of economic confidence, not marginal increases in supply. Even doubling completions to 300,000 is marginal, adding just over 1% of higher priced units to the stock each year.

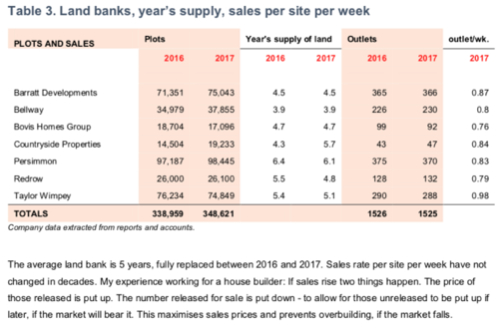

As I’ve suggested under Table 2, completion rates are regulated by varying price. Sales fluctuate between 0.7 and 1.0 units per site per week. A long-tested rate which optimises capital expenditure and makes best use of management, labour and resources, and keeps risk to an acceptable minimum. This market can shutter in a matter of weeks. Ten years at a house-builder taught me that painful lesson.

4. Factoid award winner:

“At the very heart of the matter is the planning process.” Theresa May, March 2018

No, no, no, Theresa! Whoever told you that? Sack them. Stop imagining that varying planning rules will clear the brush on the path to a housing Nirvana. The laws of supply and demand dictate output, not changes in rules of the game. Every administration tries to fix the system, giving the illusion that it can be fixed and forgetting that ‘the system’ is there to protect the public as well as provide developer with land.

The ‘planning system’ is like the tax system, it can always be improved. A Labour of Sisyphus. Do carry on. Is ‘the system’ restraining its main complainants – big builders? Hardly. In Table 3 you can see that the top seven held 348,000 plots last year, 9,000 more than in 2016, even after selling 70,000 units. The number of sales outlets is one true test of intention. At 1,525, it’s virtually the same in 2017 as in 2016

CONCLUSION

Land for Hope and Glory?

Using the Land Bounty to build homes that can be rented cheaply will bring hope to those who can never afford to buy. Plus hope to buyers who see housebuilding numbers expand. Glory goes to the politician who can galvanise the New Towns programme, cut public spending with a single sweep of the sword, and promise 300,000 new homes a year. For an army will mount against them, not just land owners.

You can hear the experts coming. Professional, legal, or financial arguments marshalled. Pennants of narrow self-interest flying. Regiments at the ready to trample ideas that endanger their territory. The only thing that might stand in the way? A MacMillan of a housing minister, exhibiting Churchillian tenacity. Without a political champion, the chances of building a Land and Hope and Glory are thin.

On that self-defeating note…

END

Republished with Peter Bill’s permission from planet-property.net.