Covid-19 is not over yet. New variants; second, third and fourth waves; and the logistical challenges of vaccinating 7.8b people around the world means that ‘post-COVID’ is likely a way off. As some United States’ cities begin to approach herd immunity with vaccination programmes, it is anticipated that some parts of normal life can return, but with travel restrictions and uncertain tenant demand, cross-border institutional property investing remains a challenge.

Despite the darkness of the moment, there is remarkable optimism expressed by institutional investors, as detailed in the recent International Investor Survey from AFIRE – a trusted barometer of institutional sentiment and commercial real estate for three decades. The most recent report was released in May 2021, with a strong indication that investors are crossing borders and finding property worthy of investment. At the same time, they are changing their approach in novel ways. In the past, large institutions focused on large office buildings in the best gateway cities. Although a major portion of those assets are and will remain in institutional hands, the appetite for more of the same is waning.

Institutional investors – usually pension plans, insurance companies, banks or sovereigns – tend to invest in a more conservative manner with a longer time horizon than other investors. Their capital structure requires a thoughtful approach, where the next quarter is less important than the next decade. In this time of transition to a so-called post-COVID world, their focus is first and foremost on the long term. That may partly explain the record level of commitment to ESG principals and high-level concern about the effects of global warming.

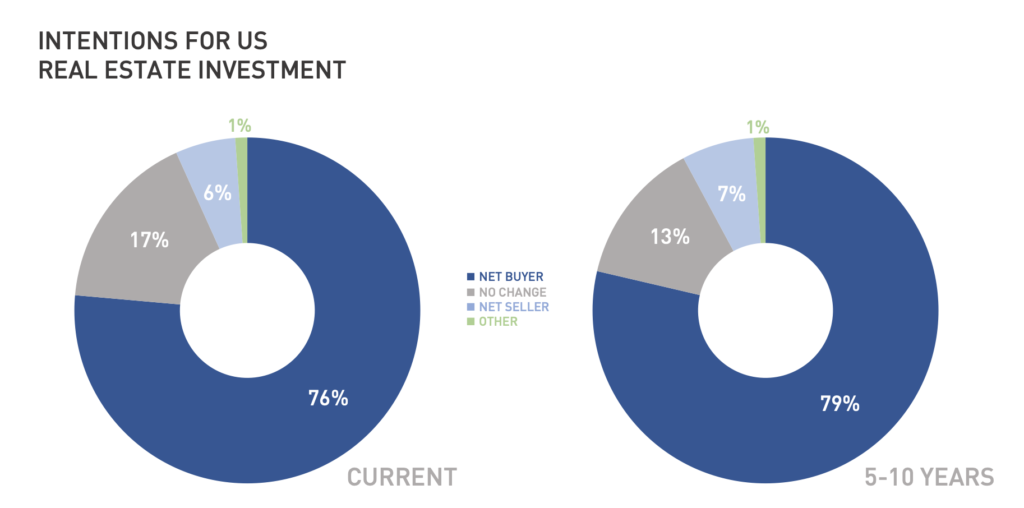

Institutional investors are remarkably optimistic. For example, 76% of AFIRE International Investor Survey respondents declared they would be a net buyer of US real estate in 2021, compared to 50% before COVID. When asked about their outlook for five to ten years from now, 79% expected to be net buyers. In 2021, they have allocated roughly the same amount of capital they allocated in 2020 even though they were only able to invest half of what they allocated last year due to the pandemic. In the UK, 38% of investors plan to increase investment in US property markets over the next three to five years. When asked whether they will be net buyers or sellers of US real estate, 76% of global investors raised their hands as buyers. This is a marked departure from months before COVID when only 50% intended to be net buyers.

AFIRE’s International Investor Survey has been conducted for 30 years to gather the pulse of AFIRE members and the industry itself. There are 200 AFIRE members from 23 countries that collectively represent approximately US$3t in assets under management. The focus of the membership and the survey is on cross-border investments into the US property markets. The survey was conducted in March of 2021 with over 100 respondents. Half of the respondents have under $20b AUM and the other half have over $20b AUM. Further, 64% represent institutions in Europe, the Middle East, Canada and Asia. The remainder are US based investors that work with global institutions.

In past economic recoveries, investors took advantage of distressed assets and forced sales to acquired properties and loans at a significant discount. That has generally not been the case so far and few expect it to be in the future. This is interesting to consider as high levels of allocations are in place without the prospect of significant discounting.

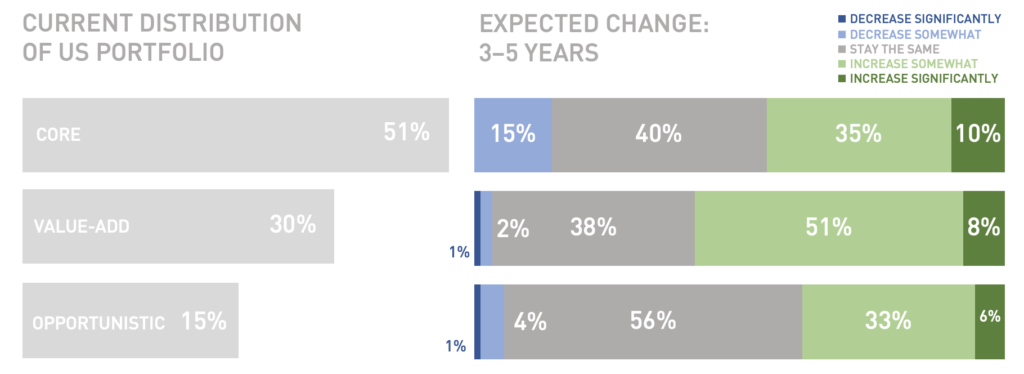

Investors are also shifting from a core strategy to more value-add and opportunistic investments. For decades, a majority of their property portfolios were in core stabilised assets in the top US cities, such as New York, Los Angeles and San Francisco. In the past few years, core portfolios have steadily dropped on a percentage basis. In 2019, the respondents averaged 60% in core. In 2020, it was 56%, and this year it is 51%. Value-add and opportunistic portfolios have grown in kind and it is not unreasonable to presume that we may see a continuation of this trend in the years to come.

Why are institutions expanding value-add and opportunistic investments? Long-term investors, such as pension plans, need higher yields than what many core investments are able to produce right now and they are willing to move up the risk curve to find it. Competition is fierce and most high-quality core assets are already owned by long-term institutions. It’s hard to buy what isn’t for sale. In a pervasive low-yield environment, core assets have climbed in price to the point where sometimes the only way to buy one is to build one and construction isn’t core (at least, not at first).

At the same time, institutions are shifting to other investment categories that don’t sit as squarely in the core category, including housing and industrial/logistics. The survey shows 86% of respondents plan to increase their investments in multifamily over the next three to five years. There is a lack of housing options in many cities and at most economic levels except for the very fortunate. According to the US Department of Housing and Urban Development, 580,466 people in the US are homeless, while those in the middle-class struggle to afford homes in major cities as well. A steady migration from northern and coastal cities to less expensive locations elsewhere in the US has increased during the pandemic. Collectively, these trends underscore a clear demand for more housing and institutional investors are paying attention.

Through the pandemic, online shopping globally grew at an average of 16.5%, leading to US$3.914t of sales predicted for 2021. Only 6% of investors intend to expand their holdings in retail. But another asset class has benefited, as demand for data centres and distribution warehouses have, of course, followed: 79% of respondents plan to increase their exposure to industrial in that same time frame, compared to 24% who plan to expand their office portfolio. Office is certainly an institutional asset class and continues to be important for investors’ portfolios, but there is less enthusiasm to grow in this area in part due to the uncertainty of office demand and tenant requirements in the years to come.

Given the global slowdown of hospitality due to Covid, it is surprising to see that there are slightly more investors (25%) who indicated that they wanted to expand their hotel portfolios compared to those who wanted to expand office. A predicted industry-wide restructuring of hotels has not materialised. Owners have been able to hold on through the lockdowns and many are already experiencing an uptick in bookings. A quarter of investors see a return to health in the months and years to come.

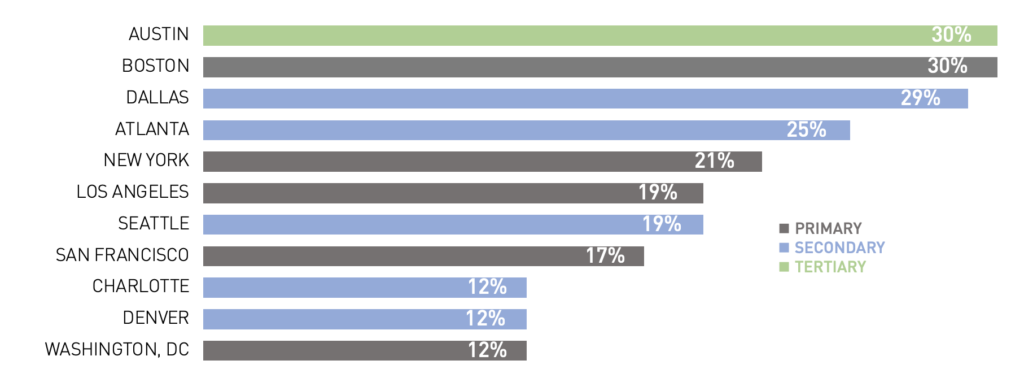

In addition to shifting priorities for property types, investors are also changing their preferred cities and markets. In the 30 years that AFIRE has conducted its survey, only primary gateway cities have topped the list of US cities for future investments. Typically, cities such New York, Washington, DC, San Francisco, Los Angeles, Boston and Chicago occupy the top spots. Given the size and focus of global institutional markets, that is exactly what one could expect. Except this year. Austin, Texas, is the leading US city for investments in 2021. As a smaller secondary city with a top-level university, an expanding tech and biotech sector, a younger and well-educated population, and limited taxes, Austin is experiencing explosive growth. In a general environment of limited rent growth, Austin stands out from other comparable cities.

Following Austin is Boston, Massachusetts (rich in education, tech, bio-tech); Dallas, Texas (rich in education, tech, finance), and Atlanta, Georgia (rich in education, fintech, healthcare). They are very different cities, with interesting cultures, events, dialects and cuisine, but to an investor they look remarkably similar: powered by rapid growth and fuelled by well-educated young people focused primarily on technology. Even though cities such as Austin might be a smaller market with fewer acquisition opportunities, they have precisely what investors hope to find.

Institutional investors are an optimistic bunch, but they have serious concerns as well. Their perennial worries about increasing tax rates, economic growth and interest rate increases may have more weight as governments around the world try to step in and help with economic recovery in the wake of the pandemic. Almost as high on their lists, and perhaps more illustrative of the times, respondents ranked cybersecurity as a concern higher than in any previous year of the survey, alongside disruptive technology and changes in consumer demand. All three of those issues have already impacted the world and will likely continue to.

When asked about political and social concerns, respondents put pandemics at the top of the list, followed closely by climate change and sustainability, social inequality, economic inequality, housing affordability and racial equity. Politics and regulations fell lower on their priority list of concerns. However, each of the concerns indicated by respondents have a tangible impact on tenants and users of real estate. What ails society ails real estate. Especially as ESG dominates everyone’s agendas, leaders in this space are intentionally focused on strategies that support a healthier society.

The commitment to ESG is almost universal now: 93% of survey respondents said that ESG criteria are important for new investments, while 31% said that new investments are required to meet them. Most of their focus has been on the impact of their buildings on the environment over the past decade, but more focus has shifted to issues related to the social and governance principles of ESG trends.

Optimism about the future should not be confused with a yearning for the way things used to be. It requires an acceptance of the way things are and a courage to take new action. Institutional investors know where innovation is taking place, and even though real estate is not known for quick changes, they are managing to intelligently position themselves for the post-Covid world. It won’t be easy, and it certainly won’t be the same, but it might be bright.