Investors chasing growth stocks creates both danger and opportunities

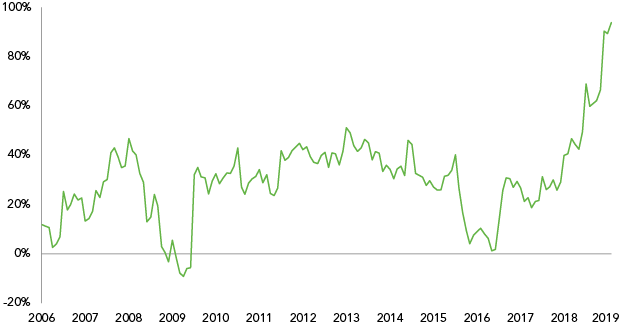

PE premium for UK growth stocks over UK value

Stock market manias always start with some grounding in solid fact, before investors get carried away and drive up valuations to extreme levels. Eventually, of course, the bubble always bursts and investors are left ruing hefty losses.

The technology mania of 1999-2000 that crashed and burned so spectacularly had at its root the truth that new technologies were set to change both companies and the world. Likewise the Railway Mania in the 1840s and no doubt the South Sea Bubble a century earlier.

Today’s mania, as the chart shows, is for ‘growth’. Like its predecessors it has its roots in solid facts. Interest rates at close to zero (or even negative) means that profits in the distant future are worth more today than they were when interest rates were higher. This justifiably provides a boost to growth stock valuations.

Debt is cheaper too, so investors’ tolerance of loss-making companies is higher, as long as future growth is promised. Hence the record percentage of loss-making IPOs in the US this year. This last peaked at similar levels in 1999 and we know how that turned out.

Growth stocks are now almost twice as expensive as the value end of the market. A record premium mirrored in the US, where growth is now more expensive against value than at the peak of the technology bubble.

This is uncharted and dangerous territory. When such high valuations collapse, not only do investors lose money, but their faith in financial markets and advisors is undermined, potentially deterring a generation of savers from accessing sensible investment products.

Look down the other end of the telescope, however, and the same chart suggests that there are opportunities to be found in value stocks – now priced at a record discount to growth. This is a global phenomenon, but it is perhaps most starkly visible in the UK.

Britain may be stuck in an increasingly chaotic Brexit nightmare, but even if Boris Johnson forces through a damaging ‘no deal’ exit, life (and well run companies) will carry on. This is something recognised by billionaire Hong Kong investor Li Ka-shing with his £4.6bn takeover bid for brewer Greene King.

That bid netted ‘value’ investors in the pub company an instant 50% gain, on top of the 6% dividend yield Greene King was paying1. There are a host of other value opportunities left in the UK market, made more attractive to overseas buyers every time sterling takes another tumble, and offering handsome dividend yields to income hungry investors.

Ruffer may be a global, multi-asset investor, and the UK represents less than 5% of global equity markets2, but for the reasons outlined above, we have almost a quarter of our equity exposure targeted in the UK with the focus very much on value.