As I read the billion dollar bids for land in Singapore and new launches of private apartments selling out in three days, I began to wonder whether the government has expanded the retail-driven Great Singapore Sale to the residential property market and I have missed the sale! A deeper look suggests that the residential market activity is somewhat like the Great Singapore Sale. The merchandise isn’t discounted a great deal but somehow the consumers bought into the hype.

We have been flagging out the change in developers’ and consumers’ appetite for private properties since June last year. The turning point in sentiments was perhaps the successful launch of the GEMS Residences, a 578-unit private condominium in the suburb of Toa Payoh. The developer did an excellent job of marketing the project with some clever gimmicks like car rental, 24-hour concierge and private chef services. Since then, the market has gone from strength to strength.

Just like what you need to do in the Great Singapore Sale, investors need to look beyond the hype and get a clear perspective of value vs price and whether the “discount” justifies the purchase.

Billion dollar bids for land were expected

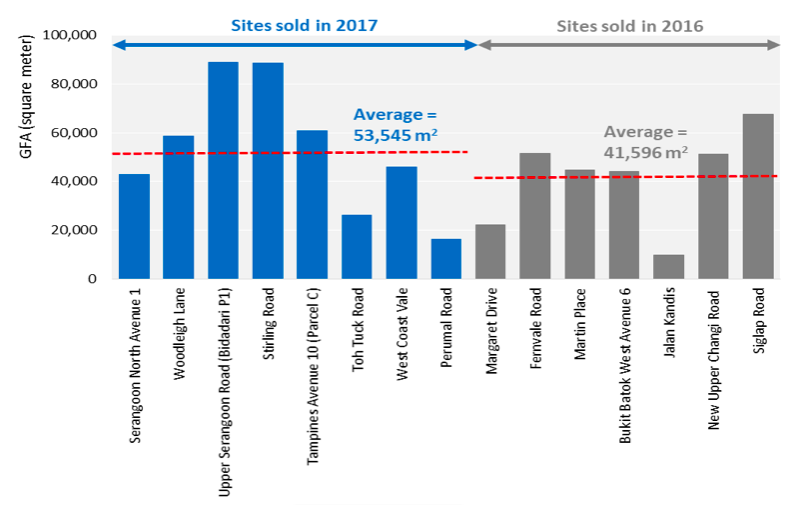

While it makes great headline sensation, the billion dollar bids for government land are expected. The sites being offered for tender have been increasingly larger and in relatively good locations. The larger sites are part of the government’s deliberate, stated intention. As seen in Figure 1, the average gross floor area of the sites sold in 2017 is 29% higher than that of the sites sold in 2016.

Figure 1: The average GFA of sites in 2017 is higher than that in 2016

Source: URA, HDB, FundPlaces Research. Note: data obtained on 14 Aug 2017

Are local developers in danger of being unemployed?

Traditional local developers have become more aggressive in land acquisitions as many of them are running low on their land bank. Foreign developers, particularly those from China and Malaysia, have other strategic objectives for their aggressive land acquisitions. Some have formed joint ventures with the traditional big boys to undertake developments. Others have decided to take the plunge themselves.

Foreign developers have been entering the Singapore property market as the government land tender system provides a very efficient and transparent way to enter the market. Generally, foreign developers have been working on increasingly thin profit margins when they acquire sites. However, their intent for acquisitions has not always been purely profit driven. Some used this as a means to build up their portfolio as a trophy piece to showcase their development expertise. Others use this as a means to get their funds out of their home country where there are outflow controls. Foreign developers have out-bidded traditional local big boys in three out of eight government land sites in 2017.

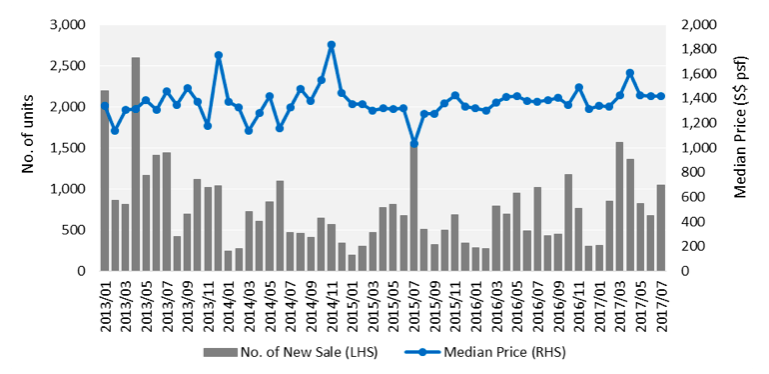

New home sales surged

The new home sales market has also been buoyed the positive stance from developers. It is becoming more common to see new launches being sold out within 1-2 months of launch. However, while month-on-month sales momentum has picked up, we found that the number of units sold is far from peak sales level in 2013, where the monthly sales volume reached more than 2,500 units in a month. The median selling price of new homes is still lower than the peak in 2014.

Figure 2: Number of monthly new sales is increasing but still lower than the peak in 2013

Source: URA, FundPlaces Research. Note: data obtained on 14 August 2017

Empty completed condominiums remain a challenge

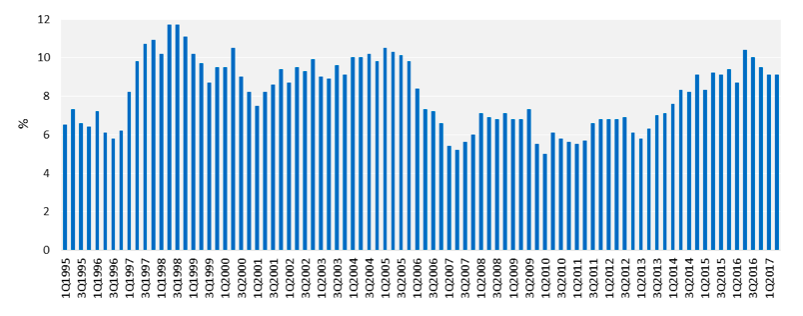

The increase in primary home sales had contributed to four consecutive quarters of decline in vacancy rates. The overall vacancy rate in 2Q 2017 was 9.1%, which was lower than the peak of 10.4% in 2Q 2016. Despite the decline, vacancy rates remained high compared with historical levels in 2010, where it reached as low as 5%. This is an evidence that the market starts to clear its stock.

Figure 3: Vacancy rate of non-landed residential properties registered four consecutive quarters of decline

Source: URA, FundPlaces Research. Note: data obtained on 14 August 2017

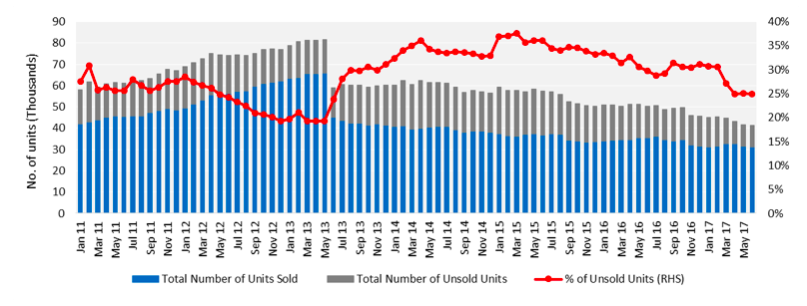

Total unsold inventory fell but remained high as compared to historical level

Looking at the total unsold inventory, we noticed that it fell for the fourth consecutive month. Including those units that have not launched by the developers yet, the total number of unsold units held by the developers fell 1% m-o-m and 31% y-o-y to 10,303 units. This represents 24.9% of the total number of units that developers have obtained permits to sell but have not received Certificate of Statutory Completion (CSC) yet. Despite this percentage had declined 12.7 percentage points from the peak of 37.6%, the level of unsold inventory remained high as compared to 19.3% in May 2013, as seen in Figure 4. The market still needs some time to clear the stock.

Figure 4: The percentage of total number of units unsold declines (Ex-ECs)

Source: URA, FundPlaces Research. Note: data obtained on 17 July 2017

Private Residential Property Price Index continued to decline

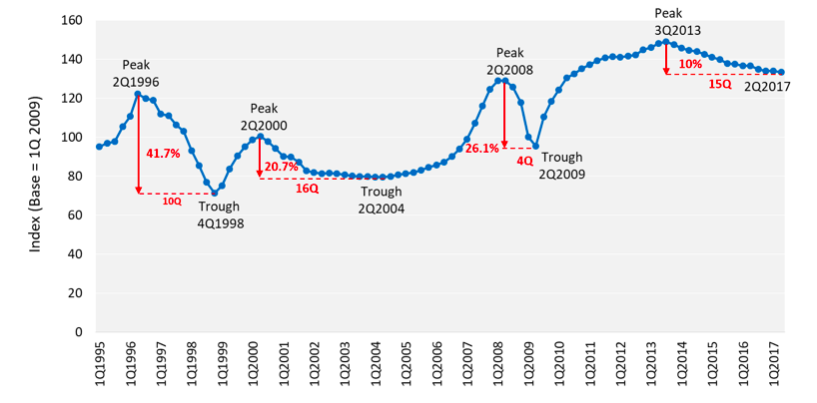

While the market continued to clear the stock, the official non-landed Private Residential Property Price Index registered its 15th consecutive quarters of decline in 2nd quarter of 2017. This is the longest period of price decline since 2004. As compared to the previous down cycle where the index declined 41.7% during the Asian financial crisis, 20.7% during the SARS period and 26.1% during the global financial crisis, the Index has only declined 10% so far in the current down cycle.

Figure 5: Non-landed private residential property price index declined for 15Q in 2Q2017

Source: URA, FundPlaces Research. Note: data obtained on 14 August 2017

What’s ahead for the market then?

In our opinion, the upswing in sentiment amongst the consumers is a result of consumers running out of investment options while any economic pain from Singapore’s slower economic growth remains limited. In addition, the announcement by the Singapore government that they are unlikely to ease any of the taxes triggered investors who have been waiting on the sidelines to bite the bullet and jump onto the bandwagon.

More broadly, Singapore has many positive attributes. It remains one of the premier financial hubs and has a government that is amongst the few that is cohesively promoting innovation and new technologies. While its economy might have slowed, its general attributes as a great place to conduct business and the conducive living environment have continued to draw the wealthy Asians to allocate some of their funds to Singapore real estate.

For the real estate sector, Singapore remains amongst the most transparent market in the world for investors. The key factors going for Singapore now are that the surge in the sale of private apartments for redevelopment will reap a windfall for the owners which will support another surge in demand for housing. Against this backdrop, investors waiting for a “firesale” might have to wait for the next economic shock to lit the fire. For investors, it is worth looking at luxury properties in Singapore now. We believe the downside of the luxury residential market is limited. We believe the market is right on track to bottom out within the next six to nine months but the price recovery is likely to be slow. Perhaps it might be time to join the sale.