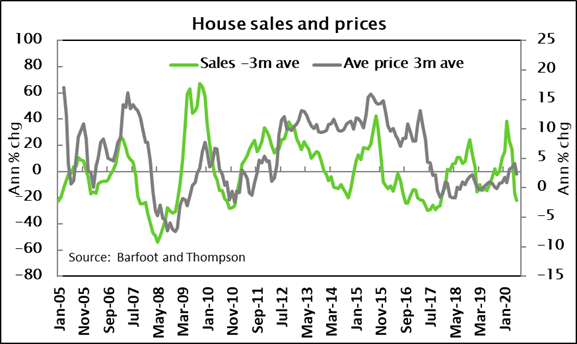

As we sift through the data, we found a few pleasant surprises. So far we have had housing market data for April and May, and only a very limited look at June. April’s lockdown and the rollback of social distancing measures over May generated significant distortion to the data. As would be expected, house sales slumped and the median number of days for a property to sell (a measure of slack in the market) jumped. And house prices have started to fade too. In May, the REINZ’s house price index was down around 2% on March.

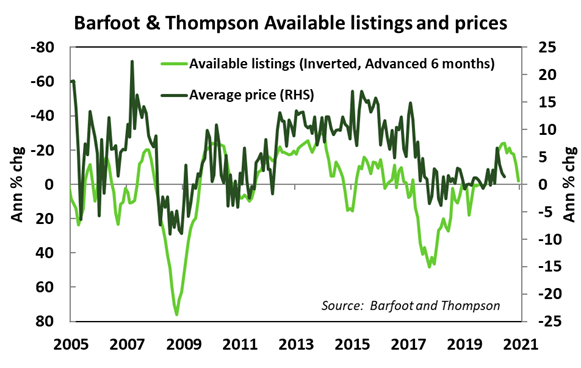

However, Barfoot & Thompson – the Auckland focused real estate firm– released their June report. A solid rebound in sales was recorded, as too was the number of new properties listed with B&T. We don’t know if B&T’s experience will translate to the wider market when REINZ releases their June report – but we suspect so. We suspect that any jump in June activity will reflect a catch-up in lost activity seen during the lockdown months. And there are a few reasons why buyer interest might be sustained despite the Covid-19 crisis. Mortgage rates have been slashed to fresh record lows. And the RBNZ has removed LVR restrictions on new lending. The LVRs had previously fell heaviest on first-home buyers and the investor segment. Anecdotes suggest first-home buyers were quite active over June. Finally, supply and demand imbalances remain. New Zealand still has a chronic shortage of affordable dwellings. Over the last six years New Zealand has experienced the largest migration boom ever recorded. Over the last few months, New Zealand has experienced another spike in migration, as Kiwis flew home to escape the pandemic.

New Zealand’s housing made has very strong fundamentals, but, the labour market has taken a significant hit from Covid-19. We are forecasting an unemployment rate peaking at ~9% by the end of the year. Labour intensive industries such as tourism, education and possibly construction, are likely to be most impacted by continued border closure. The migration boom will eventually run out of steam. There’s only so many Kiwis wanting to come home. Net migration has to trend towards zero with Kiwi borders closed to non-citizens and residents. We are currently forecasting house prices will be 9%yoy lower toward the end of the year. However, the recent data is giving us pause for thought.Compared to the GFC, the current downturn is a very different beast. The GFC, because it was financial market driven, led to a sharp pull-back in bank credit as well as demand. This time banks are in very good positions to lend appropriately. Assuming we don’t have a second wave of Covid-19 infection, the housing market downturn is likely to be shorter-lived than the GFC.