Assuming the U.S. elections still happen in November 2020– how might that affect the U.S. economy and investment returns going forward?

While no one can yet predict the outcome of the November election – it may be instructive to look at what has happened over the past 40 years. Reviewing the 2-year election cycles to see what happened when

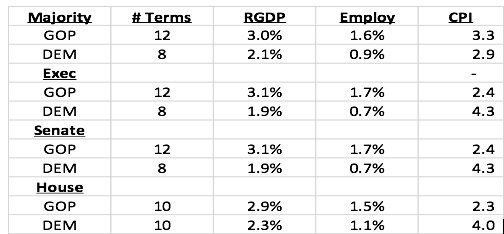

Exhibit 1

In all cases, when the GOP was in charge real GDP and Employment growth outperformed and usually at a 50% higher rate than when DEM was in control. Inflation (using CPI) was 13.8% higher when GOP had majoritycontrol, but was 79% higher when DEM had control of Executive, Senate or House. (Most believe high inflation is not a good thing).

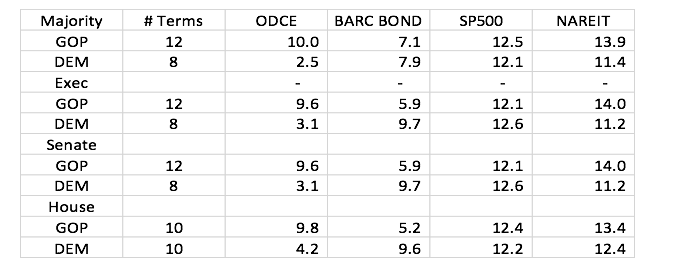

Next the returns for private institutional real estate (represented by the National Council of Real Estate Investment Fiduciaries NCREIF – ODCE index) Barkley’s Bond Index, S&P 500 stocks and publicly traded real estate (represented by the National Association of Real Estate Investment Trusts FTCE-NAREIT index.

Exhibit 2

In all cases when GOP had control, private real estate and REITs did better by two to four times the return amount verses when DEM was in charge. When Dem was in charge Bonds always did better. The S&P 500 did better when the GOP majorityand house were in charge by a very small margin of 0.2% to 0.4% and better by 0.5% when DEMs were in charge of the Exec and Senate branches.

Most people believe that the pro-business and smaller government themes of the GOP drove a stronger economy and better returns for real estate, as employment growth has always been the major demand generator for all property types in real estate. A slowing economy drives investors to the safety of bonds driving their prices up. Thus, the correlation of slower economy and higher bond returns makes sense when DEM policies of more restriction and higher taxes were implemented.