Rumours of the agency’s demise are premature. And even if such disruptors fail, the fortunes they are spending on marketing could change customers’ expectations forever.

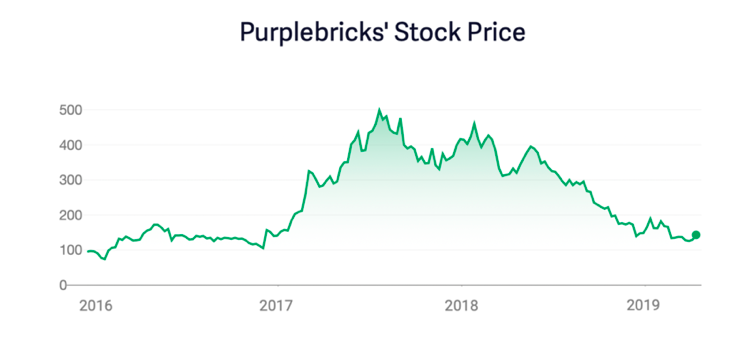

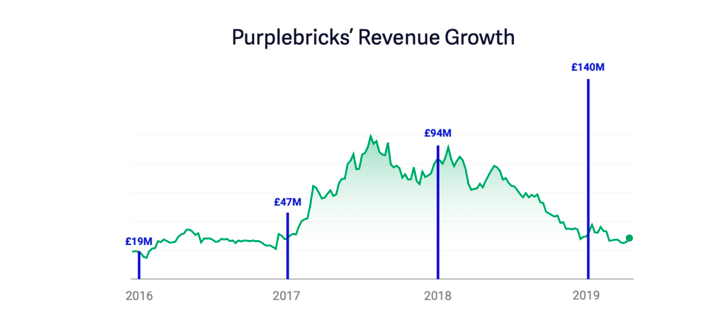

If you believe everything you read in the media, you could be excused for thinking the UK-based online real estate agency Purplebricks is a company in crisis. The stock price is significantly down from the highs of last year, the US and UK CEOs are out, and revenue guidance has been repeatedly downgraded.

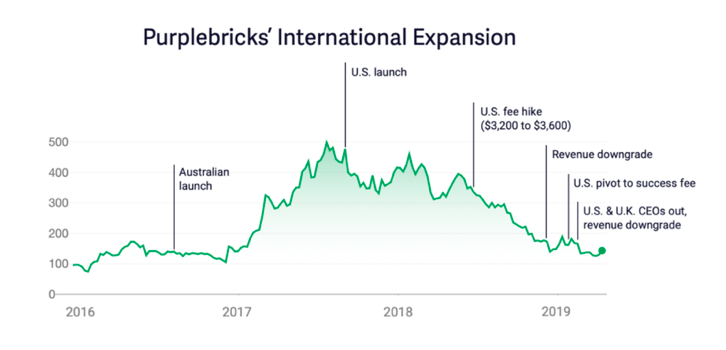

Purplebricks faced a rocky international expansion, especially in the US. In a span of nine months, it quietly raised prices, completely pivoted its fee model, and then parted ways with its US chief executive. During the same period, it lowered future revenue expectations not once but twice, down from total group revenues of £185 million to £140m.

But like all irrational systems, the stock market trades not only on

The sharp rise in 2017 was driven by unrealistic optimism for international expansion, on the back of 100% growth in the UK. In 2018 it was clear international markets were a tough nut to crack, while UK growth slowed considerably.

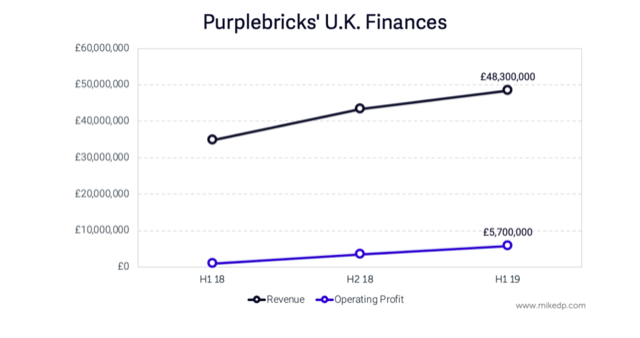

As I wrote in July 2018, Purplebricks’ UK business model works, it makes money, and – at scale – is profitable.

It’s a mistake to confuse Purplebricks’ stock price with its overall success. The only challenge facing the UK business is growth, which is clearly slowing down as the company saturates the market. All online agents are not doomed to failure because of some fundamental flaw.

Market share can only get so high. In November 2018 I was quoted in the Financial Times saying, “I rolled my eyes when analysts were talking about 20, 25 per cent market share [for digital leaders].” And it’s true. Depending on the source, Purplebricks’ UK market share is anywhere from 3.2 to 4.5 per cent.

So what’s the problem in theUS? The challenge is simple: Purplebricks’ massive marketing spend is not generating enough customers.

The company recently pivoted its business model in the US, from an upfront fixed fee (paid regardless of the home selling), to a success fee paid only when a home sells – both at a discount. This move brings Purplebricks squarely in line with the traditional industry it was attempting to disrupt. The proposition is now also identical to Redfin.

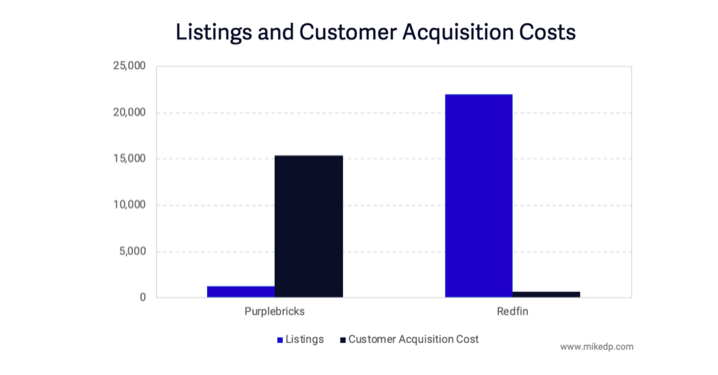

In December of 2018, I estimated Purplebricks generated between 1,200 and 1,400 new listings over the preceding six-month period. During that same time, Redfin reported around 22,000 closed transactions.

Also during that period of time, Purplebricks spent over $20m in marketing, compared to Redfin’s $16m. The result is a customer acquisition cost of $15,000 for Purplebricks, compared to $730 for Redfin.

Purplebricks is still dangerous: it has deep pockets, a willingness to spend, and the self-awareness to pivot when things aren’t working. I wouldn’t count it out of the US quite yet.

The biggest impact of Purpluebricks and its fellow disruptors, however, could be the massive amount of money being spent on marketing by such players (over $100m between Purplebricks and Redfin alone in 2019). And what’s the message of that marketing? Traditional agents are expensive, we offer the same service at a discount, use us instead.

Expand the scope to iBuyers like Opendoor and Zillow and the tens of millions they are spending on marketing. What’s the message? Traditional sales are complicated and confusing, use us instead.

Disruptive companies are spending hundreds of millions of dollars on TV commercials, radio ads, and online advertising that hammers home a clear message to consumers: there is a credible alternative to traditional real estate.

Now, more than ever before, consumers are being bombarded with advertising offering them a choice. The industry may not change overnight, but consumers will be asking more and more questions.