A ray of hope for the central London property market

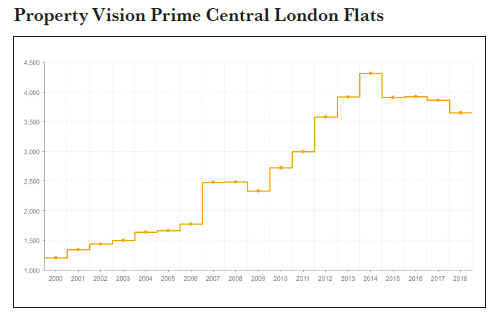

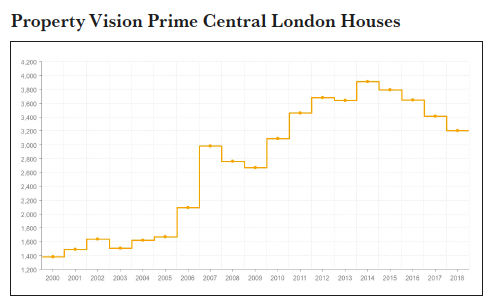

The prime central London market has been a tough place over the last year, with a continuing decline in both flats and houses. Against the trend of the past four years, flats in 2018 declined more than houses – off 8.4% as opposed to 6.2% for houses. Since 2014 flats are off 21.7% and houses by nearly 25%.

Here at Property Vision, an independent buyer’s adviser business, we annually publish a prime central London index. Created by economists from the London School of Economics, using Property Vision’s own market database and

Here at Property Vision, an independent buyer’s adviser business, we annually publish a prime central London index. Created by economists from the London School of Economics, using Property Vision’s own market database and

Falling prices are only part of the picture. Falling turnover is the source of what can only be described as a recession in the wider ecosystem of the property market: decorators,

removalscompanies, suppliers of kitchens and bathrooms and estate agents to name a few. Foxtons’share price is 20% of what it was four years ago and that of Countrywide (which own, amongst others, Hamptons and John D Wood) is priced for bare survival. Over the last year, turnover is down 20% between £5m and £10m, and 30% over £10m. Compared with 2013, the volume of transactions is down 50% and 70% over the same period. Thank you, George Osborne – and, this year,Brexit.

It isn’t all doom and gloom though: there have beensome spectacular transactions, particularly at the very topof the market. For example, KenGriffin of Citadel bought both ahouse on Carlton Gardens and a flaton top of the new Peninsula Hotel, on Hyde Park Corner, for a reported £95m and £100mrespectively. At below£1.5m in the lesscentral domestic market, priceshave been firmer as the supplyhas tightened and sellers siton their hands. This marketis not as effected by stamp duty and still less discretionary – if you have anotherbaby, you have to trade up; if you want to buy a second homein London while livingin New York, you can afford towait.

The taxman has been throwing yet more sand into the buy-to-let market, by changing the rules on private residency qualification. This is a market which has had unrelenting bad news from HMRC over the last few years, where there is an obvious

policy decision to removetax breaks for investors. Lowyields (in comparison with those available in the commercial market) and capital values under pressure, when added to a hostile tax environment, add up to a less than compelling investment story.

The positive news is that, for dollar-thinking investors, the prime central London market is now nearly 50% cheaper than four years ago. Many less sophisticated buyers, who bought what were effectively options on new developments in the boom times, are now nursing real or potential losses. However, the more sophisticated and wealthy are now looking hard and buying – despite Brexit.

There are still plenty of clouds – but an increasing number of silver linings.