- FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) decreased slightly from 876.88 to 842.13 (-3.96%) compared to the last month update. Currently the Singapore REIT index is still trading with a range between 816 and 890.

- Yield spread (in reference to the 10-year Singapore government bond of 1.57% as of 2nd October 2021) widened slightly from 4.17% to 4.21%. The risk premium is attractive to accumulate Singapore REITs in stages to lock in the current price and to benefit from long-term yield after the recovery. Moving forward, it is expected that DPU will increase due to the recovery of global economy, as seen in the previous few earning updates. NAV is expected to be adjusted upward due to revaluation of the portfolio.

- Technically the REIT Index is currently going through correction after failing to break the resistance zone at 875-890. Presently the market sentiment is slightly due to a few reasons (1) China Evergrande debt issue; (2) The potential rate hike by US Fed (3) Sept is a statistically volatile month (4) The continuous increasing trend of Covid-19 cases in Singapore.

Technical analysis

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) decreased slightly from 876.88 to 842.13 (-3.96%) compared to the last month update. Currently the Singapore REIT index is still trading with a range between 816 and 890.

- As for now, short term direction: sideways.

- Immediate support at 816, followed by 775.

- Immediate resistance at 890.

- Most overvalued REITs (based on Price/NAV)

- Parkway Life REIT (Price/NAV = 2.32)

- Keppel DC REIT (Price/NAV = 2.02)

- Mapletree Industrial Trust (Price/NAV = 1.58)

- Mapletree Logistics Trust (Price/NAV = 1.52)

- ARA LOGOS Logistics Trust (Price/NAV = 1.35)

- Frasers Logistics and Commercial Trust (Price/NAV = 1.32)

- Ascendas REIT (Price/NAV = 1.31)

- Most undervalued REITs (based on Price/NAV)

- Lippo Malls Indonesia Retail Trust (Price/NAV = 0.53)

- BHG Retail REIT (Price/NAV = 0.64)

- Suntec REIT (Price/NAV = 0.68)

- Frasers Hospitality Trust (Price/NAV = 0.69)

- First REIT (Price/NAV = 0.73)

- Far East Hospitality Trust (Price/NAV = 0.76)

- Highest distribution yield REITs (ttm)

- First REIT (12.35%)

- United Hampshire REIT (9.07%)

- Sabana REIT (8.77%)

- Sasseur REIT (8.32%)

- Keppel Pacific Oak US REIT (8.22%)

- Prime US REIT (8.04%)

- Reminder that these yield numbers are based on current prices taking into account delayed distribution/dividend cuts due to COVID-19.

- Some REITs opted for semi-annual reporting and thus no quarterly DPU was announced.

- Highest Gearing ratio REITs

- ARA Hospitality Trust (49.0%)

- Suntec REIT (43.1%)

- ESR REIT (42.9%)

- Lippo Malls Retail Trust (42.5%)

- Elite Commercial REIT (42.1%)

- Frasers Hospitality Trust (42.1%)

- Manulife US REIT (42.1%)

- No change since September 2021 since Gearing ratios are updated quarterly (all values are still Q2 2021 values)

- Total Singapore REIT market capitalisation decreased by 3.75% to S$105.1b.

- Decreased from S$109.2b in September 2021 2021.

- Biggest market capitalisation REITs:

- Capitaland Integrated Commercial Trust ($13.08b)

- Ascendas REIT ($12.50b)

- Mapletree Logistics Trust ($8.58b)

- Mapletree Industrial Trust ($7.37b)

- Mapletree Commercial Trust ($6.80b)

- No change in Top 5 rankings since August 2021.

- Smallest market capitalisation REITs:

- BHG Retail REIT ($292M)

- ARA Hospitality Trust ($374M)

- Lippo Malls Indonesia Retail Trust ($391M)

- First REIT ($410M)

- United Hampshire REIT ($454M)

Fundamental analysis of 38 Singapore REITs

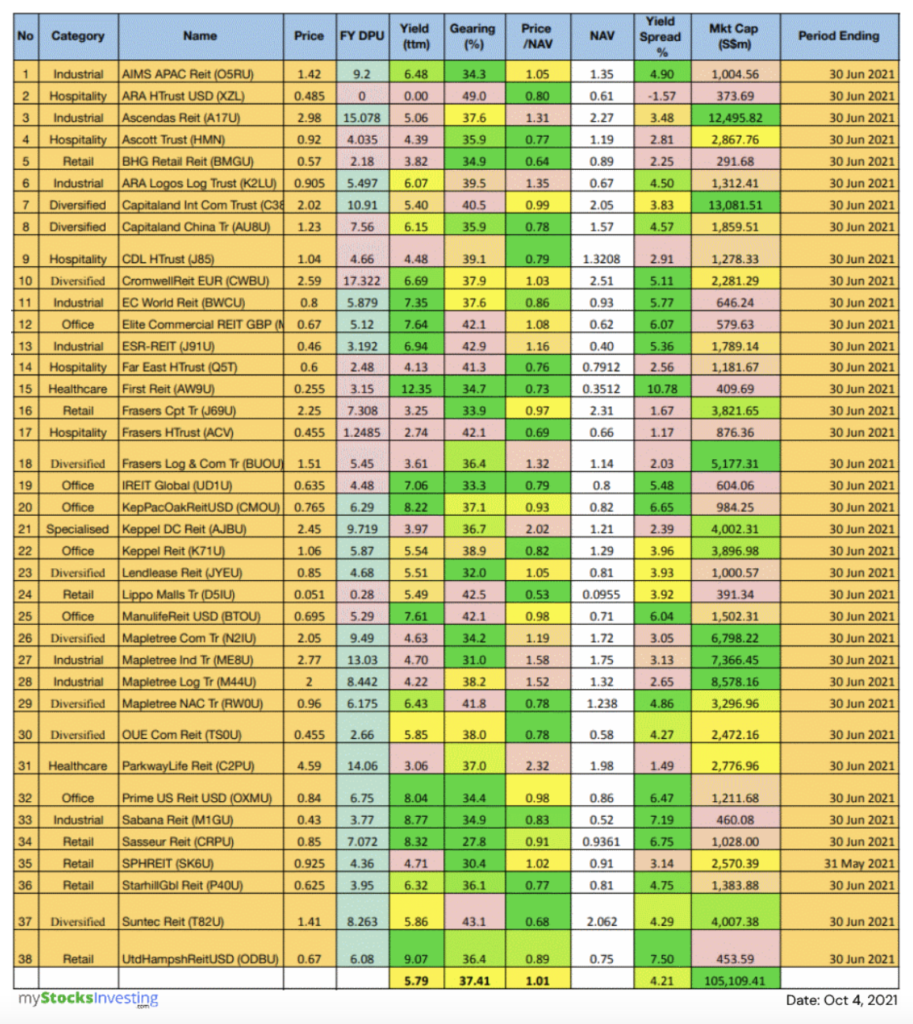

The following is the compilation of 38 Singapore REITs with colour coding of the distribution yield, Gearing ratio and price to NAV ratio.

- Note 1: The Financial Ratio are based on past data and there are lagging indicators.

- Note 2: This REIT table takes into account the dividend cuts due to the Covid-19 outbreak. Yield is calculated trailing 12 months (ttm), therefore REITs with delayed payouts might have lower displayed yields, thus yield displayed might be lower.

- Note 3: All REITs have been updated with Q2 2021 business updates/earnings.

(Source: https://stocks.cafe/kenny/advanced)

- Price/NAV decreased to 1.01

- Increased from 1.06 in September 2021.

- Singapore Overall REIT sector is at fair value now.

- Take note that NAV is adjusted downward for most REITs due to drop in rental income during the pandemic (property valuation is done using DCF model or comparative model)

- TTM distribution yield increased to 5.79%

- Increased from 5.55% in September 2021.

- 10 of 38 (26.3%) Singapore REITs have distribution yields of above 7%.

- Do take note that these yield numbers are based on current prices taking into account the delayed distribution/dividend cuts due to Covid-19 and post circuit breaker recovery.

- Gearing ratio remained at 37.41%

- Almost no change from 37.40% in September 2021.

- Gearing ratios are updated quarterly. Hence there is little change to the Gearing ratio compared to September’s update.

- In general, Singapore REITs sector gearing ratio is healthy but increased due to the reduction of the valuation of portfolios and an increase in borrowing due to Covid-19.